Steering Clear of medmix and Exploring One Better Dividend Stock Option

Dividend-paying stocks often attract investors looking for reliable income streams. However, the allure of dividends can be misleading if the underlying company's dividend growth is stagnant or declining, as seen with medmix. In such cases, it becomes crucial to evaluate whether a company's stable dividend payment reflects robust financial health or masks deeper issues.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.58% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.22% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.24% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.39% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.85% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.18% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.19% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

Jungfraubahn Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF 1.08 billion.

Operations: The company generates revenue from three main segments: CHF 188.24 million from Jungfraujoch - TOP of Europe, CHF 45.94 million from Experience Mountains, and CHF 41.26 million from Winter Sports.

Dividend Yield: 3.4%

Jungfraubahn Holding AG, despite a volatile dividend track record over the past decade, has shown resilience in its financial management. The company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 47.8% and a cash payout ratio of 61.7%, respectively. This stands in contrast to some peers who have seen declining dividends. However, it is trading below its estimated fair value and offers a lower yield (3.35%) compared to the top Swiss dividend payers.

One To Reconsider

medmix

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Medmix AG is a global company that designs, produces, and sells high-precision devices and services for the healthcare, consumer, and industrial sectors with a market capitalization of CHF 553.82 million.

Operations: The company generates CHF 177 million from its healthcare segment and CHF 309.60 million from consumer and industrial operations.

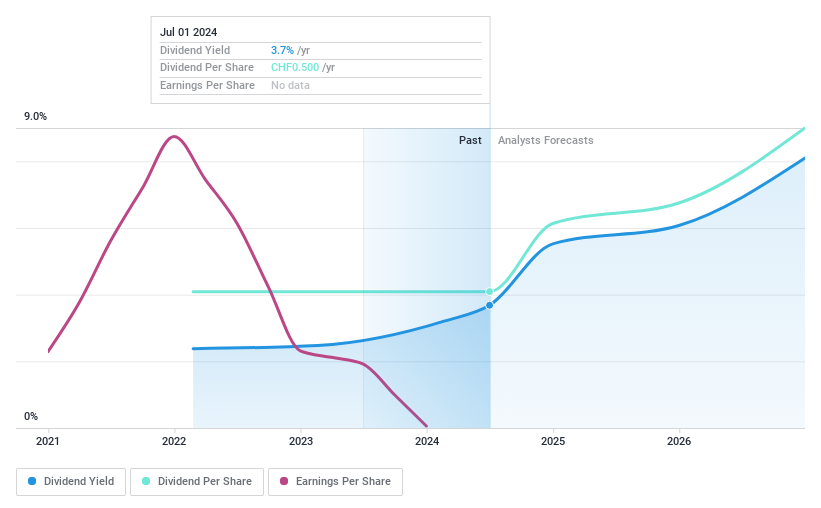

Dividend Yield: 3.7%

Medmix presents concerns for dividend-focused investors, with a low yield of 3.68% against Switzerland's top payers at 4.25%. Despite only offering dividends for two years, there has been no growth in payments. Challenges are compounded by a high payout ratio of 6812% and cash payout ratio of 637.2%, indicating that earnings and cash flows do not adequately cover the dividend, raising sustainability issues. Additionally, profit margins have decreased from last year's 2.4% to just 0.06%, further stressing financial health.

Turning Ideas Into Actions

Reveal the 26 hidden gems among our Top Dividend Stocks screener with a single click here.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:JFN and SWX:MEDX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance