Softness in New Pool Construction Hurts Pool Corp (POOL)

Pool Corporation POOL is hurt by weakness in new pool construction-related activities and a challenging macroeconomic environment. High costs remain a concern.

In the past 30 days, estimates for 2024 earnings have witnessed downward revisions of 0.7% to $13.30. This Zacks Rank #4 (Sell) company’s earnings in 2024 are likely to witness a decline of 0.4% from the year-ago levels.

Let’s delve deeper.

Concerns

During the fourth quarter of 2023, POOL’s operations were impacted by lower sales volume courtesy of reduced pool construction and deferred discretionary replacement activities. This and a challenging macroeconomic environment added to the downside. The company anticipates the softness in construction activities to persist for some time. For 2024, it expects new pool construction to plunge 10%.

Pool Corp has been witnessing increased expenses lately. Notably, inflationary cost increases in facilities, freight, insurance, IT, advertising and marketing are leading to higher expenses. During the fourth quarter of 2023, operating expenses (as a percentage of net sales) increased to 16.5% from 14.7% reported in the prior year.

During fourth-quarter 2023, operating income declined 26.1% year over year to $79.3 million. The operating margin came in at 7.9%, down 190 basis points from the prior-year quarter’s level. We believe the company must work hard toward cutting expenses to achieve high margins.

Pool Corp’s business is susceptible to weather changes. Usually, sales are favored by weather conditions in the second and third quarters of a calendar year, while unseasonably warm conditions in spring or early winter affect sales. Meanwhile, roughly 50% of the company’s branches and sales are in California, Florida, Texas and Arizona. This reflects a high degree of concentration and dependence on these areas and their weather conditions.

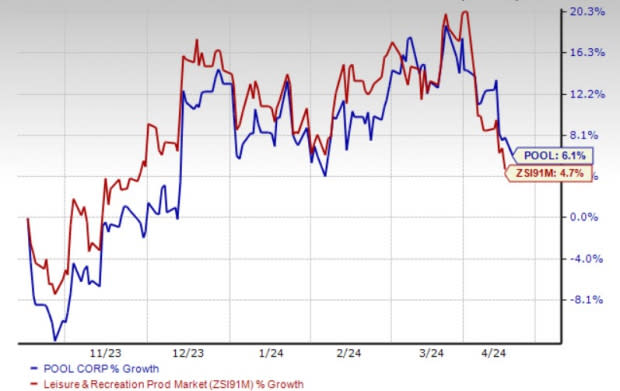

However, the company’s shares have gained 6.1% in the past six months compared with the industry’s growth of 4.7%.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Trip.com Group Limited TCOM presently sports a Zacks Rank #1 (Strong Buy). TCOM has a trailing four-quarter earnings surprise of 53.1%, on average.

Shares of TCOM have gained 34.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TCOM’s 2024 sales and earnings per share (EPS) indicates a rise of 18.2% and 1.8%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently carries a Zacks Rank #2 (Buy). RCL has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have surged 101.3% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates a rise of 14.7% and 47.9%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H presently carries a Zacks Rank of 2. It has a trailing four-quarter earnings surprise of 17.8%, on average. Shares of H have rallied 33.8% in the past year.

The Zacks Consensus Estimate for H’s 2024 sales and EPS indicates a rise of 3.5% and 25%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance