Stock Market Live Updates: Stocks slide, Black Friday on track for record year

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

-

9:11 p.m. ET: Black Friday online shopping hits record

From a spokesperson for Adobe Analytics: “Black Friday shopping hit new records with $5.4B spent online as of 9pm ET, up 22.3% YoY. The spend for the day is expected to reach $7.6B, the second largest online sales day ever (last year’s Cyber Monday spending was $7.9B). U.S. consumers are spending on average a whopping $5.3 million per minute in online purchases on Black Friday.

“Looking ahead, Adobe is forecasting that Cyber Monday will set a new record with $9.4B in sales, an 18.9% increase YoY.“

Click here for comprehensive coverage of Black Friday with Yahoo Finance’s Brian Sozzi.

-

1:00 p.m. ET: Stocks close lower

Stocks pulled back from their record highs during an abbreviated trading session.

S&P 500 (^GSPC): -0.40%, or -12.65 points

Dow (^DJI): -0.40%, or -112.59 points

Nasdaq (^IXIC): -0.46%, or -39.70 points

Crude oil (CL=F): -4.44% to $55.53 per barrel

Gold (GC=F): +0.66% to $1,470.50 per ounce

Read more here.

-

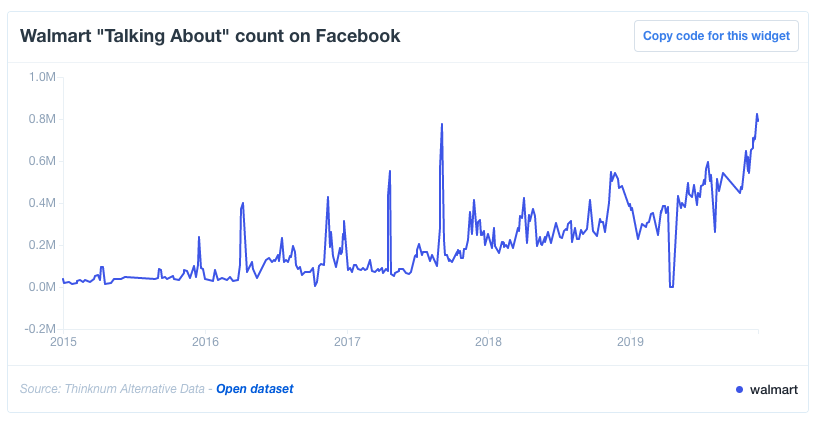

12:12: p.m. ET: Walmart is booming on social

According Thinknum, Walmart’s mentions on Facebook have gone parabolic into the holiday shopping season.

-

11:09 a.m. ET: Monthly retail sales data to be distorted

Black Friday, the annual kickoff to the U.S. holiday shopping season, came late this year. (Read more about that here.) This means much of the holiday shopping that would’ve occurred will likely be moved into December.

For those following the Census’ monthly retails sales report, prepare for the November and December reports to have some noise. Heres’ JPMorgan economist Daniel Silver: “Historically, this shift in spending has been more evident in sales of the important control group— which excludes autos, gasoline, building materials, and food services—than in headline retail sales readings. For sales of the control group, the November sales changes have been below average in years with very late Thanksgivings while the December sales changes have been above average. There are not many instances of Thanksgivings on November 28 since the start of the monthly retail sales data in 1992 and seasonal patterns for sales likely have changed over time, so it is hard to draw very firm conclusions from past data. But if the historical patterns hold, the monthly change in sales of the control group could be held down by 0.2%-0.3%-pt in November because of the late Thanksgiving, with this shortfall likely made up in December.“

-

10:22 a.m. ET: Black Friday on track to hit $7.4 billion in sales

From a spokesperson for Adobe Analytics: “Black Friday is on track to hit $7.4B; as of 9am EST this morning, $600M have already been spent online, representing 19.2% growth YoY. The full holiday season is tracking at 14.9% YoY growth with $57.2 billion spent online between 11/1 and 11/28, representing a comparable* increase of 16.0% YoY. As forecasted, all 28 days in Nov. have surpassed $1B in online sales, with 9 days surpassing $2B. We’re reaffirming our full season (Nov-Dec) forecast of $143.7B spent online.”

-

10:02 a.m. ET: Nordstrom is looking at 2020

Nordstrom’s president of stores Jamie Nordstrom spoke with Yahoo Finance’s Brian Sozzi: “We look at our business over the long-term, we have been around for 119 years now. So we are thinking about how do we create value and loyalty with customers over the long-term. That’s not about next quarter or next month, it’s about doing a good job for the customer and making them feel good. And when we do that, they come back to buy more from us and we see a lot of opportunities to do a better job with that.“

-

9:49 a.m. ET: 3,200 on the S&P 500 in the next week or so?

FundStrat’s Tom Lee thinks the S&P 500 could add another 50 points in the next week. Here’s an excerpt from a note he sent to clients on Wednesday.

“...We believe the strength and recent persistent bid reflects the fact that investor positioning remains "uncomfortably" defensive. This along with strong seasonals supports our view that the S&P 500 likely >3,200 before year-end (perhaps even higher). The re-positioning towards risk-on is stemming from mounting evidence that 2020 economy > 2019 economy, so this is not simply blind "buying of momentum." From a timing perspective, we are now starting to suspect that the highs of the year (3,200 or 3,300?) might take place soon, like in the next week or so. Our conviction is not high on this, and this is also not suggesting economic momentum is faltering... We are looking for 3,200 or so in the next week or so, but suspect this could be the high for the year.”

The S&P 500 (^GSPC) was at 3,150 in early trading on Friday.

-

9:32 a.m. ET: Markets open lower

Not much action. But the little action there is isn’t great.

S&P 500 (^GSPC): -0.19%, or -6.07 points

Dow (^DJI): -0.26%, or -72.36 points

Nasdaq (^IXIC): -0.25%, or -21.89 points

Crude oil (CL=F): -1.89% to $57.01 per barrel

Gold (GC=F): +0.08% to $1,462 per ounce

-

8:59 a.m. ET: It’s Black Friday, and people are shopping

Yahoo Finance’s Brian Sozzi has wall-to-wall coverage of the Black Friday shopping extravaganza, which actually began on Thanksgiving Thursday for some retailers. Here are some highlights:

Thanksgiving Day sales online in the U.S. rose 17% to $4.1 billion, according to Salesforce.

Target says “one million” more people shopped on the Target app versus last year.

Walmart says “millions of customers joined us online and in stores across the country for our Black Friday event.”

-

8:01 a.m. ET: Futures are lower

Here were the main moves in markets so far:

S&P futures (ES=F): -0.16%, or -5.25 points

Dow futures (YM=F): -0.15%, or -43 points

Nasdaq futures (NQ=F): -0.24%, or -20 points

Crude oil (CL=F): -0.14% to $58.03 per barrel

Gold (GC=F): +0.10% to $1,462.20 per ounce

-

Mark your calendar!

December marks the 10th anniversary of DoubleLine's founding. Yahoo Finance’s Julia La Roche will be reporting from DoubleLine in Los Angeles on Monday Dec 2nd. We'll have exclusive access to the trading floor with live interviews with DoubleLine portfolio managers. We’ll also have a live exclusive sit-down with founder and CEO Jeffrey Gundlach.

-

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance