The Software Share Price Is Down 21% So Some Shareholders Are Getting Worried

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market – but in the process, they risk under-performance. Investors in Software Aktiengesellschaft (ETR:SOW) have tasted that bitter downside in the last year, as the share price dropped 21%. That’s well bellow the market return of -4.9%. Because Software hasn’t been listed for many years, the market is still learning about how the business performs. It’s up 2.3% in the last seven days.

See our latest analysis for Software

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Software share price fell, it actually saw its earnings per share (EPS) improve by 19%. It’s quite possible that growth expectations may have been unreasonable in the past. The divergence between the EPS and the share price is quite notable, during the year. So it’s well worth checking out some other metrics, too.

With a low yield of 2.0% we doubt that the dividend influences the share price much. Revenue was fairly steady year on year, which isn’t usually such a bad thing. But the share price might be lower because the market expected a meaningful improvement, and got none.

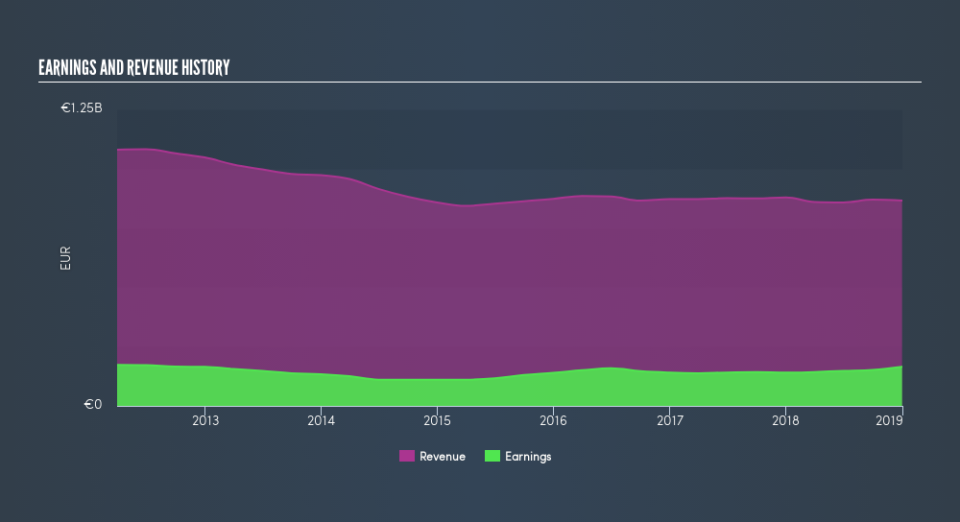

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Software is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Software in this interactive graph of future profit estimates.

A Different Perspective

We doubt Software shareholders are happy with the loss of 20% over twelve months (even including dividends). That falls short of the market, which lost 4.9%. That’s disappointing, but it’s worth keeping in mind that the market-wide selling wouldn’t have helped. With the stock down 8.0% over the last three months, the market doesn’t seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we’d remain pretty wary until we see some strong business performance. Before forming an opinion on Software you might want to consider these 3 valuation metrics.

We will like Software better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance