Do Stifel Financial's (NYSE:SF) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Stifel Financial (NYSE:SF), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Stifel Financial with the means to add long-term value to shareholders.

See our latest analysis for Stifel Financial

Stifel Financial's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Stifel Financial has managed to grow EPS by 26% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

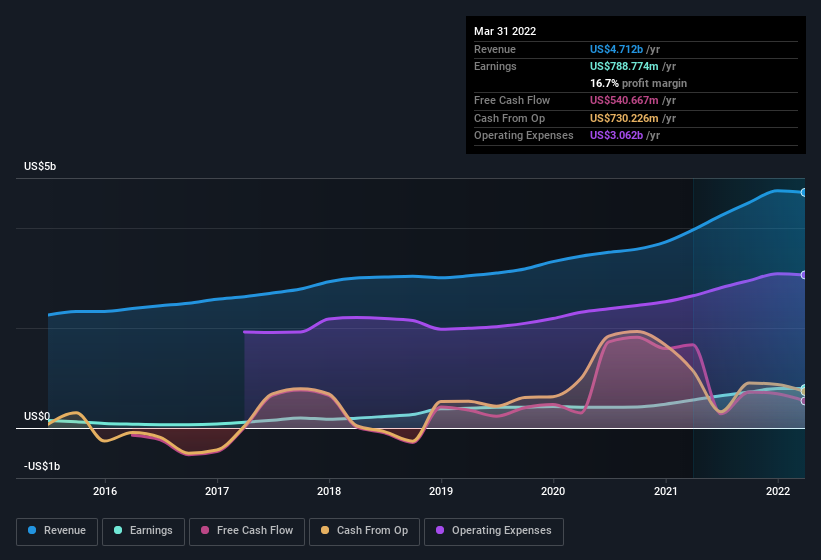

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Stifel Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Stifel Financial achieved similar EBIT margins to last year, revenue grew by a solid 19% to US$4.7b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Stifel Financial's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Stifel Financial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first, there weren't any reports of insiders selling shares in Stifel Financial in the last 12 months. But the really good news is that Chairman & CEO Ronald Kruszewski spent US$619k buying stock, at an average price of around US$61.94. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for Stifel Financial bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$204m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Stifel Financial Worth Keeping An Eye On?

For growth investors, Stifel Financial's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Stifel Financial that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Stifel Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance