State Street (STT) Stock Up on Q3 Earnings & Revenue Beat

State Street’s STT third-quarter 2021 adjusted earnings of $2.00 per share outpaced the Zacks Consensus Estimate of $1.92. Also, the bottom line was 37.9% higher than the prior-year level.

The stock gained 1.2% in pre-market trading, reflecting investors’ bullish sentiments over its robust quarterly performance. The full-day trading session will display a clearer picture.

Results reflected new investment servicing wins, provision benefits, and improvement in revenues. However, a marginal rise in expenses and lower interest rates were the headwinds.

Results excluded non-recurring items. After considering those, net income available to common shareholders was $693 million or $1.96 per share, up from $517 million or $1.45 per share in the year-ago quarter.

Revenues Improve, Expenses Rise Marginally

Total revenues were $2.99 billion, increasing 7.4% year over year. Also, the top line beat the Zacks Consensus Estimate of $2.95 billion.

Net interest income was $487 million, up 1.9% year over year. The growth was mainly driven by higher loan balance and a rise in deposits and investment portfolio balance, which was partially offset by lower investment portfolio yields.

Net interest margin contracted 9 basis points to 0.76%.

Total fee revenues grew 8.6% year over year to $2.50 billion. The rise was mainly driven by improvement in all fee components.

Non-interest expenses were $2.11 billion, increasing marginally from the prior-year quarter. Excluding notable items, adjusted expenses were relatively stable at $2.10 billion.

Provision for credit losses was a benefit of $2 million in the reported quarter against no provisions in the prior-year quarter.

Asset Balances Improve

As of Sep 30, 2021, total assets under custody (AUC) and administration were $43.3 trillion, up 18.3% year over year. The rise was mainly due to higher market levels, net new business growth, and client flows.

Assets under management were $3.9 trillion, up 22.7% year over year. The growth was driven largely by higher market levels and net inflows from exchange-traded funds and cash, partly offset by institutional net outflows.

Capital and Profitability Ratios Strong

Common equity Tier 1 ratio was 13.5% as of Sep 30, 2021, compared with 12.4% in the corresponding period of 2020.

Return on common equity was 11.6% compared with 8.9% in the year-ago quarter.

Share Repurchase Update

In September, State Street announced a temporary suspension of its share repurchase program and raised $1.9 billion of capital through a common stock issuance to fund the proposed acquisition of BBH Investor Services. The company plans to resume the program during the second quarter of 2022.

Our Take

New business wins and a strong balance sheet position are expected to continue supporting State Street's profitability. Further, the planned acquisition of BBH Investor Services will make the company the leading asset servicer globally (in terms of AUC). However, elevated costs due to the company’s restructuring efforts and lower rates remain major concerns.

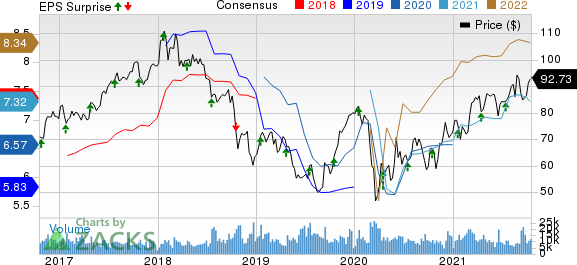

State Street Corporation Price, Consensus and EPS Surprise

State Street Corporation price-consensus-eps-surprise-chart | State Street Corporation Quote

State Street currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Robust advisory business, reserve release, and a modest rise in demand for loans drove JPMorgan’s JPM third-quarter 2021 earnings of $3.74 per share. The bottom line also handily outpaced the Zacks Consensus Estimate of $3.00.

Bank of America’s BAC third-quarter 2021 earnings of 85 cents per share beat the Zacks Consensus Estimate of 71 cents. The bottom line compared favorably with 51 cents earned in the prior-year quarter. Results in the quarter included a reserve release of $1.1 billion.

PNC Financial PNC pulled off a third-quarter 2021 positive earnings surprise of 3.02% on substantial recapture of credit losses. Adjusted earnings per share (excluding pre-tax integration costs related to the BBVA USA acquisition) of $3.75 surpassed the Zacks Consensus Estimate of $3.64 and improved 42% sequentially.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance