Sonic Automotive Inc (SAH) Q1 Earnings: Challenges Persist as Revenue and Net Income Dip

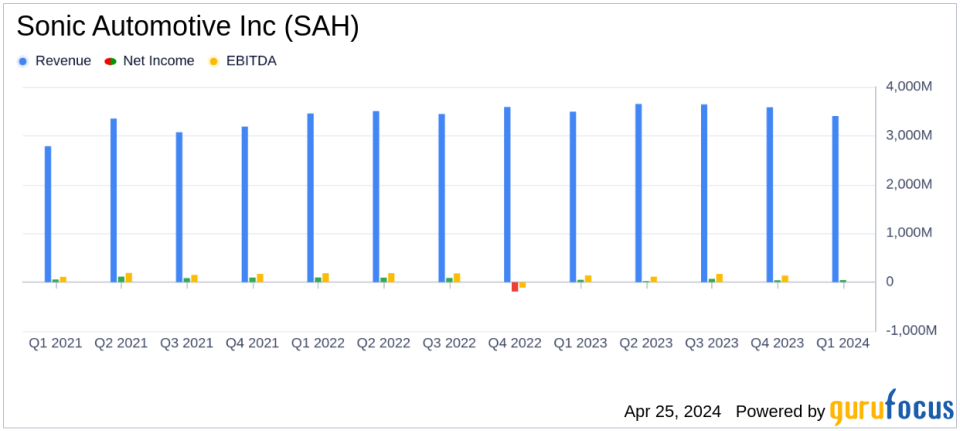

Revenue: $3.4 billion, down 3% year-over-year, below the estimated $3.448 billion.

Net Income: Reported at $42.0 million, down 12% year-over-year, falling short of the estimated $43.61 million.

Earnings Per Share (EPS): Reported at $1.20 per diluted share, down 7% year-over-year, below the estimated $1.30.

Adjusted Net Income: $47.5 million, down 3% year-over-year, with adjusted EPS at $1.36, up 2% year-over-year.

EchoPark Segment: Revenue down 14% to $559.4 million; however, gross profit in this segment rose 34% to $52.6 million.

Franchised Dealerships Segment: Same store revenues up 1%, but same store gross profit down 5% year-over-year.

Dividend: Quarterly cash dividend declared at $0.30 per share, payable on July 15, 2024.

Sonic Automotive Inc (NYSE:SAH), one of the largest auto dealership groups in the United States, released its 8-K filing on April 25, 2024, detailing its financial performance for the first quarter ended March 31, 2024. The company reported a decrease in total revenues to $3.4 billion, a 3% drop from the previous year, and a net income of $42.0 million, down 12% year-over-year. These figures fell short of analyst expectations, which estimated earnings per share of $1.30 and net income of $43.61 million.

Sonic Automotive operates 108 franchised stores across 18 states and owns 25 EchoPark used-vehicle stores, among other automotive service locations. The company's revenue streams include new and used vehicle sales, parts and collision repair, finance, insurance, and wholesale auctions. Despite the overall revenue decline, the EchoPark segment of the business stood out by achieving an all-time record quarterly adjusted EBITDA of $7.3 million, a significant 120% increase year-over-year.

Financial Overview and Segment Performance

The Franchised Dealerships Segment saw a modest increase in same store revenues by 1%, but faced a 5% decline in same store gross profit. Notably, the segment experienced a sharp 32% drop in same store retail new vehicle gross profit per unit. Conversely, the EchoPark Segment, despite a 14% decline in revenues to $559.4 million, reported a 34% increase in total gross profit to $52.6 million. This segment's performance highlights a successful adjustment in its business model, reflecting a strategic reduction in its footprint and focusing on profitable operations.

The Powersports Segment faced challenges, with revenues down 19% and a segment loss of $2.3 million. This downturn reflects the seasonal nature of the business and ongoing market adjustments.

Management Commentary and Future Outlook

David Smith, CEO of Sonic Automotive, expressed pride in the team's performance, particularly highlighting the diversified business model and the strategic return of capital to shareholders. Jeff Dyke, President of Sonic Automotive, emphasized the resilience of the EchoPark model and its adaptability to market conditions, suggesting a positive outlook for the segment in the upcoming quarters.

Heath Byrd, CFO, noted the diversified cash flow streams that continue to strengthen the company's financial position, with $847 million in total liquidity as of the end of the quarter.

Strategic Moves and Shareholder Returns

Demonstrating confidence in its financial health, Sonic Automotive repurchased approximately 0.5 million shares for about $27.0 million during the quarter. Additionally, the Board of Directors approved a quarterly cash dividend of $0.30 per share, payable on July 15, 2024, to shareholders of record as of June 14, 2024.

Despite the challenges faced in the first quarter, Sonic Automotive's strategic adjustments, particularly in the EchoPark segment, and its robust shareholder return plan, position it to potentially overcome current market adversities and capitalize on future growth opportunities.

For more detailed information on Sonic Automotive's quarterly performance and future outlook, interested parties can access the earnings conference call and investor presentation on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Sonic Automotive Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance