SoFi Technologies, Inc. (NASDAQ:SOFI) is Estimated to Break Profit in 2023, Inflation Poses an Extra Risk

This article was originally published on Simply Wall St News

With the business potentially at an important milestone, we thought we'd take a closer look at SoFi Technologies, Inc.'s (NASDAQ:SOFI) future prospects, breakeven date and a latent risk factor.

SoFi Technologies, Inc. provides digital financial services such as student, personal, mortgage and other kinds of loans. In-fact some 83% of their revenue came from their lending segment. SoFi is offering these and other financial services via its digital platform. Their goal is to become the leading platform for lending and offer comprehensive banking services for the public.

As we veer deeper to 2021 there are two things that stand out for this company.

SoFi's stock has been trending downwards since its peak on January 29th 2021, shortly after their December IPO. The price dropped from the US$25.14 high to US$15.11 in yesterday's session, an almost 40% decline. For investors, this could mean that there are additional risks that are being priced in the stock, or it can be seen as an opportunity for a longer term investment.

Considering the risks, we would like to point out one qualitative factor. In the macro landscape, inflation is ever more present, and economists are still debating both on the type and timeframe of inflation. The debate is split between:

Growth driven inflation: a restarting economy drives up prices via productivity

Stagflation: No real growth but an increase of prices because of reduced purchasing power caused by more money in circulation and dollar weakness

And the timeframe divide between transitory (short term), and long term inflation.

None or very few people really know the answer to this question, and the company is affected by the uncertainty that inflation may bring.

Since SoFi is, at its core, a digital lender, inflation can have a massive impact on fixed rate loans, and the company's profits can turn into losses in a high interest environment. This scenario may not happen, but it is the uncertainty behind it that prompts some investors to be patient for a while longer.

Alternatively, the lower price can be seen as an opportunity for a long term investment. SoFi is currently trading 50% above the IPO valuation, and for a young company it is the period when a company is making the biggest losses before turning profit, when the stock is the cheapest.

To that end, let's see how much longer would long term investors need to wait for SoFi to turn profitable and with that, get a chance to increase its market valuation.

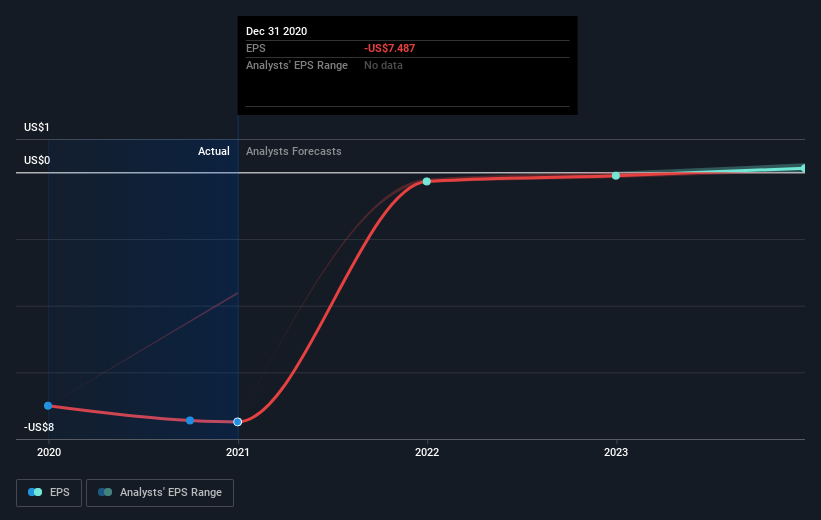

The US$13b market-cap company announced a latest loss of US$317m on 31 December 2020 for its most recent financial year result.

Check out our latest analysis for SoFi Technologies

According to the 3 industry analysts covering SoFi Technologies, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2022, before generating positive profits of US$105m in 2023.

The company is therefore projected to breakeven around 2 years from today.

In order to meet this breakeven date, we calculated the rate at which the company must grow year-on-year.

It turns out an average annual earnings growth rate of 68% is expected, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Before we wrap up, there one issue worth mentioning, SoFi Technologies currently has a debt-to-equity ratio of 159%. Typically, debt shouldn't exceed 40% of your equity, which in this case, the company has significantly overshot.

Note that a higher debt obligation increases the risk around investing in the loss-making company. We also need to keep in mind that since SoFi is a lender, that it might be in a position to use debt more strategically than ordinary companies.

Conclusion

SoFi is estimated to break profit in 2023.

Investors can expect short term volatility, but may have an opportunity to use a buy and hold strategy to their advantage.

The risk of uncertainty regarding inflation may be a factor on why some investors are holding back, since a high interest-rate environment will weaken the fixed rate lending segment for the company.

Next Steps:

There are key fundamentals of SoFi Technologies which are not covered in this article, but we must stress again that this is merely a basic overview.

For a more comprehensive look at SoFi Technologies, take a look at SoFi Technologies' company page on Simply Wall St. We've also compiled a list of essential factors you should further examine:

Valuation: What is SoFi Technologies worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether SoFi Technologies is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business. Take a look at who sits on SoFi Technologies's board and the CEO's background.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance