Star Lake BioscienceZhaoqing Guangdong And Two More High Yield Dividend Stocks On The Chinese Exchange

Amidst a backdrop of mixed economic signals from China, with manufacturing data highlighting a slowdown yet some sectors showing resilience, investors are navigating a complex landscape. In this context, exploring high-yield dividend stocks like Star Lake Bioscience Zhaoqing Guangdong offers an intriguing avenue for those looking to potentially enhance returns in the face of fluctuating market conditions.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Lao Feng Xiang (SHSE:600612) | 3.51% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.70% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 4.22% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.69% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.09% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.78% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.83% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.44% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.75% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.71% | ★★★★★★ |

Click here to see the full list of 257 stocks from our Top Chinese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Star Lake BioscienceZhaoqing Guangdong

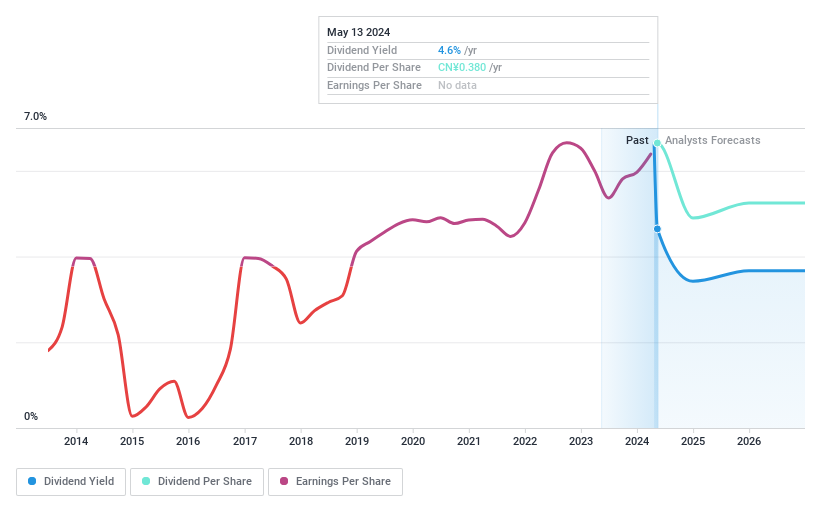

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc., operating under the Star Lake and Yue Bao brands, manufactures and sells pharmaceutical raw materials, as well as food and feed additives in China and abroad, with a market capitalization of approximately CN¥9.94 billion.

Operations: Star Lake Bioscience Co., Inc. generates its revenue from the production and sales of pharmaceutical raw materials, along with food and feed additives.

Dividend Yield: 6.4%

Star Lake Bioscience Zhaoqing Guangdong has shown a significant improvement in its financial performance, with net income rising to CNY 251.48 million in Q1 2024 from CNY 120.52 million the previous year. Despite this growth and a low cash payout ratio of 29.4%, the company's dividend history is too short to establish reliability or growth trends in payouts. Additionally, while trading at a value deemed good relative to peers, it carries high debt levels and experiences substantial share price volatility, adding elements of risk for dividend-focused investors.

Zhejiang Langdi Group

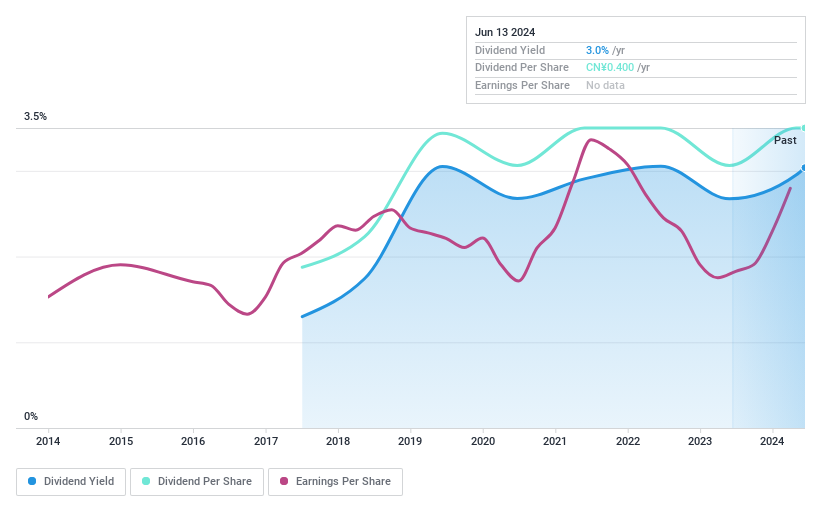

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Langdi Group Co., Ltd. is a company based in China that specializes in manufacturing and selling wheels for household air conditioners, with a market capitalization of approximately CN¥2.35 billion.

Operations: Zhejiang Langdi Group Co., Ltd. generates revenue primarily from its electronic components and parts segment, totaling CN¥1.69 billion.

Dividend Yield: 3.1%

Zhejiang Langdi Group has demonstrated robust financial growth, with a notable increase in net income to CNY 38.48 million in Q1 2024 from CNY 14.77 million the previous year, and a steady dividend payout of CNY 0.40 set for July. Despite this positive trend, the company's dividend history spans less than a decade and it experiences significant share price volatility. Trading at a slight undervaluation, its dividends are well-covered by earnings and cash flows, with payout ratios of 55.6% and 48.6% respectively, suggesting financial prudence but also hinting at an unstable dividend track record due to its relatively short history of payments.

Shenzhen Transsion Holdings

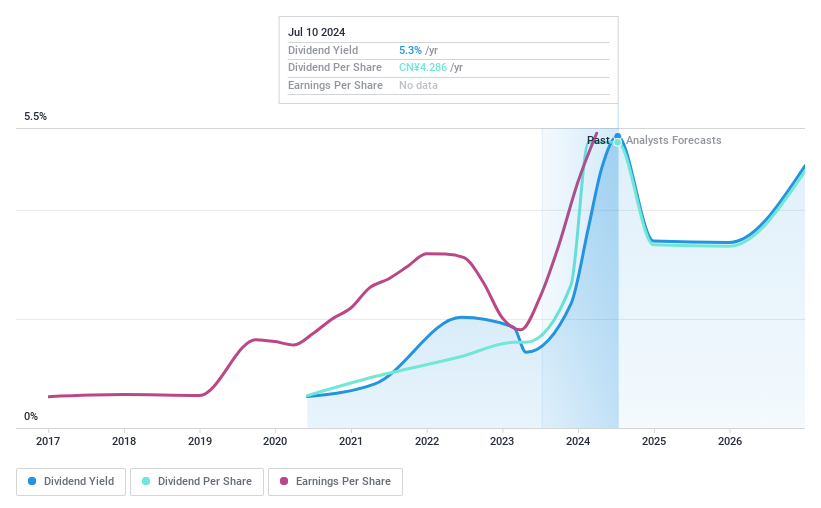

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Transsion Holdings Co., Ltd., a company that manufactures and sells smart devices both in Africa and internationally, has a market capitalization of approximately CN¥90.49 billion.

Operations: Shenzhen Transsion Holdings Co., Ltd. generates its revenue primarily from the manufacture and sale of smart devices across Africa and other international markets.

Dividend Yield: 5.3%

Shenzhen Transsion Holdings, despite a short dividend history of just 4 years, has shown commitment to its shareholders with increasing dividend payments. With a payout ratio of 72.7% and cash payout ratio at 54.2%, dividends are well-supported by both earnings and cash flows. Recent financial results highlight strong performance: Q1 2024 sales doubled year-over-year to CNY 17.44 billion, and net income tripled to CNY 1.63 billion, reflecting robust operational efficiency and market expansion.

Make It Happen

Explore the 257 names from our Top Chinese Dividend Stocks screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600866 SHSE:603726 and SHSE:688036.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance