Southwest Gas (SWX) Q2 Earnings Miss, Revenues Beat Estimates

Southwest Gas Holding Inc. SWX recorded second-quarter 2022 operating earnings per share (EPS) of 23 cents, which missed the Zacks Consensus Estimate of 53 cents by 56.7%. The bottom line also decreased by 46.5% from the year-ago quarter’s tally of 43 cents per share.

Total Revenues

Operating revenues of $1,146.1 million surpassed the Zacks Consensus Estimate of $1,011 million by 13.4%. The top line improved by 39.5% from $821.4 million in the prior-year quarter.

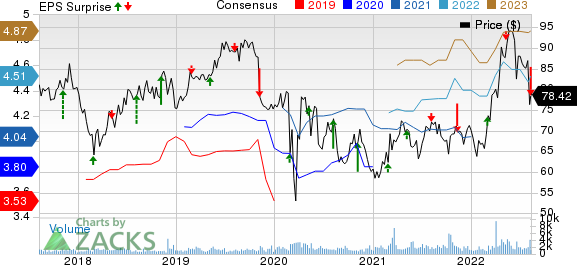

Southwest Gas Corporation Price, Consensus and EPS Surprise

Southwest Gas Corporation price-consensus-eps-surprise-chart | Southwest Gas Corporation Quote

Highlights of the Release

Total operating expenses in the second quarter amounted to $1,100.5 million, up 44.4% from the year-ago figure of $762.2 million, due to an increase in the net cost of gas sold, utility infrastructure services expenses and higher operations and maintenance expenses.

The operating income was $45.7 million, down 22.9% year over year.

Financial Highlights

Cash and cash equivalents as of Jun 30, 2022 were $215.9 million compared with $222.7 million as of Dec 31, 2021.

The long-term debt, less current maturities, amounted to $4,588.5 million as of Jun 30, 2022 compared with $4,115.7 million as of Dec 31, 2021.

Southwest Gas’ net cash provided by operating activities for the first six months of 2022 was $263.6 million compared to cash used in operating activities of $1.4 million in the year-ago period.

Guidance

SWX updated capital expenditure plans in the range of $600-$650 million compared with the previously announced $650-$700 million range in the Natural Gas Distribution segment. The segment expects a utility rate base CAGR of 5% to 7% for the 2022-2026 period.

Natural Gas Distribution segment reiterated the five-year capital expenditure expectation in the range of $2.5-$3.5 billion.

The Utility Infrastructure Services segment reiterated its 2022 revenue expectation in the range of $2.65 billion-$2.8 billion.

Zacks Rank

Southwest Gas carries a Zacks Rank #4 (Sell) currently.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Atmos Energy Corporation ATO posted third-quarter fiscal 2022 EPS of 92 cents, which surpassed the Zacks Consensus Estimate of 86 cents by 7%.

The Zacks Consensus Estimate for ATO’s 2022 earnings implies year-over-year growth of 8.4%. Atmos Energy’s long-term earnings growth is pegged at 7.4%.

Sempra Energy’s SRE second-quarter 2022 adjusted EPS came in at $1.98, which beat the Zacks Consensus Estimate of $1.82 by 8.8%.

The Zacks Consensus Estimate for SRE’s 2022 earnings implies year-over-year growth of 1.8%. Sempra Energy’s long-term earnings growth is pegged at 5.8%.

National Fuel Gas Company NFG posted third-quarter fiscal 2022 adjusted operating earnings of $1.54 per share, surpassing the Zacks Consensus Estimate of $1.47 by 4.8%.

The Zacks Consensus Estimate for NFG’s 2022 earnings implies year-over-year growth of 36.4%. National Fuel Gas’ long-term earnings growth is pegged at 13.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sempra Energy (SRE) : Free Stock Analysis Report

Southwest Gas Corporation (SWX) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance