Standard Motor's (SMP) Q4 Earnings & Revenues Beat Estimates

The share price of Standard Motor Products Inc. SMP rose 6.1% to $51.14 on Feb 20, as the company beat earnings estimates.

Fourth-quarter 2017 adjusted earnings of 54 cents per share surpassed the Zacks Consensus Estimate of 39 cents. Also, the bottom line improved from the prior-year quarter figure of 42 cents per share.

During the quarter, loss from continuing operations was $8.1 million against earnings of $8.8 million in the prior-year quarter.

Total revenues increased to $240 million from $229.8 million a year ago. The top line surpassed the Zacks Consensus Estimate of $229 million.

Gross profit in the fourth quarter of 2017 increased to $69.3 million from $66.8 million in the year-ago quarter. Operating income also rose to $16.1 million from $12.6 million in the year-ago quarter.

For 2017, earnings came in at $2.83, higher than $2.77 in 2016. In 2017, total revenues also increased to $1.12 billion from $1.06 billion a year ago.

Segment Results

During the quarter, revenues at the Engine Management segment rose to $198 million from $185.2 million a year ago.

Operating profit was $22.8 million (11.5% of sales) compared with $18.1 million (9.8% of sales) in the prior-year quarter.

Revenues at the Temperature Control segment decreased to $40.3 million from $42.7 million a year ago. The segment recorded an operating profit of $50,000 (0.1% of sales) compared with a profit of $1.3 million (2.9% of sales) in the fourth quarter of 2016.

Revenues at the All Other segment slightly decreased to $1.72 million from $1.92 million a year ago. The segment registered an operating loss of $4.8 million, lower than $5.2 million in the fourth quarter of 2016.

Financial Position

Standard Motor had cash and cash equivalents of $17.3 million as of Dec 31, 2017, compared with $19.8 million as of Dec 31, 2016. Long-term debt was $79,000 as of Dec 31, 2017, compared with $120,000 as of Dec 31, 2016.

Business Update

At the end of November, Standard Motor entered into a joint venture (JV) with Foshan Guangdong Automotive Air Conditioning Co. This JV is in sync with its strategy to develop Temperature Control business in China.

Zacks Rank & Key Picks

Currently, Standard Motor has a Zacks Rank #3 (Hold).

Some better-ranked companies in the auto space are General Motors Company GM, Daimler AG DDAIF and Lear Corporation LEA. Each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Motors has an expected long-term growth rate of 8.4%. In the past six months, shares of the company have grown 16.8%.

Daimler has an expected long-term growth rate of 5%. The shares of the company have risen 22.4% in the past six months.

Lear has an expected long-term growth rate of 7.1%. In the past six months, shares of the company have gained 33.2%.

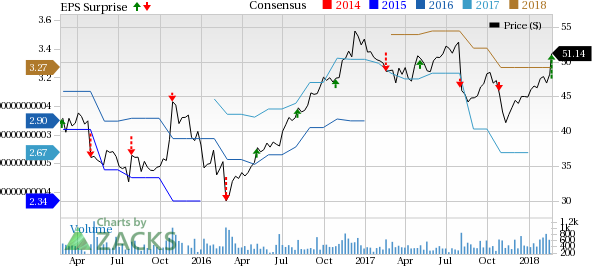

Standard Motor Products, Inc. Price, Consensus and EPS Surprise

Standard Motor Products, Inc. Price, Consensus and EPS Surprise | Standard Motor Products, Inc. Quote

Today’s Stocks from Zacks’ Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7% and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Daimler AG (DDAIF) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Standard Motor Products, Inc. (SMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance