Sony (SNE) Trims Overhead Strength to Streamline Operations

Recently, Sony Corporation’s SNE business arm — Sony Pictures Entertainment (‘SPE’) — is trimming down 5% of its worldwide distribution and marketing staff. The company has undertaken this move in a bid to streamline its marketing division, going forward.

SPE is an operating subsidiary of Sony Entertainment Inc., which is itself a subsidiary concern of Sony.

Henceforth, movie marketing activities of Culver City, California-based SPE’s employee’s will be more digitally and globally focused. The aforementioned reorganizational move will help workers more proficiently reflect the realities regarding today’s movie-releasing approaches.

With the job-elimination move, SPE has removed several positions within its publicity, media, research and strategy, and consumer and distribution groups.

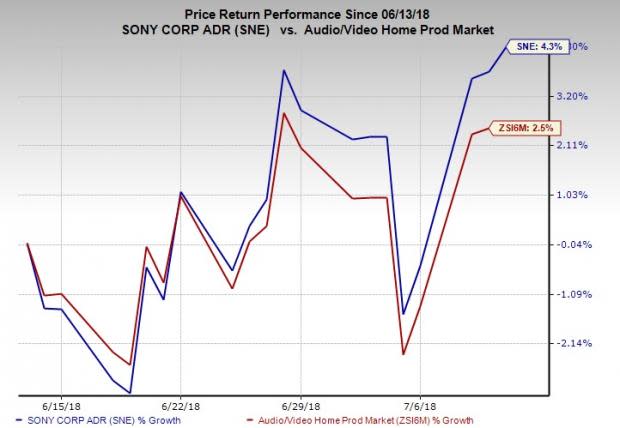

Innovative forms of entertainment, such as streaming, are demanding greater efficiency from Hollywood studios. In sync with this trend, Sony has been undertaking several management reshaping moves (similar to the abovementioned one) to boost its movie business, moving ahead. Over the past month, Sony’s shares have rallied 4.3%, outperforming 2.5% growth recorded by the industry.

However, the company currently carries a Zacks Rank #5 (Strong Sell). Decline in smartphone sales and sustained weaknesses in the semiconductors market are expected to thwart the company’s long-term growth. Moreover, the Sony’s existing battery business has been showing signs of weakness, and its camera module business too, is likely to deteriorate in the near future. Also, intensifying competition in the smartphones domain is further weighing down on profitability.

Stocks to Consider

Some better-ranked stocks in the Zacks Consumer Discretionary sector are listed below:

AMC Networks Inc. AMCX sports a Zacks Rank #1 (Strong Buy). The company pulled off an average positive earnings surprise of 28.43% over the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Public Education, Inc. APEI also flaunts a Zacks Rank of 1. The company recorded an average positive earnings surprise of 21.52% over the trailing four quarters.

AMC Entertainment Holdings, Inc. AMC carries a Zacks Rank #2 (Buy). The company came up with an average positive earnings surprise of 67.61% over the preceding four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Sony Corporation (SNE) : Free Stock Analysis Report

AMC Networks Inc. (AMCX) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance