Standard Life Aberdeen's £1.75bn payout plan fails to impress investors

Standard Life Aberdeen has failed to impress shareholders after unveiling plans to return up to £1.75bn to investors once it sells its insurance business.

The asset management giant said it would be left with “surplus” capital after the planned £3.2bn sale of its 193-year-old insurance unit to smaller rival Phoenix Group closes.

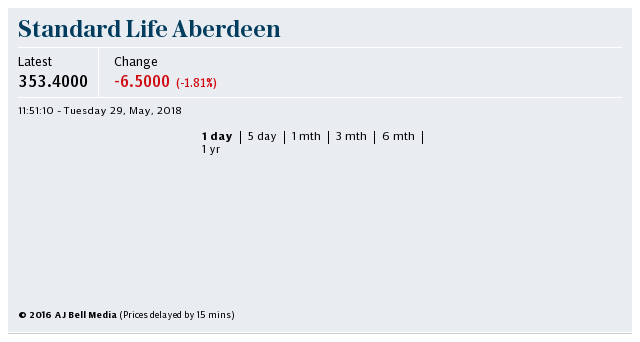

But shareholders took a dim view of the sweetener, with the Scottish group's shares falling more than 2pc in late morning trading. This was faster than the overall FTSE 100, which fell 1.3pc as markets digested news of further political turmoil in Italy.

The deal with Phoenix Group, which specialises in closed books of business or 'zombie' funds, first emerged in February. If it gets the green light, the company has promised to pay £1bn to investors through new B shares and around £750m via a share buyback.

"Should our shareholders vote to approve the transaction, it will allow us to make a substantial return of capital to shareholders," chairman Sir Gerry Grimstone promised at the company's AGM, its first since the group was formed last summer.

The fund house has also said it will enjoy lower capital requirements once it offloads the insurance business and will use the remaining proceeds from the deal to reduce its £1.9bn outstanding debts.

Investors will be sent a circular by the company on Wednesday, with a general meeting to approve the transaction and return the capital scheduled for June 25.

Sir Gerry said in London on Tuesday that 2017 had been a "truly momentous year" for the business, created by the merger of Standard Life and Aberdeen Asset Management in an £11bn deal last August. He also said a committee had been set up to find his replacement.

"But I’m not going yet and, as I promised at the time of the merger, I will only go once the merger is successfully bedded down," he added. "It has always been a very great privilege to be the chairman of this fine company."

However Standard Life Aberdeen has faced a number of obstacles since its tie-up nine months ago, notably losing a £109bn asset management contract with its biggest client Lloyds Banking Group. It has also lost some senior staff including former head of equities David Cumming and its head of corporate governance Paul Lee.

The firm's co-CEO structure has also been repeatedly questioned by shareholders, coming up again at the group's AGM on Tuesday. However co-head Martin Gilbert told The Telegraph earlier this year that the structure would stay in place for a number of years.

Yahoo Finance

Yahoo Finance