Steel Dynamics Inc. Surpasses Analyst Earnings Estimates in Q1 2024

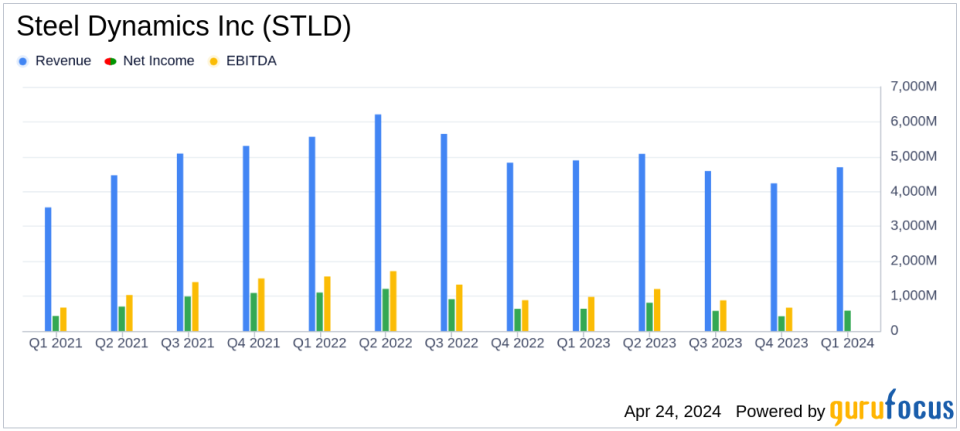

Revenue: Reported at $4.7 billion for Q1 2024, slightly below analyst estimates of $4.736 billion.

Net Income: Achieved $584 million, surpassing the estimated $559.36 million.

Earnings Per Share (EPS): Recorded at $3.67 per diluted share, exceeding the forecast of $3.51.

Operating Income: Reached $751 million in Q1 2024, showing significant growth from the previous quarter.

Steel Shipments: Near-record first quarter shipments at 3.3 million tons, driven by demand in automotive, construction, energy, and industrial sectors.

Capital Investments: Invested $374 million in Q1 2024, focusing on strategic growth initiatives.

Stock Repurchase: Repurchased $298 million of its common stock, representing 1.5% of outstanding shares.

Steel Dynamics Inc (NASDAQ:STLD) unveiled its first quarter financial results for 2024 on April 23, reporting a notable performance that exceeded analyst expectations. The company announced net sales of $4.7 billion and net income of $584 million, translating to earnings of $3.67 per diluted share. These figures surpass the estimated earnings per share of $3.51 and estimated net income of $559.36 million projected by analysts. For further details, you can view the full 8-K filing.

Steel Dynamics Inc operates scrap-based steel minimills and is a prominent player in the steel production industry in North America. The company's diverse operations span steel production, metals recycling, and steel fabrication, generating the majority of its revenue from its steel operations segment.

Quarterly Financial Highlights

The company's financial strength was particularly evident in its steel operations, where it achieved an operating income of $675 million, marking an 85% increase from the previous quarter. This surge was driven by robust demand across automotive, non-residential construction, energy, and industrial sectors, contributing to near-record steel shipments of 3.3 million tons. The average external product selling price for the companys steel operations rose to $1,201 per ton, up $111 sequentially.

Despite challenges such as early quarter steel order volatility and declining scrap prices, Steel Dynamics reported a strong rebound in customer orders in March, particularly for its value-added coated flat rolled steel products. This rebound supported increased pricing and solid order backlogs, showcasing the company's resilience in a fluctuating market.

Operational and Strategic Developments

Steel Dynamics' strategic initiatives include the commissioning of four new value-added flat rolled steel coating lines, expected to significantly boost production capacity in the coming quarters. Additionally, the company is progressing with its aluminum flat rolled products mill, aiming to diversify its product offerings and tap into new market segments by mid-2025.

The company's commitment to innovation and sustainability is evident in its plans to supply high-recycled content aluminum products to various industries, aligning with growing environmental and sustainability trends.

Financial Position and Future Outlook

Steel Dynamics ended the quarter with strong liquidity of $3.1 billion. The company's cash flow from operations stood at $355 million, supporting significant capital investments of $374 million, dividend payments, and robust stock repurchases. Looking ahead, CEO Mark D. Millett expressed confidence in the continued strength of domestic steel consumption and pricing throughout 2024, supported by solid order entry activity across all business segments.

In conclusion, Steel Dynamics Inc's first quarter results for 2024 not only surpassed analyst expectations but also highlighted the company's strategic positioning and operational efficiency in a challenging market environment. With ongoing investments in growth and a focus on sustainability, Steel Dynamics is well-positioned to maintain its competitive edge and deliver long-term value to its stakeholders.

For detailed insights and further information, investors and stakeholders are encouraged to attend the upcoming conference call scheduled for April 24, 2024, details of which can be found on the companys website.

Explore the complete 8-K earnings release (here) from Steel Dynamics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance