Steven Scruggs Adjusts Portfolio, Notably Reduces Fabrinet Stake by 1.96%

Insights from FPA Queens Road Funds' Latest N-PORT Filing

Steven Scruggs (Trades, Portfolio), a seasoned portfolio manager with Bragg Financial Advisors, has made strategic moves in the first quarter of 2024, as revealed in the latest N-PORT filing. With a career spanning over two decades at BFA, Scruggs has honed his expertise in value investing, drawing on the wisdom of Benjamin Graham. As the Director of Research and a key figure on the Investment Committee, he applies a meticulous, bottom-up approach to identify undervalued small-cap stocks for the FPA Queens Road Funds. His investment decisions are informed by a blend of quantitative and qualitative analysis, with a keen eye on balance sheets, valuations, management quality, and industry dynamics.

Summary of New Buys

Steven Scruggs (Trades, Portfolio) added a total of 1 stock to his portfolio this quarter:

The most significant addition was John Bean Technologies Corp (NYSE:JBT), with 102,092 shares, accounting for 1.66% of the portfolio and a total value of $10.7 million.

Key Position Increases

Steven Scruggs (Trades, Portfolio) also increased stakes in a total of 11 stocks, with notable adjustments including:

Enstar Group Ltd (NASDAQ:ESGR), with an additional 15,143 shares, bringing the total to 44,778 shares. This represents a 51.1% increase in share count and a 0.73% impact on the current portfolio, valued at $13.9 million.

MDU Resources Group Inc (NYSE:MDU), with an additional 154,823 shares, bringing the total to 438,918. This adjustment represents a 54.5% increase in share count, with a total value of $11.1 million.

Summary of Sold Out Positions

Steven Scruggs (Trades, Portfolio) completely exited 1 holding in the first quarter of 2024:

Owens & Minor Inc (NYSE:OMI): Scruggs sold all 2,203 shares, resulting in a -0.01% impact on the portfolio.

Key Position Reductions

Steven Scruggs (Trades, Portfolio) reduced positions in 8 stocks. The most significant changes include:

Reduced Fabrinet (NYSE:FN) by 65,000 shares, resulting in a -32.93% decrease in shares and a -1.96% impact on the portfolio. The stock traded at an average price of $200.6 during the quarter and has returned -5.21% over the past 3 months and -6.12% year-to-date.

Reduced Deckers Outdoor Corp (NYSE:DECK) by 12,502 shares, resulting in a -44.87% reduction in shares and a -1.32% impact on the portfolio. The stock traded at an average price of $831.65 during the quarter and has returned 16.73% over the past 3 months and 22.89% year-to-date.

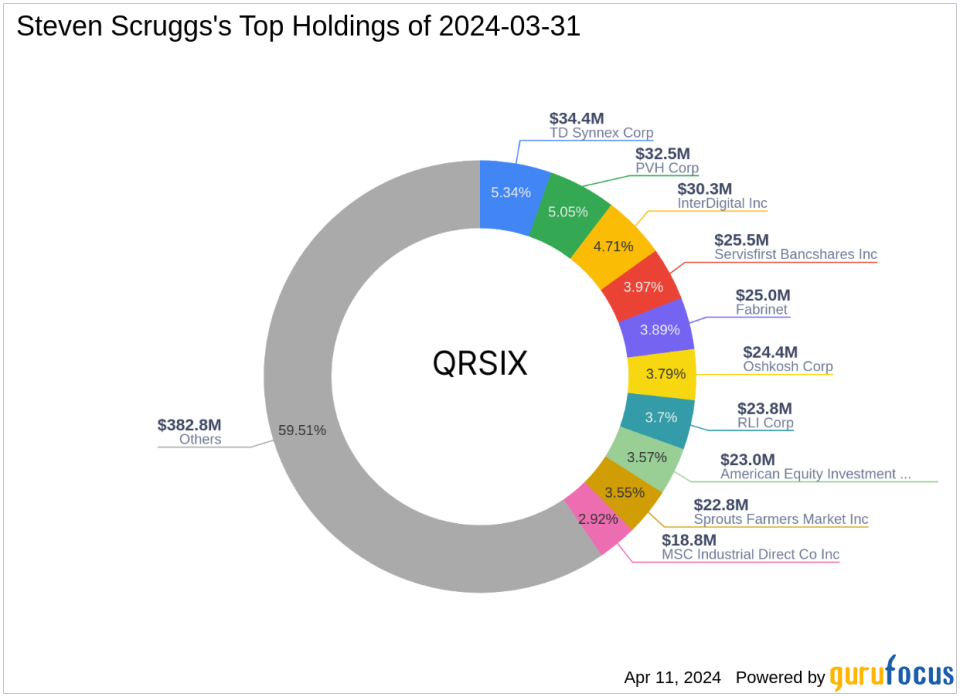

Portfolio Overview

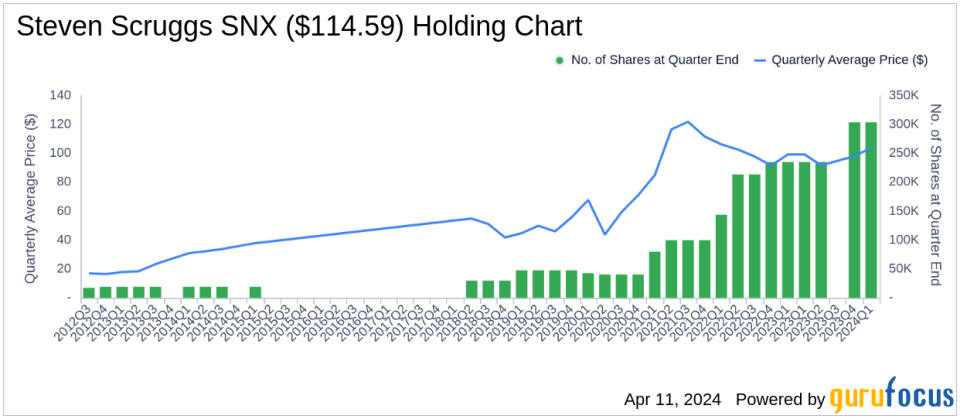

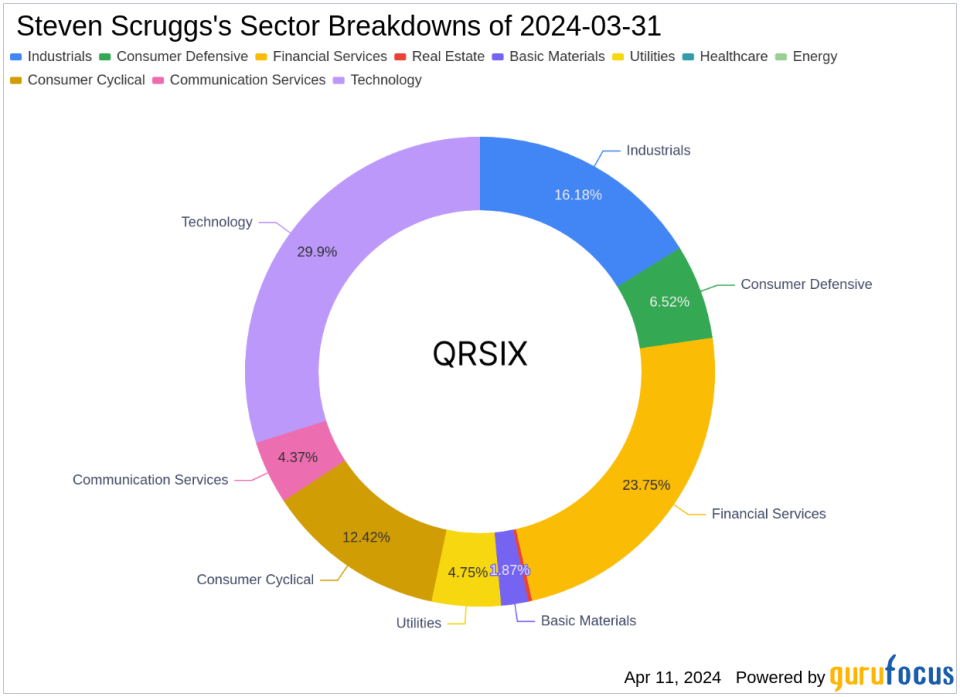

At the close of the first quarter of 2024, Steven Scruggs (Trades, Portfolio)'s portfolio comprised 50 stocks. The top holdings included 5.34% in TD Synnex Corp (NYSE:SNX), 5.05% in PVH Corp (NYSE:PVH), 4.71% in InterDigital Inc (NASDAQ:IDCC), 3.97% in Servisfirst Bancshares Inc (NYSE:SFBS), and 3.89% in Fabrinet (NYSE:FN). The holdings are mainly concentrated in 9 of the 11 industries, with significant exposure to Technology, Financial Services, Industrials, Consumer Cyclical, and other sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance