Square (SQ) Looks Strong Going Into Q4 Earnings

After a dismal couple days of trading, the fintech powerhouse, Square SQ, prepares to release its Q4 earnings to round out 2019. SQ has traded all over the board in the past year and is now effectively flat from 52 weeks ago. Will tonight’s earnings launch this stock up and out of its recent trading slump? Has the stock’s 8% decline since Monday created a springboard for gains tonight (February 26)?

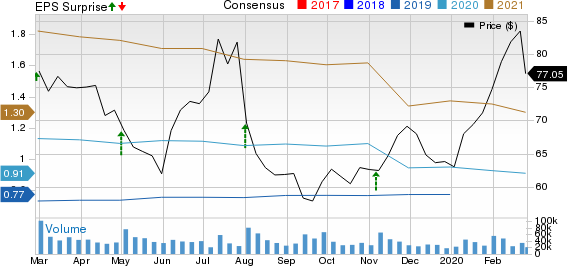

Square, Inc. Price, Consensus and EPS Surprise

Square, Inc. price-consensus-eps-surprise-chart | Square, Inc. Quote

SQ is a big mover on earnings with the past 6 quarterly reports resulting in an average price action of 7.5% (3 up, 3 down). The firm beat top and bottom-line estimates in all the past 6 reports, with its losses coming from its recent CEO change and downward revisions in forward guidance.

Zacks Consensus estimates project an EPS of $0.21 on sales of $1.19 billion, representing year-over-year growth of 43% and 27%, respectively. Remember that SQ will likely beat on both metrics with its IR team proving to be quite effective in telegraphing expected results to the markets. Management guidance and noteworthy news will be the likely catalyst for a share price movement.

The Business

The financial world has been evolving with the technological revolution finding its way into every crevice of the economy. The world is digitalizing, and the paper cash economy we once knew is becoming antiquated. Millennials and Gen Z’s don’t carry cash anymore with the use of cards and smartphones becoming the preferred payment methods. Square has been able to capitalize on the evolving financial world with its innovative payment process technology.

Most of you have likely used Square at your local main street businesses, recognized for its sleek hardware design being either a small square plug-in on a smartphone or a glossy white chip insert block. Square’s hardware, combined with its cloud-based software allows any business to accept digital payments.

Square has adopted a peer-to-peer (P2P) payment app called Cash App. This application is competing in this overly competitive market with PayPal’s PYPL Venmo, Apple Cash, and Zelle, which was started by some of the largest US banks, including Bank of America BAC, JP Morgan Chase JPM, and Wells Fargo WFC.

Square has been building out its subscription-based business model that has been yielding the company the substantial margins and exponentially growing its topline with reliable revenue.

The firm’s purchase of Weebly ($365 million in cash and stock mix) last year has broadened Square’s reoccurring revenue stream. Weebly is a tech company that gives businesses the necessary tools to build out an e-commerce platform and helps the business manage it. Weebly and Square have an overlapping customer base, which should provide significant synergies for the combined company.

SQ has been building out its business fast with high double-digit topline growth and its ability to be cash-flow positive for the past 2 years. SQ has a proven business model, and its market is only expected to expand. Analysts are expecting 23% topline growth this year and extensive margin expansions, which would grow the firm’s 2020 profitability by 66%.

Square is now opening its business to CBD merchants, creating an enormous market opportunity for this small business propelling enterprise. Once marijuana is federally legalized, Square will be well-positioned to take on the massive payment demands that these merchants require. I think that current estimates are not taking the potential of the cannabis market into account. This new wave of retail could drive enormous growth for Square.

Take Away

The enterprise is just beginning to turn a profit, and the stock is on an upswing in anticipation of margin expansion into robust long-term profitability. I am not saying that you are guaranteed to turn a quick profit from putting on a position before earnings this evening, but I like this stock at its current price level.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance