The Société Française de Casinos Société Anonyme (EPA:SFCA) Share Price Is Down 35% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Société Française de Casinos Société Anonyme (EPA:SFCA) have tasted that bitter downside in the last year, as the share price dropped 35%. That falls noticeably short of the market return of around -0.5%. However, the longer term returns haven't been so bad, with the stock down 18% in the last three years. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

View our latest analysis for Société Française de Casinos Société Anonyme

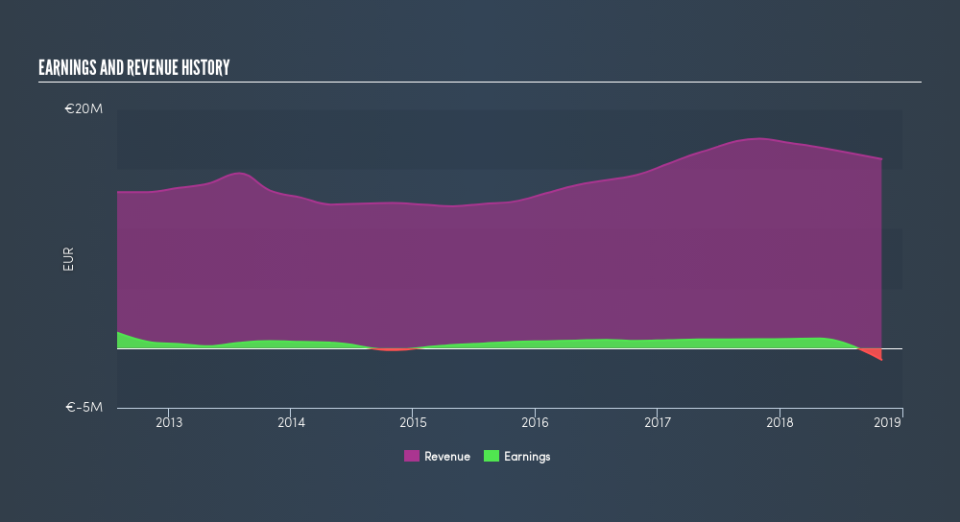

Given that Société Française de Casinos Société Anonyme only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In just one year Société Française de Casinos Société Anonyme saw its revenue fall by 9.8%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 35% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Société Française de Casinos Société Anonyme's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 0.5% in the twelve months, Société Française de Casinos Société Anonyme shareholders did even worse, losing 35%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 2.9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is Société Française de Casinos Société Anonyme cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Société Française de Casinos Société Anonyme may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance