Southwestern (SWN) Stock Gains 4.2% Since Q1 Earnings Beat

Southwestern Energy Company’s SWN shares have jumped 4.2% since it reported strong results for the first quarter of 2022. A favorable energy business scenario, resulting in strong earnings for upstream companies, is likely to have driven the company’s stock price.

Southwestern reported first-quarter earnings of 40 cents per share, beating the Zacks Consensus Estimate of 36 cents. The bottom line improved from the year-ago quarter’s earnings per share of 29 cents.

Quarterly operating revenues of $2,943 million surpassed the Zacks Consensus Estimate of $1,693 million. The top line also increased from the year-ago quarter’s $1,072 million.

The strong quarterly results can be attributed to higher natural gas production volumes and commodity price realizations.

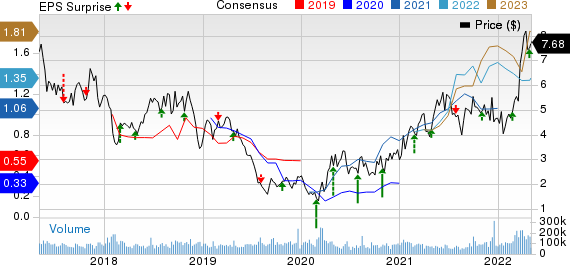

Southwestern Energy Company Price, Consensus and EPS Surprise

Southwestern Energy Company price-consensus-eps-surprise-chart | Southwestern Energy Company Quote

Total Production

Southwestern’s total first-quarter production increased to 425 billion cubic feet equivalent (Bcfe) from 269 Bcfe a year ago. Gas production in the reported quarter was 376 Bcf compared with the year-ago level of 214 Bcf.

Natural gas liquids’ production in the quarter under review was 6,919 thousand barrels (MBbls), lower than the year-ago level of 7,578 MBbls. Oil production declined to 1,270 MBbls from 1,662 MBbls in the year-ago quarter. Almost 88.5% of its volume mix constituted natural gas.

Average Realized Prices

Southwestern’s average realized gas price in the reported quarter, excluding derivatives, increased to $4.50 per thousand cubic feet (Mcf) from $2.11 a year ago. Oil was sold at $86.30 per barrel compared with the year-earlier level of $48.14. Natural gas liquids were sold at $39.33 per barrel, significantly higher than $22.86 in the year-ago period.

Expenses

On a per-Mcfe basis, lease operating expenses were 94 cents compared with the prior-year level of 93 cents. General and administrative expenses per unit of production were 9 cents versus 13 cents in the year-ago quarter.

Financials

Southwestern’s total capital investment in the first quarter was $544 million.

As of Mar 31, 2022, the company’s cash and cash equivalents were $21 million. Long-term debt was $4,895 million.

Guidance

For the second quarter of 2022, the Zacks Rank #3 (Hold) company expects total production of 418-434 Bcfe, consisting of natural gas of 370-382 Bcf.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshot of Other Upstream Energy Companies

Matador Resources Company MTDR reported first-quarter 2022 adjusted earnings of $2.32 per share, beating the Zacks Consensus Estimate of $2.05 per share. The strong quarterly earnings were driven by increased oil-equivalent production volumes and higher commodity price realizations.

As of Mar 31, 2022, Matador had cash and restricted cash of $120.2 million. Long-term debt was recorded at $1,498 million, including $50 million of borrowings under its credit agreement. Debt to capitalization was 39.1%.

Range Resources Corporation RRC reported first-quarter 2022 adjusted earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.15 per share. The strong quarterly earnings can be attributed to higher realizations of commodity prices.

At the first-quarter end, Range Resources had total debt of $1,829.7 million. It had a debt-to-capitalization of 53.3%. In first-quarter 2022, the company’s board of directors approved the authorization of a $500-million share repurchase program.

Diamondback Energy FANG reported first-quarter 2022 adjusted earnings per share of $5.20, beating the Zacks Consensus Estimate of $4.74. The outperformance can be attributed to the surge in energy prices in the quarter, which led to higher oil, gas and natural gas liquid sales.

As of Mar 31, Diamondback had $149 million in cash and cash equivalents and $5.8 billion in long-term debt, representing a debt-to-capitalization of 29.5%. In good news for investors, FANG raised its regular quarterly dividend payout by almost 17% to 70 cents a share and declared a variable dividend of $2.35, bringing the total distribution to $3.05.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Southwestern Energy Company (SWN) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance