STERIS (STE) Gains From New Offerings, Macro Issues Ail

STERIS’ STE strong rebound of procedure volumes in the United States is leading to solid growth in the Healthcare business. Yet, a fiercely competitive market offsets the positive. The stock carries a Zacks Rank #3 (Hold) at present.

STERIS’ Healthcare segment is gaining from the successful market adoption of its comprehensive offerings, including infection prevention consumables and capital equipment. Further, its services to maintain that equipment, repair reusable procedural instruments and outsource instrument reprocessing services are gaining traction. Over the past few quarters, the segment’s organic growth has been driven by the continuous procedure volume improvement in the United States and favorable pricing and market share gains.

The company concluded fiscal 2024 with Healthcare achieving 13% constant currency organic revenue growth, marking its third consecutive year of double-digit expansion. The success was fueled by the actions of its operations teams to reduce lead times and return backlog to normal levels. By the fourth quarter, the lead times returned to pre-pandemic levels for the first time in two years.

STERIS’ Applied Sterilization Technologies (“AST”) successfully offers a wide range of sterilization modalities through a worldwide network of more than 50 contract sterilization and laboratory facilities. STERIS, particularly, is gaining success with ethylene oxide (EO) sterilization. The company’s customers in this business are mostly the manufacturers of single-use, sterile technologies that are used in aseptic manufacturing of vaccines and biopharmaceuticals.

In fiscal 2024, the AST division faced obstacles, mainly due to inventory destocking in some categories of MedTech and the decline in customer demand for bioprocessing, both of which were viewed as temporary. However, since the fiscal third quarter, there have been positive signs of recovery in the MedTech demand, especially in the United States, driven by the improving procedure environment and the burndown of customer inventory. This recovery trend became prominent within the AST business, too.

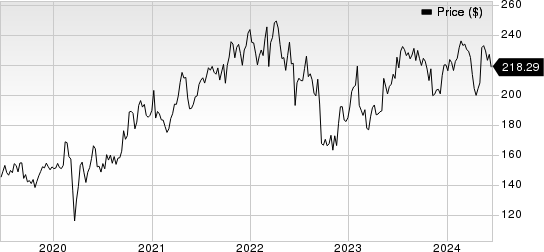

STERIS plc Price

STERIS plc price | STERIS plc Quote

On the flip side, the current macroeconomic environment across the globe has adversely affected STERIS’ financial operations. Governments and insurance companies continue to look for ways to contain the rising cost of healthcare. This might put pressure on players in the healthcare industry, with STERIS being no exception. An increase in price or decrease in the availability of raw materials and oil and gas might impair STERIS’ procurement of necessary materials for product manufacture, or increase production costs. In addition, economic and market volatility have been affecting the investment portfolio of STERIS’ legacy defined benefit pension plan. We are skeptical that the lingering macroeconomic softness might hamper STERIS’ growth.

These macroeconomic factors are also resulting in a significant escalation in the company’s operating expenses. STERIS witnessed a 7.7% year-over-year rise in selling, general and administrative expenses in the fiscal fourth quarter. Research and development expenses rose 7.6%, which usually gives a hint about the company investing in innovations. However, if the increased expenses do not lead to the development of competitive products or services, there could be a risk of declining demand for STERIS’ offerings, which may hurt profitability.

Further, STERIS competes for pharmaceutical, research and industrial customers against several large companies that have robust product portfolios and global reach, as well as a number of small companies with limited product offerings and operations in one or a few countries. In the Healthcare segment, STERIS’ notable competitors include 3M, Baxter, Boston Scientific, Belimed, Ecolab, Getinge, Go Jo, Johnson & Johnson, Kimberly-Clark, Skytron and Stryker.

STERIS’ Life Sciences segment operates in highly regulated environments where the most intense competition results from technological innovations, product performance, convenience and ease of use, and overall cost-effectiveness. Competitors from the pharmaceutical segment include Belimed, Ecolab, Fedegari, Getinge, MECO, Stilmas, and Techniplast. The company expects to face continued competition in the future as new infection prevention, sterile processing, contamination control, and gastrointestinal and surgical support products and services enter the market.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD. While Hims & Hers Health and Medpace sport a Zacks Rank #1 (Strong Buy) each, ResMed carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 181.1% in the past year. Estimates for the company’s earnings have remained constant at 18 cents for 2024 and increased 3.1% to 33 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share (EPS) have remained constant at $11.29 in the past 30 days. Shares of the company have surged 80.5% in the past year compared with the industry’s 6.7% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for ResMed’s fiscal 2024 EPS have remained constant at $7.70 in the past 30 days. Shares of the company have lost 1.9% in the past year against the industry’s growth of 0.9%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance