SolarEdge (SEDG) Launches Smart Power Optimizer S-Series

SolarEdge Technologies, Inc. SEDG has introduced a new range of power optimizers, S-Series, at the RE+ show. The power optimizer is equipped with SolarEdge Sense Connect technology and ensures greater safety in commercial and industrial photovoltaic (PV) applications.

The new product, available for commercial and industrial PV applications across North America, entails significant opportunities for SolarEdge amid the rapidly expanding U.S. solar market. Moreover, the increased reliability, backed by the higher safety standard the product offers, will be well-suited for industrial and commercial solar arrays.

Significance of S-Series & Sense Connect Technology

The S-Series Power Optimizer has been designed to accommodate higher power modules and bi-facial modules. Providing 99.5% efficiency and supporting two high-power, high-input current PV modules, the S-Series lowers the levelized cost of energy due to its higher yield and enables longer and more powerful strings. Also, it offers a simplified cable layout, allowing faster installation and reducing potential isolation faults.

Meanwhile, SolarEdge Sense Connect is the industry-first technology that detects temperature increases at the connector level to prevent potential electric arcs. This helps maximize system safety and uptime and reduces operation and maintenance costs.

With the expected rise in solar PV installations, such a strategic product, which is specifically engineered with technologically advanced and enhanced safety features, may witness strong demand in the days ahead in the commercial market.

Looking Ahead

Per the Energy Information Administration's short-term energy outlook, the largest increases in the U.S. electricity generation forecast come from renewable energy sources, mostly solar and wind.

While renewable sources can be expected to occupy a major portion of the energy mix of the United States in the days ahead, solar-based energy is likely to be at the forefront and may continue to gain momentum.

Moreover, the recently enacted Inflation Reduction Act has spurred demand for solar installations. This has propelled solar companies in the United States to pursue strategic measures to expand their footprint in the nation. The recent product introduction by SolarEdge is a bright example of that.

Meanwhile, other solar companies that are adopting strategies to augment their business strength are as follows:

In August 2022, First Solar FSLR announced that it plans to invest up to $1.2 billion in scaling the production of PV solar modules and boost its production capacity to more than 10 gigawatts by 2025.

First Solar’s long-term earnings growth rate is pegged at 49.3%. FSLR shares have risen 35.9% in the past year.

In September 2022, Canadian Solar CSIQ announced the launch of the battery storage solution EP Cube for homeowners and SolBank for utility-scale operations at the RE+ trade show. The company intends to scale up its battery manufacturing capacity to 10 gigawatt-hours by the end of 2023.

The Zacks Consensus Estimate for Canadian Solar’s 2022 earnings suggests growth of 135.4% from the prior-year reported figure. CSIQ shares have returned 6.3% in the past year.

In September 2022, SunPower Corporation SPWR announced marginal investment in leading solar dealers, EmPower Solar and Renova Energy, as part of its Dealer Accelerator Program.

The Zacks Consensus Estimate for SunPower’s 2022 sales suggests a growth rate of 26.1% from the prior-year reported figure. SPWR shares have appreciated 5.2% in the past year.

Price Movement

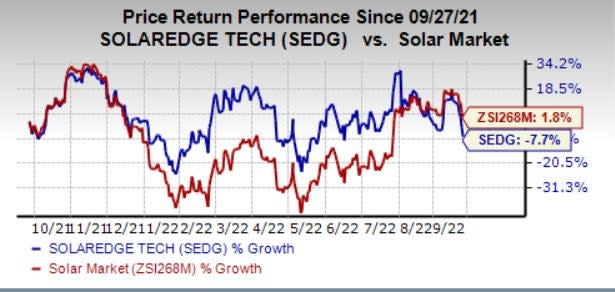

In the past year, shares of SolarEdge have dropped 7.7% against the industry’s 1.8% growth.

Image Source: Zacks Investment Research

Zacks Rank

SolarEdge currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance