Stay Away! 3 Dividend Stocks that Are Yield Traps

Amid the market volatility experienced the last few months, stocks that pay high dividend yields become more popular. The reasoning is that, with many stocks declining in value, big dividend payouts can help lessen the pain.

While true in theory, many stocks with high yields are high-yielding for a reason: They are also high risk. What seemed like easy money could end up having the opposite of the desired effect. With that in mind, here are three stocks that look like yield traps to me: Pitney Bowes (NYSE: PBI), R.R. Donnelley & Sons (NYSE: RRD), and Teekay Tankers (NYSE: TNK).

Don't trust the mail

Mail services and logistics company Pitney Bowes has struggled. The company is best known for its postage meters and other equipment used to get things shipped, but times have changed. A period of transition to digital services is underway, with last year's purchase of e-commerce service company Newgistics and the recently announced sale of the production mail segment helping round out its switch to higher-growth revenue sources.

Image source: Getty Images.

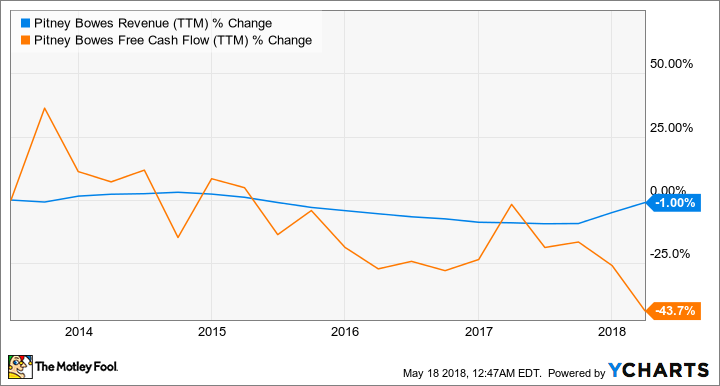

Earlier in the year, management finished a review of strategic alternatives where it decided it made more sense to continue executing its rebound strategy rather than sell itself to a competitor. In the first quarter, that decision was seemingly justified with an 18% year-over-year increase in revenue. However, profitability, as measured by earnings per share, fell by 20% as the costs involved with new business segments skyrocketed. Even though management is anticipating an 11% to 15% annual gain in revenue in 2018, adjusted profits are expected to fall 8% to 18%.

Thus, things could get worse before they get better at Pitney Bowes. Though the stock is currently yielding an 8.4% dividend, there's a reason why. The mail service company hasn't figured out how to stop the bleeding in its ever-shrinking profit margins.

Data by YCharts.

Global advertising is changing, too

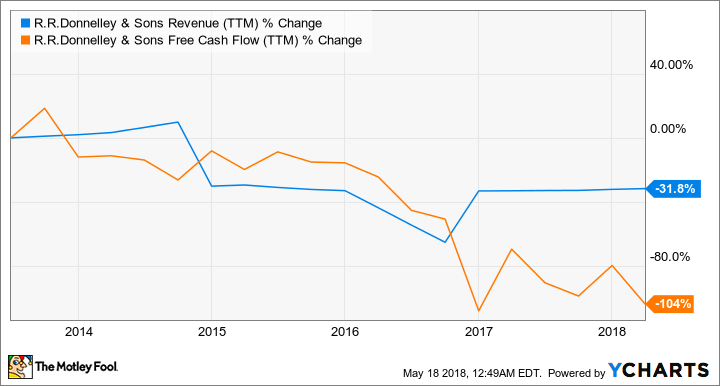

Here's another case of a company with shrinking profit margins: global business communications and marketing firm R.R. Donnelley & Sons. Revenue has begun to stabilize for the multi-channel customer engagement company, but profits as measured by free cash flow -- money left over after basic business operations are paid for -- have not.

Data by YCharts.

The costs of sales and other expenses have increased faster than recent advances in revenue have, making for smaller profit margins. And it's not like sales are breaking any records either -- increasing only 1.6% last year and 3% to start 2018. The way businesses market themselves and stay in touch with customers is changing, and technology is playing an increasingly important role. It looks like RRD got to the party late. Full-year sales are expected to be roughly flat, even while new advertising giants like Alphabet's Google are growing by double digits.

The dividend yield is currently 6%, but that may not be enough to warrant a purchase until the company can prove it can deliver on some metric of growth.

How oil sank a fleet

Global shipping of oil got hit by multiple factors the last couple of years. First was the boom in U.S. shale. That not only tanked the cost of oil starting in 2014 -- which affects the price to ship it -- it also decreased the demand for shipping overall as domestic production lessened the need for imports. Second, at a time when shipping demand was on the wane, lot's of new ships came on line, which also negatively impacted shipping rates.

That situation has been absolutely catastrophic for oil shippers, Teekay Tankers included. Though management thinks an industry recovery is in order in late 2018 or early 2019, the damage has nevertheless been impressive. Operations ran at an $8.4 million loss in the first quarter of 2018, and the net loss was $19.2 million on $168.5 million in revenue.

It's important to note that many financial sites may still list Teekay Tankers as a dividend payer. However, management just suspended its dividend beginning in the first quarter of 2018. Based on past payouts, the yield was at a whopping 10.2%.

Teekay Tankers made this list anyway to illustrate the potential danger in investing in high-yielding companies. They may look enticing, but the big dividend payday exists for a reason. The company may be in sore straights, putting downward pressure on the stock and even putting the dividend at risk. Thus, investors beware, these stocks could be a yield trap. They are better suited for people wanting to bet on a rebound story rather than looking for stable income.

More From The Motley Fool

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Nicholas Rossolillo and his clients own shares of Alphabet (A shares) and Alphabet (C shares). The Motley Fool owns shares of and recommends Alphabet (A shares) and Alphabet (C shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance