SS&C Technologies Holdings Inc (SSNC) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

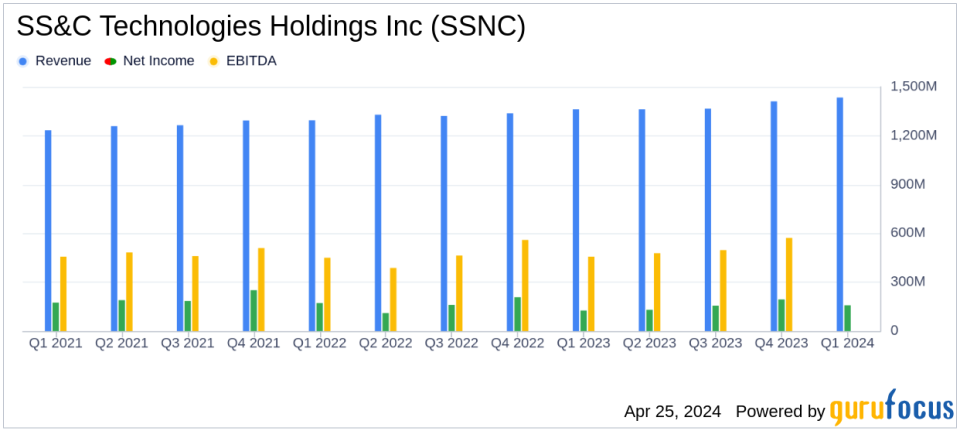

Reported GAAP Revenue: $1,435.0 million, reflecting a 5.3% increase year-over-year, exceeding the estimated revenue of $1,412.76 million.

Adjusted Revenue: Reached $1,435.8 million, also marking a 5.3% growth from the previous year, surpassing the estimated revenue.

GAAP Net Income: $157.6 million, up 25.1% year-over-year, significantly exceeding the estimated net income of $291.85 million.

Adjusted Diluted Earnings Per Share (EPS): $1.28, up 12.3% from the previous year, surpassing the estimated EPS of $1.21.

Operating Income Margin: Improved to 23.2% from 20.6% a year earlier, reflecting better operational efficiency.

Adjusted EBITDA: Increased to $556.8 million, up 9.4% year-over-year, with the EBITDA margin expanding to 38.8% from 37.3%.

Debt Reduction: Paid down $79.9 million in debt, reducing the net leverage ratio to 2.95 times consolidated EBITDA.

On April 25, 2024, SS&C Technologies Holdings Inc (NASDAQ:SSNC) disclosed its first-quarter earnings for 2024, showcasing a robust performance with significant increases in both GAAP and adjusted revenue, alongside a notable rise in earnings per share. The company released its earnings details in its 8-K filing.

Financial Performance Overview

SS&C Technologies reported a GAAP revenue of $1,435.0 million for Q1 2024, marking a 5.3% increase from $1,362.7 million in Q1 2023. This performance notably exceeds the analysts' estimated revenue of $1,412.76 million. The adjusted revenue also saw a similar increase, reaching $1,435.8 million.

The company's GAAP diluted earnings per share rose by 26.5% to $0.62, while the adjusted diluted earnings per share improved by 12.3% to $1.28, surpassing the estimated earnings per share of $1.21. The adjusted operating income for the quarter was $540.0 million, up 9.5% from the previous year, and the adjusted operating income margin expanded to 37.6%.

Strategic Achievements and Operational Highlights

SS&C's quarter was highlighted by strategic debt reduction and share buybacks, enhancing shareholder value. The company repurchased 0.8 million shares for $52.9 million and reduced its debt by $79.9 million, achieving a net leverage ratio of 2.95 times consolidated EBITDA. Additionally, SS&C hosted its inaugural Deliver Europe event, strengthening client engagement and service capabilities.

Guidance and Future Outlook

Looking ahead to Q2 2024, SS&C projects adjusted revenue to be between $1,412.1 million and $1,452.1 million and adjusted net income between $295.7 million and $311.7 million. For the full year, the company expects adjusted revenue to range from $5,694.6 million to $5,854.6 million and adjusted net income from $1,242.3 million to $1,322.3 million.

Challenges and Market Conditions

Despite strong financial outcomes, SS&C experienced a decrease in net cash from operating activities, which fell by 29.2% to $180.5 million. This decline reflects the volatile market conditions and the ongoing need to adapt to dynamic economic environments.

Company's Position and Industry Standing

Founded in 1986, SS&C Technologies has grown into a global provider of financial services and healthcare software, supporting thousands of the world's largest entities. The company's continuous innovation and strategic acquisitions, such as the purchase of Intralinks and the integration of DST Systems, have solidified its market position as a comprehensive provider of technology-driven solutions.

For more detailed financial information and future updates, stakeholders and interested parties are encouraged to refer to SS&C Technologies' official communications and upcoming financial disclosures.

Explore the complete 8-K earnings release (here) from SS&C Technologies Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance