Stanley Druckenmiller's Strategic Moves: A Deep Dive into NVIDIA's Significant Portfolio Reduction

Insights from the First Quarter 13F Filing of 2024

Stanley Druckenmiller (Trades, Portfolio), a renowned figure in the investment world, recently disclosed his first quarter 13F filing for 2024. Born in 1953 in Pittsburgh, Pennsylvania, Druckenmiller is the President, CEO, and Chairman of Duquesne Capital, which he founded in 1981 and later transformed into a family office in 2010. His investment career includes a notable period managing money for George Soros (Trades, Portfolio) from 1988 to 2000, where he was the lead portfolio manager for the Quantum Fund. Druckenmiller's investment approach is heavily influenced by Soros, focusing on a top-down strategy that involves both long and short positions across various asset classes including stocks, bonds, currencies, and futures.

Summary of New Buys

Stanley Druckenmiller (Trades, Portfolio) expanded his portfolio by adding a total of 42 stocks. Noteworthy new acquisitions include:

Coherent Corp (NYSE:COHR), with 2,525,070 shares, making up 3.49% of the portfolio and valued at $153 million.

Discover Financial Services (NYSE:DFS), comprising 645,205 shares, which represent about 1.93% of the portfolio, with a total value of $84.58 million.

Kinder Morgan Inc (NYSE:KMI), with 3,880,500 shares, accounting for 1.62% of the portfolio and a total value of $71.17 million.

Key Position Increases

Druckenmiller also increased his stakes in 15 stocks, with significant boosts in:

Natera Inc (NASDAQ:NTRA), adding 1,036,350 shares, bringing the total to 1,929,380 shares. This represents a 116.05% increase in share count, impacting 2.16% of the current portfolio, valued at $176.46 million.

Woodward Inc (NASDAQ:WWD), with an additional 549,595 shares, bringing the total to 954,230. This adjustment marks a 135.82% increase in share count, valued at $147.07 million.

Summary of Sold Out Positions

During the first quarter of 2024, Stanley Druckenmiller (Trades, Portfolio) exited 20 holdings, including:

UBS Group AG (NYSE:UBS), where he sold all 2,414,735 shares, impacting the portfolio by -2.23%.

Lamb Weston Holdings Inc (NYSE:LW), liquidating all 539,209 shares, which had a -1.74% impact on the portfolio.

Key Position Reductions

Druckenmiller reduced his positions in 13 stocks, with the most notable changes in:

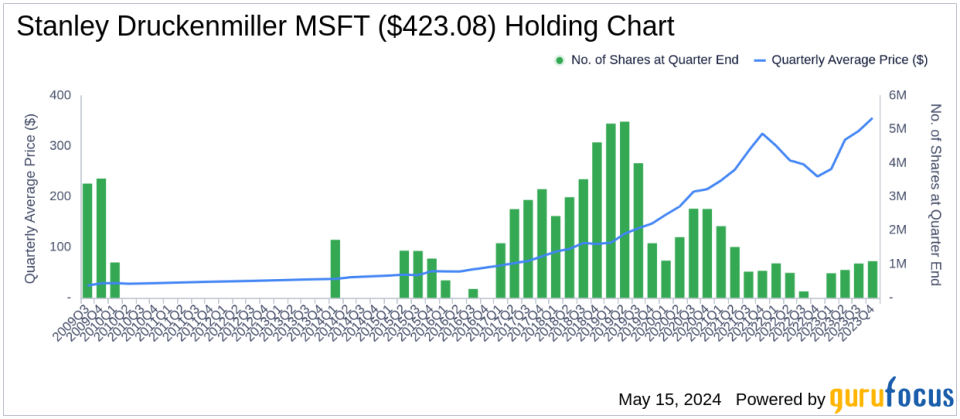

NVIDIA Corp (NASDAQ:NVDA), reducing by 441,551 shares, which resulted in a -71.51% decrease in shares and a -6.52% impact on the portfolio. NVIDIA traded at an average price of $724.8 during the quarter and has seen a return of 30.25% over the past three months and 91.09% year-to-date.

Eli Lilly and Co (NYSE:LLY), reducing by 340,886 shares, resulting in an -84.68% reduction in shares and a -5.93% impact on the portfolio. The stock traded at an average price of $711.67 during the quarter and has returned 4.04% over the past three months and 35.49% year-to-date.

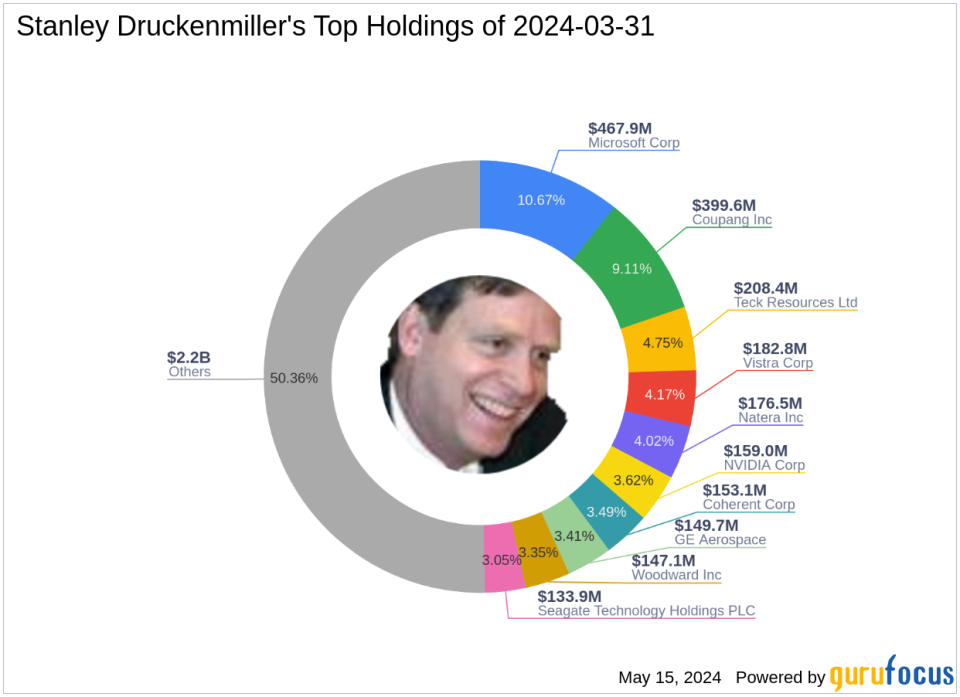

Portfolio Overview

As of the first quarter of 2024, Stanley Druckenmiller (Trades, Portfolio)'s portfolio included 73 stocks. The top holdings were 10.67% in Microsoft Corp (NASDAQ:MSFT), 9.11% in Coupang Inc (NYSE:CPNG), 4.75% in Teck Resources Ltd (NYSE:TECK), 4.17% in Vistra Corp (NYSE:VST), and 4.02% in Natera Inc (NASDAQ:NTRA). The holdings are mainly concentrated in 9 of the 11 industries: Technology, Industrials, Consumer Cyclical, Healthcare, Basic Materials, Communication Services, Utilities, Financial Services, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance