Squeeze on UK household incomes less severe than many think, says MoneySavingExpert

The squeeze on household finances might not be a hard as many people think.

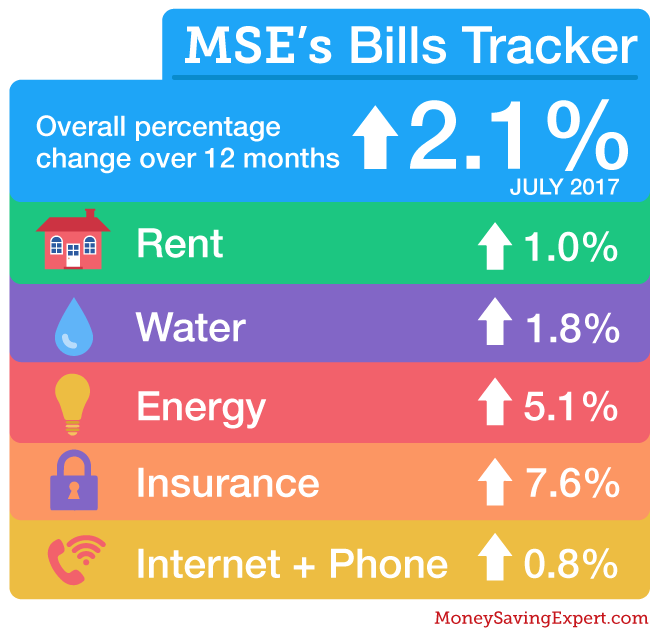

New research shows bills rose 2.1% for the 12 months to July – below the official rate of inflation of 2.6% for the month.

The percentage rise in bills also mirrored the rise in average weekly earnings, suggesting that while households up and down Britain aren’t exactly making money, they are treading water.

MORE: Martin Lewis launches Twitter tirade against ‘disgusting’ scam companies using his name

Consumer website MoneySavingExpert.com’s new Bills Tracker service indicates the cost of living squeeze may actually be less severe than many realise.

It found costs including rent, energy bills, council tax and insurance have risen by 2.1% in the past year.

In the 12 months to July 2017, average energy costs increased by 5.1%. The biggest increase was seen in insurance, said MSE, with an overall rise of 7.6% – motor vehicle insurance and travel insurance saw the biggest changes of 12.8% and 12.4%, respectively.

However, some other bills – such as overdraft and credit card fees and mobile phone bills – actually fell over the past year.

MORE: Commuters face rail fare hikes of hundreds of pounds on back of 3.6% inflation figure

The Bills Tracker focuses on about 40 areas that are deemed “unavoidable” household costs.

“It’s cold comfort for many, but there are things you can do to ease the pinch,” said Guy Anker, managing editor at MoneySavingExpert.com.

“The average home can save £300 a year by switching energy provider, you can tackle sky-high insurance costs with a quick comparison, and we know that many make huge savings by haggling with their broadband, phone and TV providers,” he said.

The data was compiled before British Gas announced a rise of 12.5% for electricity customers from September 15.

MORE: Raising a child to 18 in Britain now cost single parents more than £100,000

Gas prices will be unchanged, but the average annual dual-fuel bill for a typical household on a standard tariff will rise by £76 to £1,120, up by 7.3%.

And, the July Retail Prices Index figure is also used to set next year’s rail ticket price increases – so regulated fares could climb by 3.6% from January, adding hundreds of pounds to the cost of season tickets and standard returns.

Yahoo Finance

Yahoo Finance