Standard Life Aberdeen tries to put merger gloom in the past as boss quits

Standard Life Aberdeen boss Keith Skeoch is to step down three years after spearheading the £11bn merger that transformed two mid-tier asset managers into a financial services titan.

The exit of Skeoch, who led Standard Life Investments into the combination, means neither of the deal’s architects remain at the asset manager.

Martin Gilbert, the former boss of Aberdeen Asset Management, with whom Skeoch plotted the tie-up over burgers and fries at an Edinburgh hotel, has already departed after an uneasy spell when the pair were co-chief executives.

The unorthodox arrangement was wildly unpopular. “Everybody hated it externally,” admits a source close to the firm.

The merger, which was intended to propel SLA into asset management’s $1 trillion club, has fallen far short of that aim. “You have to be very charitable to say it’s gone well,” says David McCann, an analyst at Numis.

SLA now manages £490bn and has been hit by outflows including the loss of a £109bn mandate from Lloyds Banking Group’s Scottish Widows. It also sold its life insurance business to Phoenix Group, a division that could have offset the impact of the struggles in its asset management wing.

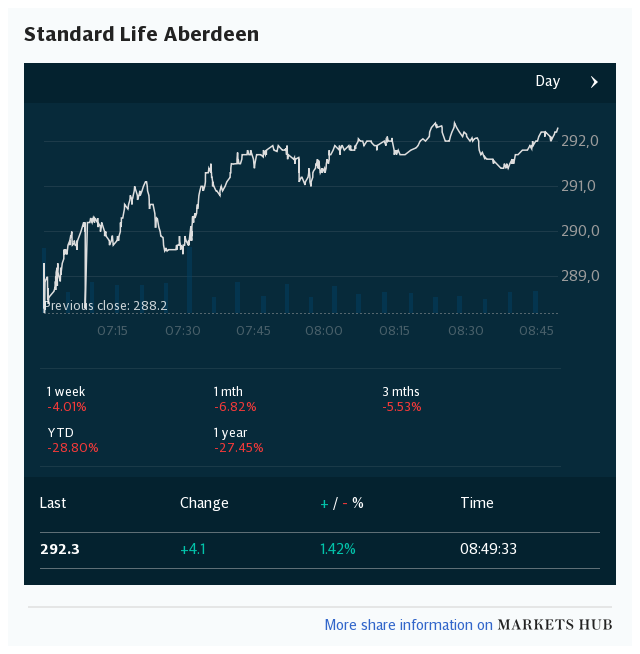

Shares are worth around half of what they were when the deal was completed in August 2017, though investors have benefited from share buybacks.

“The share price is always right,” says Sir Douglas Flint, chairman of Standard Life Aberdeen (SLA). “If you say it doesn't reflect the success of what you're doing then either you haven't articulated the success well enough so that people understand it, or you're kidding yourself.”

He thinks it will be five or 10 years before the merits of the merger can be properly assessed but understands investors’ impatience. “I always think markets can see the opportunity, but they start to give you credit when they actually see the actuality as opposed to the articulation of a vision.”

Flint, the former chairman of HSBC who joined SLA after the merger, says both Skeoch and Gilbert have been “extraordinary servants” of the business but says the Covid crisis accelerated the search for a successor to Skeoch.

The new chief, Stephen Bird, will join on Wednesday and, subject to regulatory approval, take over later this year. Once he takes the hot seat, Skeoch will serve his notice period at the group’s internal think tank.

Bird, a Scot, comes with top class banking pedigree. He led Citigroup’s global retail banking division until last year and was linked with the chief executive role at HSBC. Flint says the pair had met at banking conferences over the years.

There was an element of serendipity in his appointment as he had moved back to Edinburgh following his departure from Citi. The time elapsed since his departure from the bank means SLA avoids having to compensate him for bonuses he might otherwise have missed out on.

Bird has no asset management experience, which caused certain analysts to raise an eyebrow, but some investors are enthused by his arrival. Shares bounced more than 3pc after the announcement on Tuesday morning, although slipped back later in the day.

Berenberg analysts say Skeoch’s exit means “senior positions are filled by people not associated with the unpopular merger... so could make it easier for the company to pursue big M&A deals again”.

“Never rule anything out,” says Flint before adding that SLA has plenty of opportunities to grow already. Bird’s arrival marks a new chapter but the handover signals a “natural evolution” rather than a more drastic shakeup, he says.

Across the market asset managers have been bulking up in an effort to improve their efficiency, but SLA is still far short of the scale needed to compete globally. Assets tied up on the firm’s balance sheet could be used to fund a major acquisition. Another possibility is finding a larger US suitor to take over SLA.

Either way, investors will expect performance to improve. “It can’t really continue like it is indefinitely,” says McCann. “It is in desperate need of stabilisation.”

Yahoo Finance

Yahoo Finance