Sterling's (STRL) E-Infrastructure Books $325M Contract in Q1

Sterling Infrastructure, Inc. STRL has been gaining from the solid demand for large next-generation industrial facilities, as the country is busy building the domestic infrastructure to support the production of electric vehicles (EV) and solar products. Also, the data center market continues to provide growth opportunities.

The company’s E-Infrastructure Solutions segment — the fastest-growing and highest-margin segment — reported $325 million of new contracts in the first quarter of 2023. It includes the contract from Hyundai Engineering America, Inc. for a site development project encompassing more than 600 acres, the largest E-Infrastructure project in the company’s history.

The projects under the company’s E-Infrastructure segment comprise large-scale site development services for industrial facilities, data centers, multi-use facilities, e-commerce distribution centers and warehouses. The segment has shown robust growth, strengthening the company’s leading market position.

Pertaining to the announcement, Joe Cutillo, Sterling’s CEO, said, “We have built a track record delivering even the most complex projects on time, solidifying us as a trusted partner to our Blue-Chip customers. The strength in awards in the first quarter supports our view that sustainable construction trends will continue throughout 2023.”

Infrastructure Solutions Segment: A Major Growth Driver

Sterling’s E-Infrastructure Solutions segment delivered solid top-line growth of 93% from the prior year and remained the largest revenue-generating, fastest-growing and highest-margin segment. Organically, sales grew 31%, whereas the company witnessed 62% growth from the acquisition of Petillo.

The U.S. government’s continuous flow of investments in next-generation factories for solar and EV battery plants, along with the rise of data center ecosystem development, is accelerating the demand for the company.

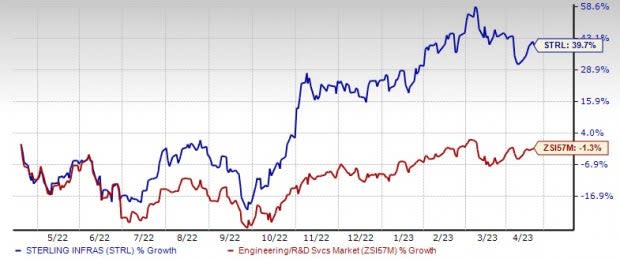

Image Source: Zacks Investment Research

Shares of Sterling moved down 1.5% on Apr 18. But shares have risen 39.7% in the past year, outperforming the Zacks Engineering - R and D Services industry’s 1.3% decline. This Woodlands, TX-based company specializes in E-Infrastructure, Building and Transportation Solutions, mostly in the United States, mainly across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain states, California and Hawaii.

A solid backlog level depicts the strong visibility of growth for Sterling. The backlog as of Dec 31, 2022, was $1.69 billion, reflecting an increase of 25% from 2021.

Zacks Rank

Sterling currently carries a Zacks Rank #3 (Hold).

3 Better-Ranked Construction Stocks Hogging the Limelight

Installed Building Products, Inc. IBP, currently sporting a Zacks Rank #1 (Strong Buy), is a leading installer of insulation and complementary building products. It primarily banks on a robust pipeline of acquisition opportunities across multiple geographies, products and end markets.

Installed Building’s earnings for 2023 are expected to decline 5.7%. Nonetheless, the same has moved north to $8.44 per share from $7.45 per share over the past 60 days, reflecting analysts’ optimism for its growth potential.

CRH plc CRH currently flaunts a Zacks Rank #1. The long-term earnings growth rate is anticipated to be 10.2%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRH’s 2023 sales and earnings per share indicates growth of 6% and 13.2%, respectively, from the year-ago period's actuals.

Eagle Materials Inc. EXP, carrying a Zacks Rank #2 (Buy) at present, produces and supplies heavy construction materials and light building materials in the United States.

EXP’s expected earnings growth rate for fiscal 2023 is 29.4%. This company surpassed earnings estimates in three of the trailing four quarters but met on one occasion, the average surprise being 4.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance