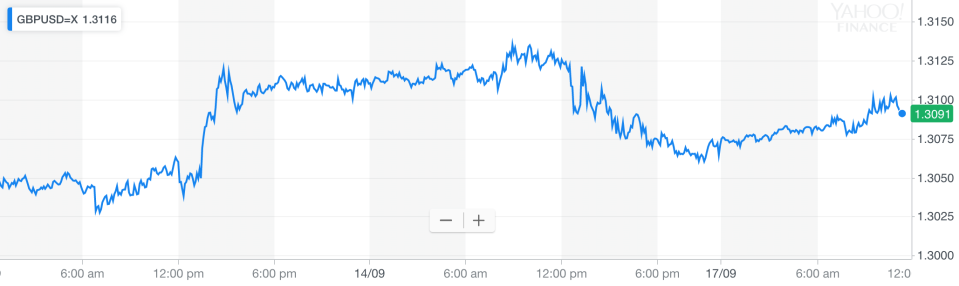

Sterling jumps on hopes of Irish border Brexit solution

The pound surged on Monday after reports of a breakthrough over the Irish border issue that has dogged Brexit talks.

The markets, which have been highly sensitive to recent Brexit developments, reacted positively to news of EU flexibility which makes a Brexit deal more likely.

Sterling was up 0.2% against the dollar at $1.3086 (GBPUSD=X), although it remained flat against the euro.

Until now, the EU has proposed a backstop solution to avoiding a hard border which would effectively keep Northern Ireland in the customs union and parts of the single market.

MORE: EXCLUSIVE: EU says publishing its Chequers analysis would risk ‘jeopardising’ Brexit deal

The UK government and its DUP allies in Northern Ireland say that is unacceptable because it challenges the integrity of the UK by creating a customs border in the Irish sea.

EU officials revealed last week that they were working on new plans in order to “de-dramatise” the issue.

Today the Times reports details of the new EU plan that would see technological solutions and a trusted trader scheme to minimise the need for checks at the border.

That would see goods tracked using a barcode and undergo customs checks on ferries or on arrival at factories, according to a separate report in the Financial Times.

British officials would also carry out checks on behalf of the EU at mainland ports before goods were moved to Northern Ireland.

EU chief Brexit negotiator Michel Barnier signalled his willingness to adapt the backstop when he spoke to MPs at Westminster earlier this month. “We are open to discussing other backstops, so we can discuss this text, we can make changes to it,” he told them of the EU’s former plan.

“We are open, but whatever happens, there has to be a backstop.”

The UK government’s backstop proposal was for the entirety of the UK to remain in the EU’s customs union temporarily if there’s no Brexit deal.

However, the EU have said they will not accept a solution that is time-limited or allowed the whole of the UK backdoor access to the single market.

MORE: Juncker rejects May’s plan for frictionless trade after Brexit

As well as boosting the pound, the development has added momentum to Brexit talks ahead of crunch talks between Theresa May and EU leaders.

The prime minister will try to persuade her continental counterparts that her Chequers plan does not present a threat to the single market over dinner on Wednesday.

Austrian chancellor Sebastian Kurz stressed his willingness to see a deal done on Monday, saying: “I think that we agree that we have to do everything possible to avoid a hard Brexit and to make possible that there will be a strong cooperation between the UK and the European Union.”

EU leaders will also discuss whether to hold a special Brexit summit in November, which would only be necessary if the deadline for a deal by the European Council on 18 October is missed.

MORE: Barnier says Brexit deal ‘realistic’ within 8 weeks

Yahoo Finance

Yahoo Finance