Spirit Airlines Revises View Post Pilot Contract Ratification

Spirit Airlines, Inc. SAVE has recently provided an update on first-quarter 2018 and full-year guidance. The revised view comprises the estimated increased costs pertaining to the recently ratified pilot contract.

Capacity measured in available seat miles (ASMs) is projected at an approximate rise of 21.7% in the first quarter, up from the previous outlook of 21.5% growth. Full-year outlook for the metric remains unchanged at an expansion of around 23%.

Adjusted cost per available seat mile (CASM) excluding fuel is anticipated to fall 3% in the quarter under review from the prior projection of a decline between 5.5% and 6.5%. While for 2018, the metric is predicted in the range of flat to down 1%. Preceding forecast had called for a 3-5% decrease in the same.

Apart from the higher expenses associated with pay-related deal with its pilots, the surge in fuel costs are also expected to weigh on the bottom line, going forward. Fuel cost (economic) is projected at $2.17 per gallon in the first quarter, slightly higher than $2.16, anticipated earlier.

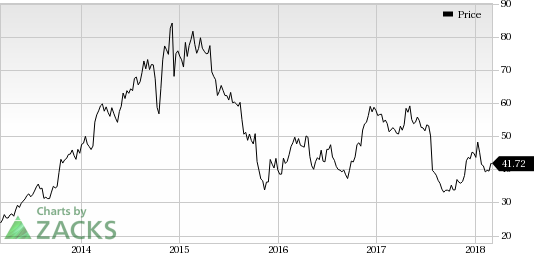

Spirit Airlines, Inc. Price

Spirit Airlines, Inc. Price | Spirit Airlines, Inc. Quote

The view for total revenue per available seat mile (TRASM), effective tax rate and capital expenditures remains unchanged. While TRASM is expected to deteriorate between 1% and 2.5%, capital expenditures for 2018 are estimated to be $649 million. Effective tax rate is pegged at 25.5% in the first quarter and 24% this year.

Zacks Rank & Key Picks

Spirit Airlines carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the airline space are International Consolidated Airlines Group SA ICAGY, Delta Air Lines, Inc. DAL and Southwest Airlines Co. LUV. While International Consolidated Airlines sports a Zacks Rank #1 (Strong Buy), Delta Air Lines and Southwest Airlines carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of International Consolidated Airlines, Delta Air Lines and Southwest Airlines have rallied more than 10%, 14% and 11%, respectively, in the last six months.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Company (LUV) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance