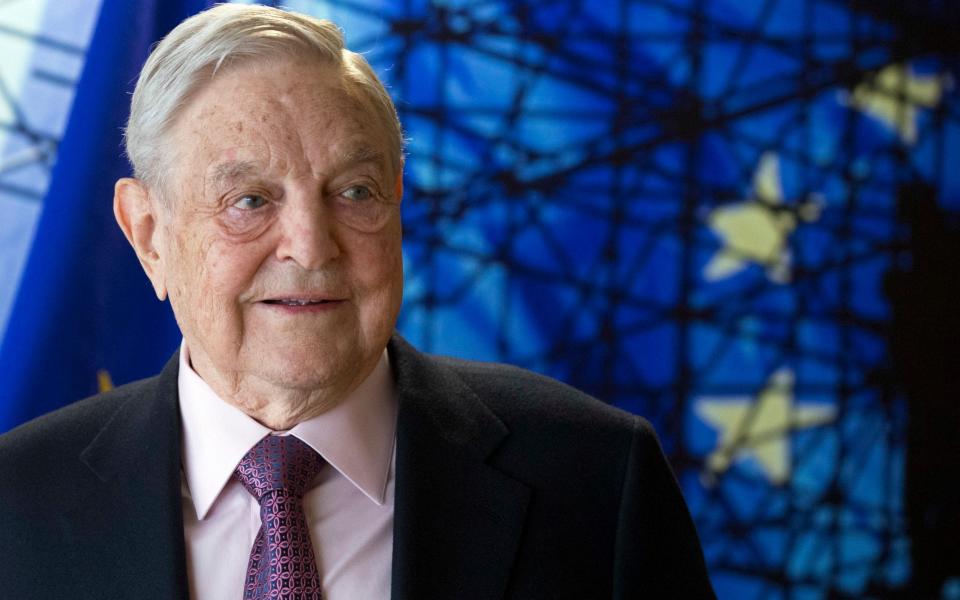

Soros vs Questor: who is right about the destination of Trainline’s share price?

Should Questor go head to head with George Soros? The legendary financier’s investment arm in Britain has “short-sold” shares in Trainline, the rail and bus ticket seller tipped by this column in October 2019.

He’s not the only one: several hedge funds have bet the same way, making Trainline one of the most “shorted” companies on the London market.

Our view of short sellers is that they are always worth listening to but are not always right. We don’t know Mr Soros’s reasons for thinking that Trainline is overvalued but the bearish case is not hard to make: trains have been all but empty for much of the past year and we don’t know when – or even if – they will again be as busy as they were before the pandemic.

We do have some facts to go on, however. Last summer, when the virus retreated here and in Europe, where Trainline has a growing presence, passengers did return to public transport. Outside Britain, where restrictions were eased later, Trainline’s revenues in the period June to August were 74pc of those in the same months of 2019.

This year the newly vaccinated may feel even more ready to travel. Pent-up demand for holidays, perhaps closer to home than normal and suited to rail as opposed to air travel, could even result in more leisure trips this year.

Sign up to our Business Briefing newsletter for a snapshot of the day’s biggest business stories

Read Questor’s rules of investment before you follow our tips

Set against that is what seems certain to be a permanent decline in commuting as hybrid working patterns become the norm. However, commuting has not been a big source of revenue for Trainline as five-day-a-week travellers tend to have season tickets.

The shift to hybrid working could even result in more business for the company if workers buy individual tickets when they do go into the office, although Trainline’s systems are ready for new flexible tickets planned by the Government to suit post-Covid commuting.

While a decline in business journeys seems likely now that everyone is used to video meetings, business travel has also so far counted for a relatively small proportion of the firm’s revenues: its Trainline for Business arm, which also includes “white label” services for train operators, accounted for 22pc of sales in the year to February 2020.

Even if the aggregate number of journeys fails to recover fully, the rise of electronic ticketing will help to make up for it. Travellers may have switched to e-tickets for reasons of hygiene during the pandemic but once they have downloaded the app and got used to buying tickets through it, will they want to go back to queuing at ticket offices?

As about 60pc of sales were made in person before the pandemic, according to the firm, there is plenty of scope for e-ticketing to grow.

Questor has been a frequent user of Trainline’s app both here and abroad and can testify to its ease of use and reliability. The company has continued to invest in the app during lockdown and travellers in this country at least are now alerted if splitting their ticket would save money. Other functions tell them which trains or individual carriages are crowded.

All this is not to say that everything is rosy. The rail industry has been turned upside down by the virus and further uncertainty stems from the inquiry into its future being undertaken by Keith Williams, whose conclusions have been repeatedly delayed.

While a return to a single train operator, a British Rail mark 2, or an enforced cut to Trainline’s 5pc share of the price of each ticket cannot be ruled out, the inquiry seems more likely to come out in favour of a continuation of rail’s regional structure and of a level of commission for ticket sellers that encourages competition, according to Harry Nimmo of Aberdeen Standard Investments, an investor in the firm.

Meanwhile, the proliferation of different train operators, which favours Trainline’s one-stop-shop model over the use of individual rail companies’ apps, seems certain to continue in its continental markets thanks to new EU rules that encourage competition on the bloc’s rail networks.

The shares have held up surprisingly well since our original tip but the opportunities for growth remain once the virus is defeated even if we acknowledge the many uncertainties.

“The share price [currently 457.6p] could go to £10 or £2, although the former is far more likely in my view,” said Mr Nimmo. “The firm’s prospects look brighter by the day and it should outperform in the medium term.”

We’ll resist the urge to side with Mr Soros and will hold on.

Questor says: hold

Ticker: TRN

Share price at close: 457.6p

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Yahoo Finance

Yahoo Finance