Sterling stumbles again as political tensions heighten talk of parity against euro

Political tensions are raising the prospect of the pound edging ever nearer to parity with the euro.

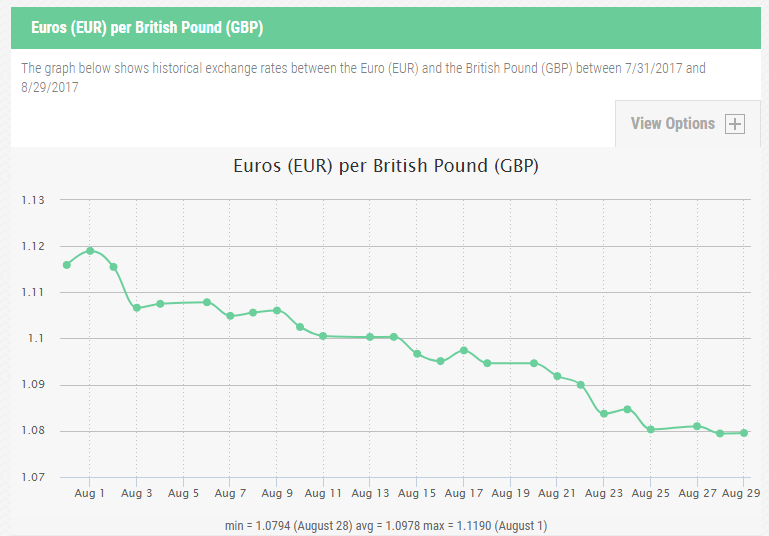

Sterling’s rollercoaster ride of recent days saw it dip to a near eight-year low overnight of €1.0763. At some points on Tuesday, it fell below €1.075, matching lows last seen in October 2009 – and just above the all-time lows during the financial crisis.

While the pound rallied in early trading on Wednesday, up around half a euro cent at €1.0807, experts are warning that with tensions over Korean missile tests and the continuing Brexit uncertainty, sterling will continue to suffer.

MORE: ‘Pantomime villain’ airport bureaux see British holidaymakers short-changed on euro rates

“You’ve got two politically plagued currencies offsetting each other – you’ve got Brexit for sterling and you’ve got Trump and geopolitics for the dollar,” ING currency strategist Viraj Patel told Reuters.

“So in effect the euro is the de-facto political haven.”

Earlier this week, the euro broke the $1.20 threshold against the dollar for the first time in about two and a half years – a direct result of North Korea’s missile launch over Japan.

Laura Lambie, senior investment director at Investec Wealth and Investment, told BBC Radio 4 Today: “Our sluggish GDP, the fact that interest rates do not look like they are going to rise anytime soon. We might have in-fighting at the Tory Party conference, we’ve got the fallout from Brexit. From the UK point of view, it’s not looking good.”

MORE: Europe’s top Brexit man Michel Barnier pockets £72,000 more a year than David Davis

However, while there were more struggles ahead, parity may not be hit, she said. “I do think parity, although we might see it in the short term, is not what we’d expect in the long term,” Lambie said.

The pound has plunged in value against the world’s major currencies since last summer’s Brexit referendum.

Before the vote in June 2016, £1 would buy €1.31 and it is a similar picture against the dollar where a year ago £1 would buy $1.47, it now commands just $1.28.

Last week, it was revealed British holidaymakers were getting less than £1 per euro at airport bureaux.

MORE: Brexit will cause ‘gaps on food shelves’ if deals with EU are not struck, warns trade body

The downside of a stronger euro is that it would tend to dampen global demand for Eurozone exports and therefore would knock some percentages of economic growth.

There is some speculation the European Central Bank could move if the euro continues to strengthen.

“Our judgment is that the Bank is more concerned about the pace of change in the currency than its level. So if the euro continues to rise, particularly at its recent rapid pace, [ECB] President Draghi seems pretty likely to use the press conference following next week’s policy meeting to talk it down,” said Jennifer McKeown, a chief European economist at Capital Economics in London.

Yahoo Finance

Yahoo Finance