Spotlight On 3 Swiss Growth Companies With Insider Ownership Reaching 17%

Recent trends in the Swiss market have shown a mix of volatility and uncertainty, with factors like unexpected inflation hikes and declining retail sales influencing overall sentiment. The benchmark SMI experienced fluctuations, reflecting these broader economic challenges. In such a market environment, growth companies with high insider ownership can be particularly noteworthy. These firms often benefit from committed leadership that is closely aligned with the company's success, potentially offering a degree of stability amidst market unpredictability.

Top 10 Growth Companies With High Insider Ownership In Switzerland

Name | Insider Ownership | Growth Rating |

VAT Group (SWX:VACN) | 10.2% | ★★★★★☆ |

Straumann Holding (SWX:STMN) | 32.7% | ★★★★★☆ |

Temenos (SWX:TEMN) | 14.6% | ★★★★☆☆ |

Swissquote Group Holding (SWX:SQN) | 11.4% | ★★★★☆☆ |

Sonova Holding (SWX:SOON) | 17.7% | ★★★★☆☆ |

LEM Holding (SWX:LEHN) | 34.5% | ★★★★☆☆ |

Landis+Gyr Group (SWX:LAND) | 10.8% | ★★★★☆☆ |

Arbonia (SWX:ARBN) | 28.8% | ★★★★☆☆ |

Sensirion Holding (SWX:SENS) | 20.7% | ★★★★☆☆ |

SHL Telemedicine (SWX:SHLTN) | 13.1% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Partners Group Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm involved in direct, secondary, and primary investments across various sectors including equity, real estate, infrastructure, and debt, with a market capitalization of CHF 30.73 billion.

Operations: The firm generates revenue from several key segments: Private Equity (CHF 1.17 billion), Infrastructure (CHF 379.20 million), Private Credit (CHF 211.30 million), and Real Estate (CHF 186.90 million).

Insider Ownership: 17.1%

Partners Group Holding AG, a Swiss private equity firm, is actively engaged in strategic maneuvers including potential sales of its renewable energy investments, with deals possibly valuing businesses up to US$400 million. Despite a high level of debt, the company forecasts robust growth with earnings expected to increase by 13.9% annually, outpacing the Swiss market's 8% growth rate. However, its dividend coverage remains weak due to insufficient earnings and cash flows support. Recent financial results show stable net income around CHF 1 billion for the year ended December 31, 2023.

Sonova Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG is a company that manufactures and sells hearing care solutions for adults and children across the United States, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of CHF 15.50 billion.

Operations: The company's revenue is primarily generated from two segments: Cochlear Implants, which brought in CHF 280.30 million, and Hearing Instruments, contributing CHF 3.38 billion.

Insider Ownership: 17.7%

Sonova Holding, a notable player in the Swiss market, is positioned to outperform with its earnings forecasted to grow at 10.7% annually, surpassing the market's 8%. Additionally, its revenue growth at 6.8% yearly also beats the Swiss average of 4.4%. Despite not having significant insider transactions recently, Sonova trades at a compelling 42.2% below estimated fair value and boasts an impressive projected Return on Equity of 28.8%. However, it carries a high level of debt which could temper financial flexibility.

Swissquote Group Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd is a global provider of online financial services catering to retail, affluent, and institutional clients with a market capitalization of approximately CHF 3.71 billion.

Operations: The company generates its revenue primarily through leveraged Forex and securities trading, with respective earnings of CHF 101.09 million and CHF 429.78 million.

Insider Ownership: 11.4%

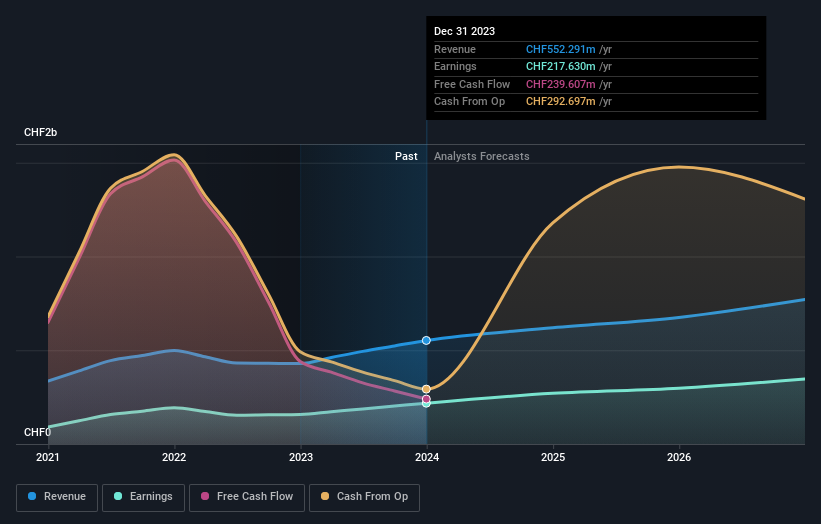

Swissquote Group Holding Ltd, a growth-oriented firm in Switzerland, reported a substantial increase in net income to CHF 217.63 million for the year ending December 31, 2023. The company's earnings are set to grow by 14.3% annually, outpacing the Swiss market's average of 8%. Additionally, revenue is expected to rise by 10.6% per year, also above the national rate of 4.4%. Despite trading at a significant discount—31% below its estimated fair value—Swissquote's projected Return on Equity stands high at 23.2%, signaling strong managerial efficiency and potential profitability.

Summing It All Up

Click here to access our complete index of 17 Fast Growing Companies With High Insider Ownership.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include SWX:PGHN SWX:SOON and SWX:SQN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance