Stelios Haji-Ioannou’s new ‘easyIsa’ offers a 4% return

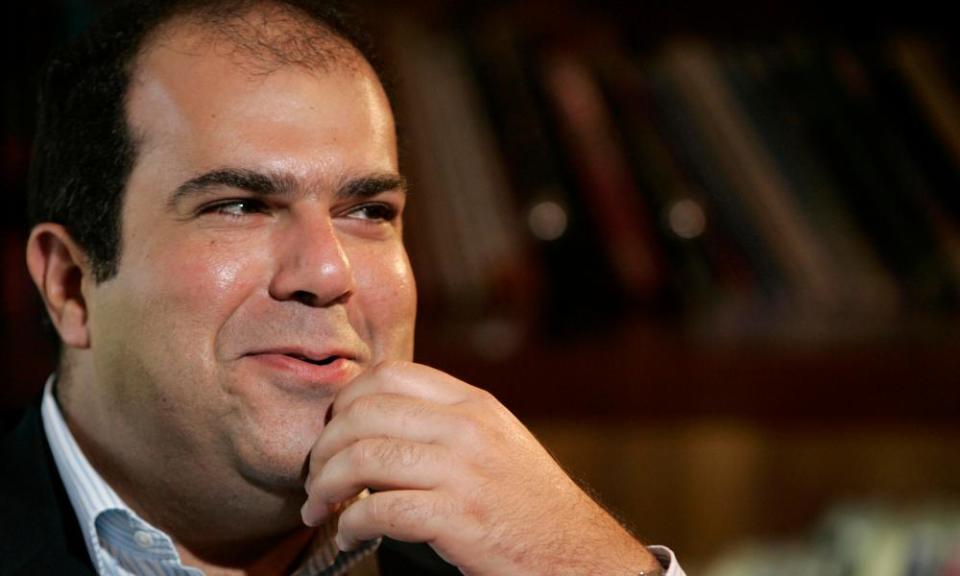

His business empire spans everything from low-cost flights, hotels and buses to coffee shops, dog-walking and groceries. Now Sir Stelios Haji-Ioannou is moving into the world of savings and investment with an Isa paying a headline-grabbing 4.05%. But this is far from a risk-free investment.

The billionaire founder of easyJet is launching (or rather, relaunching) a financial services arm called – what else? – easyMoney, and the Isa being unveiled on Saturday is the first of many planned products.

EasyMoney is hoping to grab a slice of the billions of pounds languishing in poorly paying savings accounts. Haji-Ioannou says: “We’re offering something new and taking on the big boys.”

On the face of it, the tycoon’s intervention will deliver a welcome boost to what was expected to be another lacklustre Isa season. Things have been pretty grim for Britain’s savers, with many desperate to find ways to boost their finances. But lots of people will wonder what sort of Isa this is, where the money goes, and what are the risks?

The first thing to make clear is that the new easyMoney account isn’t a cash Isa, nor is it a stocks and shares one. Instead, this is what’s called an “innovative finance” Isa – one of the latest additions to the individual savings account family. The innovative finance Isa contains peer-to-peer (P2P) loans where lenders (the people who will be giving easyMoney their cash) are matched online with borrowers, while cutting out the banks.

EasyMoney says it can offer access to “far higher” returns than cash Isas from high street banks because it gives investors access to loans secured against UK property. It adds that it “diversifies investors into multiple property-backed P2P loans”, all of which are secured by a first legal charge. A spokesman says easyMoney is not piggybacking on an existing peer-to-peer website – it will write its own lending, and there will be no minimum investment.

But take note: that 4.05% is a “target” rate. Returns are not guaranteed and your capital is at risk. Crucially, people’s investments aren’t protected by the Financial Services Compensation Scheme.

Intriguingly, the press release from Haji-Ioannou’s easyGroup is headlined “easyMoney launches in UK”, but the serial entrepreneur surely hasn’t forgotten this is actually the second outing for the brand. In August 2001 he unveiled easyMoney, which initially focused on credit cards before moving into products such as motor insurance. In recent years the brand seems to have gone quiet. A spokesman says: “There is no link between this business and the easyMoney credit card brand.”

It is also worth remembering that since creating budget airline easyJet in 1995 when he was just 28 years old, Haji-Ioannou has had his ups and downs. Several of his ventures have been profitable, but easyCinema failed, and easyInternetcafe lost more than £100m.

However, Andrew de Candole, chief executive of easyMoney, says financial services in the UK “are in desperate need of a shake-up” and the Isa market “is crying out for someone to give everyday investors more for their money”.

The spokesman says the “easyIsa” is aimed at investors “who have had enough of the poor interest rates offered by cash Isas, and are nervous about the potential volatility of most stocks and shares Isas”.

The new easyMoney venture is the trading name of a firm called E-Money Capital, which is authorised and regulated by the FCA. The spokesman says E-Money Capital “is simply the name of the corporate entity of easyMoney … It only operates easyMoney and nothing else.”

Yahoo Finance

Yahoo Finance