Sonoco Closes TEQ Buyout, Eyes Growth in Healthcare Packaging

Sonoco Products Company SON has completed the acquisition of Thermoform Engineered Quality, LLC, and Plastique Holdings, LTD, (together TEQ) from ESCO Technologies, Inc. for a cash payment of $187 million. Sonoco had entered into an agreement to acquire TEQ last November.

Headquartered in Huntley, IL, TEQ is a global manufacturer of thermoformed packaging, offering services for the healthcare, medical device and consumer markets. The company generated sales worth $87 million in the fiscal year ended Sep 30, 2019.

TEQ operates three thermoforming and extrusion facilities in the United States, has one thermoforming operation unit in the U.K., and a thermoforming and molded-fiber manufacturing facility in Poland. Each facility enables production of sterile and barrier packaging systems for pharmaceuticals and medical devices with state-of-the-art cleanroom capabilities. Additionally, the company produces recyclable, molded-pulp-fiber packaging and thermoformed plastic packaging for various consumer products, mainly based out of Europe.

Sonoco’s healthcare packaging business is a fast-growing key growth area. The latest acquisition will enable the company to become a larger supplier to healthcare and medical device manufacturers. Along with the TEQ’s broad capabilities, Sonoco’s healthcare packaging space now include its best-in-class ThermoSafe temperature-assured pharmaceutical packaging, multi-cell cuvettes and appliances, injection-molded vials, thermoformed trays for OTC medical products and medical devices, plus Alloyd heat-sealing equipment for commercial medical applications.

The company funded the deal using short-term credit facilities. This transaction is expected to be conducive to Sonoco’s 2020 earnings.

For the current year, the company anticipates earnings per share (EPS) to lie within $3.65 and $3.75. The mid-point of the range is $3.70 per share. If achieved, it would be a record for the company. The EPS guidance factors in positive impact from acquisitions, volume/mix and productivity initiatives.

For fourth-quarter 2019, EPS is envisioned between 72 and 76 cents. Compared with earnings of 84 cents reported in the year-ago quarter, the mid-point of the guided range reflects a year-over-year decline of 12%.

Sonoco projects 2020 sales at $5.55 billion, calling for year-over-year growth of 3%. The company expects to deliver 4% organic growth in Flexible packaging and 4-5% organic growth in Rigid Plastic Packaging in 2020.

Sonoco plans to pursue accretive acquisitions in targeted consumer and industrial markets. Last October, the company acquired the remaining 70% interest in the Conitex-Sonoco joint venture and Texpack's composite can operation in Spain. These buyouts have enabled the company in expanding its manufacturing presence in the Americas, Europe, as well as the rapidly-growing markets in Asia. Moreover, Sonoco’s acquisition of Corenso Holdings America has created a long-term opportunity for the company by expanding its paperboard and core converting operations.

The company is focused on driving growth, margin expansion and generating solid free-cash flow. Its strong balance sheet enables the company to invest in capacity and pursue acquisitions. For 2020, operating cash flow is projected at around $635 million. The company expects to generate free cash flow of $260 million, after spending $195 million in capital investments and a dividend payout of $180 million, subject to its board’s approval. Working capital management and strategic capital expenditure are likely to boost free cash flow.

Sonoco intends to turn the consumer packaging segment around in fiscal 2020, and grow and optimize its industrial packaging. The company will continue its portfolio-optimization initiatives. It plans to focus on profitable growth through fresh products, customers and sustainable products.

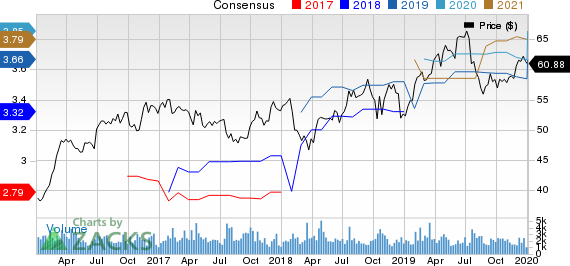

Sonoco Products Company Price and Consensus

Sonoco Products Company price-consensus-chart | Sonoco Products Company Quote

Zacks Rank & Stocks to Consider

Sonoco currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are CIRCOR International, Inc. CIR, Chart Industries, Inc. GTLS and DXP Enterprises, Inc. DXPE. While CIRCOR International sports a Zacks Rank #1 (Strong Buy), Chart Industries and DXP Enterprises carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

CIRCOR International has an expected earnings growth rate of 59.3% for the current year. The stock has surged 114.2% over the past year.

Chart Industries has a projected earnings growth rate of 73.6% for 2020. The company’s shares have gained 6% over the past year.

DXP Enterprises has an estimated earnings growth rate of 10.5% for the ongoing year. In a year’s time, the company’s shares have appreciated 37.3%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonoco Products Company (SON) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

CIRCOR International, Inc. (CIR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance