House prices rebound 1.7pc in July after flood of pent-up demand

House prices have rebounded this month and will be further boosted following the Chancellor’s stamp duty holiday announcement but analysts have called the uptick a "false dawn" and warned of steep falls later in the year.

Prices are up 1.5pc for the year, growing 1.7pc since June, when prices were down 1.6pc, according to figures from the building society Nationwide.

The cost of an average home now stands at £220,936, up from £216,403 in June.

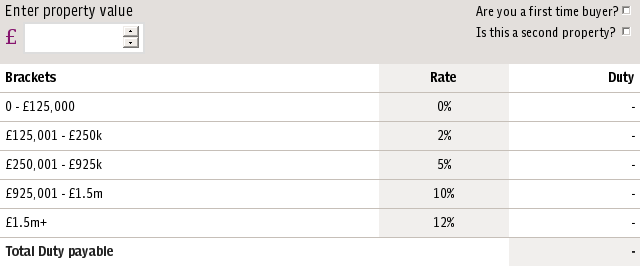

Rishi Sunak’s stamp duty holiday – which exempts property transactions of up to £500,000 from the charge until the end of March 2021, saving home buyers up to £15,000 in tax – will also support short-term price growth going forwards.

The boost in buying activity can be explained by people reassessing their housing needs and where they want to live during the recent lockdown. The increasing prevalence of working from home has freed many from having to live close to their place of work.

However, experts are still concerned the small increase in house prices is a "dead cat bounce" – a small recovery following a sharp fall that tricks markets into thinking the worst is over. True falls in house prices are yet to come, they said.

Robert Gardner, of Nationwide, said unemployment could still rise later in the year as the Government's support schemes come to an end. This would dampen house prices.

"There is a risk this proves to be a false dawn," he added.

Analysis has suggested that house prices are being driven up by pent up demand from those wanting to move while sellers have been reluctant as confidence is low. The supply of homes is still 13pc down on pre-lockdown levels, according to property website Rightmove.

Jonathan Hopper of estate agents Garington Property Finders said the stamp duty holiday announced at the start of July gave prospective buyers the extra push they needed to start house hunting in earnest.

“With many people – and their employers – rethinking the need to be in the office every day, areas that were previously off the commuter map are doing particularly well as buyers look for better value and a better standard of life.

“Like so much else that has been transformed by the pandemic, the property market map is being redrawn as people reassess what they want from their homes and when, or even if, they need to travel to work,” he said.

However, once the £30bn furlough scheme – which has protected more than 10 million jobs – ends in October and the mortgage holidays extended to two million homeowners are removed, unemployment is forecast to rise.

This could lead to large numbers of forced sellers coming to the market, pushing prices down.

The Office for Budget Responsibility has forecast unemployment to soar to 13pc by the start of 2021, while the Bank of England has predicted house prices could fall as much as 16pc by the end of the year.

Shaun Church of mortgage brokers Private Finance said the worsening economic climate had also made it harder for younger buyers to get on the property ladder.

“Although economic activity is slowly recovering, lenders remain cautious. Cuts to rates for those with larger deposits suggested lenders are keen to reduce their risk to offset high uncertainty in the housing market.

"This is likely to create a barrier to entry for first-time buyers, adding to the heavy financial burden the pandemic has placed on many people in this age group," he said.

Yahoo Finance

Yahoo Finance