Stericycle (SRCL) Stock Rises 10.5% in a Month: Here's How

Stericycle, Inc. SRCL shares have had an impressive run in the past month. The stock has gained 10.5%, significantly outperforming the 1.1% growth of the industry it belongs to and the 5.4% rise of the Zacks S&P 500 composite.

Reasons for the Upside

The services that Stericycle provides usually cannot be delayed and are required on a scheduled basis, allowing the company to achieve a steady flow of revenues. It has strong customer relationships, most of which include long-term contracts ranging from three to five years. This enables it to maintain a revenue retention rate of around 90%.

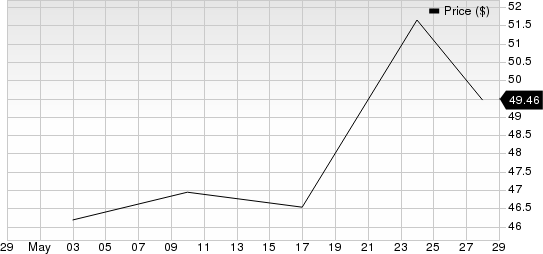

Stericycle, Inc. Price

Stericycle, Inc. price | Stericycle, Inc. Quote

Stericycle continues to grow on the back of acquisitions in both the domestic and international markets. The recent acquisition of a southeastern U.S. regulated waste business is expected to help the company in portfolio optimization. The 2021 acquisition of a Midwest-regulated waste business enhanced the company’s North American customer base.

Stericycle has progressed well with its key objectives of improving the quality of revenues, driving operational efficiency through work measurement, asset optimization, technology, strategic sourcing, portfolio rationalization through divestitures, debt reduction and leverage improvement, and ERP implementation. The company is benefiting from ongoing trends such as increasing environmental concerns, rapid industrialization, increase in population and active government measures to reduce illegal dumping.

Zacks Rank and Stocks to Consider

Stericycle currently carries a Zacks Rank #3 (hold).

Some better-ranked stocks in the broader Zacks Business Services sector are AppLovin APP and WEX WEX.

AppLovin flaunts a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

APP has a long-term earnings growth expectation of 20%. It delivered a trailing four-quarter earnings surprise of 60.9%, on average.

WEX currently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 12.4%. WEX delivered a trailing four-quarter earnings surprise of 3.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stericycle, Inc. (SRCL) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance