Softbank's big tech bet Arm Holdings faces uncertain future

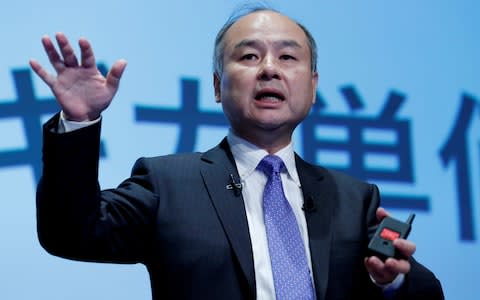

As Masayoshi Son strode confidently onto the stage, the assembled telecoms executives and investors were expecting something big. Son – the chief executive of the Japanese tech conglomerate SoftBank – was known for his bold, often eccentric predictions.

His speech, delivered in Barcelona in early 2017, did not disappoint.

Son said that within 30 years, computers will have achieved an IQ of 10,000. He predicted that we will share the planet with superintelligent robots, which will by then outnumber humans. And almost everything would be connected, down to our footwear.

“One of the chips in our shoes will be smarter than our brain,” he said. “We will be less than our shoes.”

The people tasked with realising this galactic vision worked in an unassuming office park on the outskirts of Cambridge.

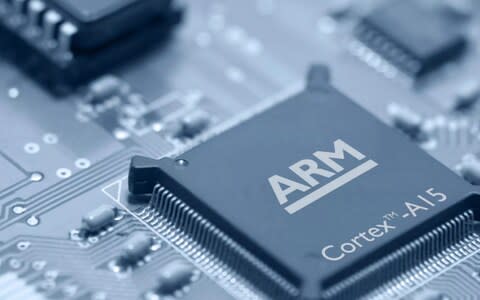

A few months earlier, SoftBank had paid £24bn in cash to acquire Arm Holdings, a FTSE 100 company whose microprocessor designs made up the basis of almost every smartphone on the planet. In two decades, Son said, one trillion microchips will be using Arm’s designs.

The deal was the biggest ever involving a British tech company, and it set pulses racing.

It had been announced just weeks after the EU referendum, and for critics, it was a taste of a grim post-Brexit future, in which foreign raiders exploited a cheap pound to feast on its best companies, move them abroad, and gut their staff.

Three years later, that has not happened. Arm’s base remains in Cambridge, and it has hired almost 1,000 new employees in the UK.

Instead the company, one of Britain’s most successful tech firms, now faces a different question: Has Masayoshi Son’s big bet paid off?

Wedded to the phone

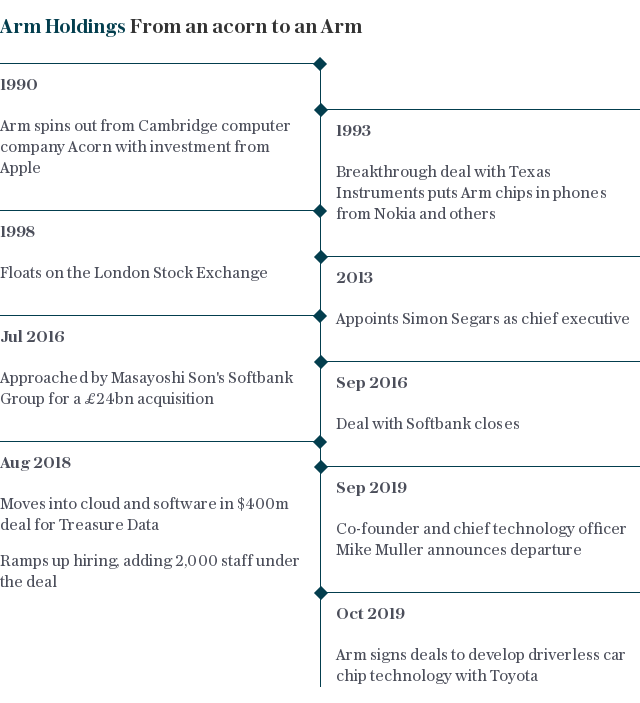

Arm, which was spun out from Acorn Computers in 1990 as a joint venture with Apple, has been tied to the fortunes of the mobile phone.

Its big break came in 1993, when a deal with microchip company Texas Instruments put its technology at the centre of phones from Nokia and others.

Further riches followed in the iPhone era, as the processors became more numerous and expensive.

In 2016, the year SoftBank came knocking, 17.7bn chips using its technology were shipped, compared to 2.5bn a decade earlier.

But it is less clear that Arm can be as successful in its next act. As the smartphone market saturates, the company is turning its attention to the “internet of things”, a world in which everything – not merely your phone – has an internet connection and a processor.

But whilst lightbulbs, ovens and security systems are coming online, it is not happening as quickly as once predicted.

“Connecting everything to the internet is a slower ramp up [than thought],” says Michael Dimelow, a former Arm executive who now runs the investment firm ADV.

Analysts largely agree that the rise of the internet of things is inevitable, once issues such as cybersecurity are ironed out.

“Each [area] has its own set of challenges, the reason it has taken longer is we have to get our heads around the security,” says Patrick Moorhead of Moor Insights and Strategy.

What is less clear is that Arm will own the market, in the same way it has dominated in mobile phones.

Increased competition

The company has had an effective monopoly in smartphones because the two dominant operating systems – Apple’s iOS and Google’s Android – have been designed specifically around Arm-designed processors.

In the IoT, an explosion of competing manufacturers and software standards means the industry has not coalesced around one company in the same way.

Smart washing machines and lightbulbs, meanwhile, do not need the same cutting-edge technology that goes into high-end smartphones, meaning the royalties it makes from licensing its designs are lower.

“It’s not that Arm is a bad solution, it’s just not the only solution,” says one senior industry executive.

In particular, the company faces an emerging challenge from a form of processor architecture known as “RISC-V”, a technology that began as a Berkeley university project nine years ago but which is now gaining momentum.

Whilst Arm makes billions from licensing its designs, RISC-V’s blueprints are open source, making them freely available to chip manufacturers.

Arm customers including Google, Samsung and Nvidia have signed up to the foundation that operates the technology.

Nobody has yet developed a RISC-V processor capable of matching Arm’s most powerful smartphone chip designs, but some believe it is only a matter of time.

In the interim, it presents an increasing threat at the lower end of the market where companies are looking for cost-effectiveness.

“RISC V challenges a fundamental profit driver for Arm: its royalties,” says Dimelow.

One industry rival says Arm’s customers are keen to avoid the company dominating the new market. “If there are customers fed up with Arm they now have an alternative.”

The company is not oblivious to these challenges.

Under SoftBank’s ownership it has pushed into software that manages and secures the thousands of internet-connected devices that might exist in a factory or office.

Last year it made two major acquisitions in the space, the UK’s Stream Technologies and Silicon Valley’s Treasure Data, the latter for $600m (£463m).

It is yet to show that those bets have paid off. Arm’s revenues from software and services were up 54pc last year to $191m, but part of that increase came from the acquisitions, and the division made up just 10pc of total revenues.

After years of growth, Arm’s total revenues were largely flat last year, and adjusted EBITDA, a measure of profitability, has fallen from $827m in 2016 to $279m last year.

Patience required

Simon Segars, Arm’s chief executive, has said it is early days for the software business. “The delivery of all that, those solutions, actually takes some time,” he told reporters.

“Prior to [the acquisition] we were a very profitable company… we’re investing our profitability in growth.”

Those investments will have to make a return eventually.

SoftBank has said it plans to return Arm to the stock market by 2023, and the Japanese conglomerate’s faltering investments in Uber, WeWork and Slack put Arm’s performance under an intense spotlight.

One former executive says Arm would have to be valued at close to $40bn to secure a reasonable return for SoftBank. “I don’t know how he would get a valuation close to what he paid for it.”

Segars says any flotation is a long way off and “a lot of things need to fall in place for us to be in the right shape”.

When it is time to list, however, most bets are on a flotation in the US, rather than a return to London.

Segars says the company has taken no decision on where to float, but today most of the executive team, including its chief executive, is based in Silicon Valley, rather than Cambridge.

Whatever happens, the Arm that emerges from SoftBank’s control will be a very different company to the one that Masayoshi Son bought three years ago.

Yahoo Finance

Yahoo Finance