SoFi Technologies ( NASDAQ:SOFI ): Investors should keep an eye on Institutional Ownership

This article originally appeared on Simply Wall St News.

Shares of SoFi Technologies, Inc . ( NASDAQ:SOFI ) have gained as much as 20% in October, following a series of analyst upgrades and recommendations. Morgan Stanley analyst Betsy Graseck initiated coverage with a $25 price target, saying the company is “a powerful revenue growth story as it ramps share of the consumer financial services.” In September, Jeffries and Mizuho Securities also initiated coverage with price targets of $25 and $28 respectively.

It’s true that SoFi has followed an exceptional growth trajectory. In March the company reported year on year revenue growth of 232%, and in June revenue was up 138% from a year earlier. Third quarter results will be announced on 10th November, with analysts expecting revenue of $255 million, which would represent a 10% increase from the second quarter.

In the last two quarters losses and negative cash flows have mounted as expenses have increased. Revenue growth will need to continue for some time before cash flow turns positive.

What is SoFi Worth?

When we recently estimated the fair value of SoFi we came to a value of $51. This estimate has subsequently increased to $80 as analysts have increased their forecasts. While these estimates appear very bullish, they are based on forecasts that could change significantly in the next year. Forecasting cash flows for a company like this is incredibly difficult given the number of unknowns.

In the meantime, the stock price will likely be very sensitive to revenue growth numbers, and the bar for this metric is very high. One aspect worth keeping an eye on is the types of investors who own shares in SoFi.

See our latest analysis for SoFi Technologies

Who Owns SoFi?

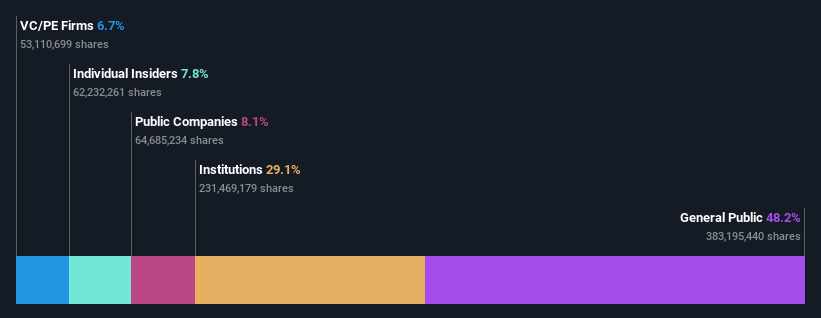

SoFi Technologies has a market capitalization of US$13b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. The following chart shows us that institutions now own 29% of the company, while retail investors own 48.2%.

What Does the Institutional Ownership Tell Us About SoFi Technologies?

Institutions typically take a longer term view when investing in a company and are less sensitive to news flow. Retail investors are more sensitive to short term news flow, which means that when most of a company’s shares are held by retail investors the stock price can be quite volatile. If a large percentage of shares are held by retail investors, the share price can be at risk if there isn’t a continuous flow of good news.

The 29% of shares held by institutions is quite low for a company of SoFi’s size. However, this can also be quite bullish if institutions increase their ownership over time. When we looked at the shareholder register in June , institutions owned just 11% of the shares, while retail investors owned 74%. This means the trend is heading in the right direction.

Other Shareholder Groups

The remaining 22.6% of shares are held by insiders, venture capital and private equity firms and public companies. Among these investors is Softbank, an early investor in SoFi. It’s encouraging to see that company insiders own a substantial stake in the company, as it means the management team have ‘skin in the game.’ You can check here to see if those insiders have been buying recently.

Next Steps:

SoFi is a company with a lot of potential. The platform has managed to gain a lot of traction amongst younger consumers, and it has a wide range of financial services to offer its customer base. However, growth stocks like this seldom move in a straight line, and volatility is likely if growth becomes lumpy.

Tracking the percentage of shares held by institutions is a good way to see where long term investors see value in the stock. You can keep track of the ownership breakdown and other key information with our free SoFi analysis which is updated regularly.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance