Splunk Acquires VictorOps, Expands DevOps Product Portfolio

Splunk SPLK is on an acquisition spree. After acquiring security startup Phantom Cyber in February 2018 and Rocana in October 2017, the company recently announced the acquisition of VictorOps, which is a leader in DevOps incident management, for $120 million in cash and stock.

The acquisition is expected to close during Splunk’s fiscal second-quarter 2018. The addition of VictorOps will enable Splunk address the needs of DevOps, which is a rapidly growing domain of software engineering.

Per Fortune, VictorOps generates notifications, pulls relevant parties into chat groups, presents pertinent documents and keeps detailed records as teams work through coding problems.

Per Splunk management, “The combination of machine data analytics and artificial intelligence from Splunk with incident management from VictorOps creates a ‘Platform of Engagement’ that will help modern development teams innovate faster and deliver better customer experiences.”

Acquisitions Driving Growth Trajectory

Splunk has focused on acquisitions to expand its portfolio. The buyout of Phantom Cyber helped it to bolster its cybersecurity offerings. Phantom’s products help automate work IT security operations.

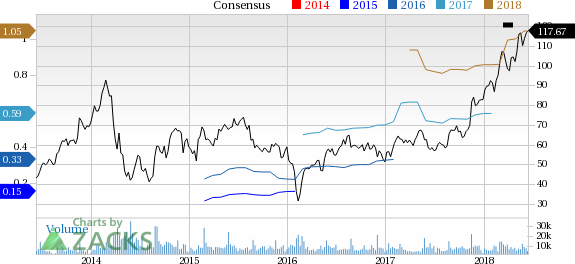

Splunk Inc. Price and Consensus

Splunk Inc. Price and Consensus | Splunk Inc. Quote

Notably, the acquisitions of Caspida and Metafor Software (both in 2015) helped it to offer behavioral analytics products.

Rocana, on the other hand, develops analytics solutions for the IT market. Splunk also acquired SignalSense in fiscal 2018, which strengthened its cloud-based data collection and breach detection solutions portfolio.

The strong portfolio and expanding clientele have been primary drivers behind Splunk’s strong top-line growth in recent times. In the last reported quarter, revenues surged 37.4% year over year to $311.6 million and surpassed the Zacks Consensus Estimate of $298 million.

Splunk added more than 460 new customers in the quarter. The company had 43 orders of $1 million or more, as compared with 35 in the year-ago quarter.

Zacks Rank & Other Stocks to Consider

Currently, Splunk has a Zacks Rank #3 (Hold).

Stocks worth considering in the same sector are Twitter TWTR, Upland Software UPLD and Attunity ATTU. All the three stocks sport Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Twitter is currently pegged at 23.10%, while both Upland Software and Attunity is expected to grow at 20%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Attunity Ltd. (ATTU) : Free Stock Analysis Report

Upland Software, Inc. (UPLD) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance