Stock market news live updates: Dow closes 1,167 points higher despite coronavirus worries

[Click here to read what’s moving markets Wednesday, March 11]

Stocks ended Tuesday’s volatile trading sharply higher, with the Dow Jones Industrial Average recouping half of the prior session’s steep losses, as investors cheered news that the Trump administration was readying stimulus proposals to mitigate the impact of the coronavirus epidemic.

Ahead of the opening bell, U.S. equity futures had risen more than 4%. At a press briefing Monday night, President Donald Trump said he would be meeting with Senate and House Republicans Tuesday to consider “a possible tax relief measure” in response to the coronavirus.

Various reports suggested that plans were being formulated around a cut to payroll taxes, which would immediately filter through to workers, as well as proposals to help lower-wage hourly workers. However, some on Wall Street have their doubts.

“Unfortunately, the bottom line is that tax cuts are unlikely to convince consumers to go out and spend if virus fears start to weigh heavily on confidence,” said Andrew Hunter, senior U.S. economist at Capital Economics.

“There is also no guarantee that the Trump administration and Congress will be able to reach a deal,” he added.

[Read more: Oil crashes, stocks crater on coronavirus, crude war fears]

Tuesday’s whipsaw dealings — in which benchmarks briefly gave up all gains — came after stocks on Monday posted their largest one-day percent declines since late 2008, with each of the S&P 500 (^GSPC), Dow (^DJI) and Nasdaq (^IXIC) off more than 7%. The drubbing – spurred as fears over the coronavirus outbreak converged with panic over a price war in oil markets – erased more than $1.87 trillion from the S&P 500’s market value in just one day.

With the case count well over 100,000 globally, countries have individually ramped up measures to try and stem the spread of the virus. Italy, the country with the highest coronavirus death toll outside of China, on Monday night extended a lockdown and travel restrictions to residents across the entire country.

Meanwhile, New York — the U.S.’s largest epicenter of new cases — declared a “containment area” around the city of New Rochelle, which has been the largest source of COVID-19 infections within the state. Bleak warnings from federal officials and the World Health Organization have compounded the sense that the battle to contain the disease’s spread is all but lost, especially as multiple schools shut their doors and/or move to online classes.

With concerns about the outbreak rising, investors have increasingly bet on further stimulus from global policymakers.

As of Tuesday, markets priced in a more than 50% probability that the Federal Reserve would step in with at least 50 basis points of rate cuts by the end of their April policy-setting meeting, bringing the lower band on benchmark interest rates down to 0.25% from 1% currently, according to CME Group data.

—

4:00 p.m. ET: Dow closes 1,160 points higher, taking back half of Monday’s losses

Here were the main moves in markets as of 4:00 p.m. ET:

S&P 500 (^GSPC): +135.28 (+4.93%) to 2,881.84

Dow (^DJI): +1,164.89 (+4.88%) to 25,015.91

Nasdaq (^IXIC): +393.58 (+4.95%) to 8,344.25

Crude (CL=F): +$3.43 (+11.02%) to $34.56 a barrel

Gold (GC=F): -$26.40 (-1.58%) to $1,649.30 per ounce

10-year Treasury (^TNX): +24.9 bps to yield 0.7480% as of close at 3 p.m. ET

—

3:34 p.m. ET: Treasury meets with Fed and SEC to discuss coronavirus

Treasury Secretary Steven Mnuchin convened a call with officials of the Federal Reserve and Securities and Exchange Commission Tuesday to discuss recent market and economic conditions amid the COVID-19 outbreak, the Treasury Department said in a statement.

In addition to Mnuchin, Fed Chair Jerome Powell, Vice Chair Randal Quarles, New York Fed President John Williams and SEC Chairman Jay Clayton were among the participants.

—

2:49 p.m. ET: Oil climbs 10%, recovering some of Monday’s deep declines

U.S. crude oil prices surged 10.4% Tuesday to settle at $34.36 per barrel. A day earlier, West Texas intermediate crude oil prices had dropped more than 30% in its worst decline since 1991, and settled more than 20% lower by Monday’s close.

Brent crude oil prices also recovered some losses, rising 9.4% to $37.59 per barrel as of 2:41 p.m. ET.

—

12:17 p.m. ET: Stocks return to positive territory, Dow adds 400+ points

Tuesday’s volatility showed few signs of abating, with the Dow adding more than 400 points shortly after noon. At the lows of the session so far, the 30- stock index had been off as many as 160 points.

Here were the main moves in markets, as of 12:17 p.m. ET:

S&P 500 (^GSPC): 2,795.25, up 48.69 points, or +1.77%

Dow (^DJI): 24,253.74, up 402.72 points or +1.69%

Nasdaq (^IXIC): 8,110.31, up 159.64 points or +2.01%

Crude oil (CL=F): $33.32, up $2.21 or +7.1%

10-year Treasury (^TNX): yielding 0.635%, up 13.7 basis points

—

12:04 p.m. ET: Occidental slashes dividend, capital spending as oil price slump hits business

Occidental Petroleum (OXY) announced a rare dividend reduction and plans to cut spending amid a sharp drop in oil prices, the company announced Tuesday.

Occidental said it will cut its quarterly dividend to 11 cents per share from 79 cents a share previously. Capital spending in 2020 will be between $3.5 billion to $3.7 billion, down from the range of $5.2 billion to $5.4 billion previously planned.

"Due to the sharp decline in global commodity prices, we are taking actions that will strengthen our balance sheet and continue to reduce debt,” Vicki Hollub, Occidental’s President and Chief Executive Officer, said in a statement. "These actions lower our cash flow breakeven level to the low $30s WTI, excluding the benefit of our hedges, positioning us to succeed in a low commodity price environment."

The announcement marks the first time in at least 20 years that the energy company cut its dividend, according to Bloomberg data.

Occidental shares were halted before noon in advance of the news.

—

11:34 a.m. ET: Stocks flatline as rally gets wiped out

Major benchmarks have surrendered the session’s gains — which began with a 900+ point rally on the Dow — and are now flat to slightly weaker.

Here were the main moves in markets, as of 11:34 a.m. ET:

S&P 500 (^GSPC): 2,743.36, down 3.2 points, or -0.12%

Dow (^DJI): 23,766.48, down 84.54 points or -84.54%

Nasdaq (^IXIC): 7,966.67, up 15.79 points or +0.2%

Crude oil (CL=F): $33.02, up $1.89 or +6.07%

10-year Treasury (^TNX): yielding 0.574%, up 7.6 basis points

—

10:50 a.m. ET: Paddy Power: Trump’s reelection odds take a coronavirus hit

Paddy Power, an odds-making site, is showing Trump’s reelection chances drifting downward with the coronavirus imperiling growth. Just a month ago, the market calculated the president’s reelection chances were 66.7%, but on Tuesday that fell to 55.6% — better than a coin toss but markedly lower than when the COVID crisis took a toll on markets and sentiment. Other betting markets have shown Trump has an advantage heading into November.

—

10:25 a.m. ET: Trump lashes ‘pathetic’ Fed again

Taking aim at one of his favorite targets, President Donald Trump lashed out anew at the Federal Reserve for being behind the curve on monetary policy as the coronavirus panic pummels stocks. In a Twitter tirade on Tuesday, Trump faulted the Fed for hiking too soon and cutting too slowly (the central bank’s emergency cut last week sent markets into a tailspin).

—

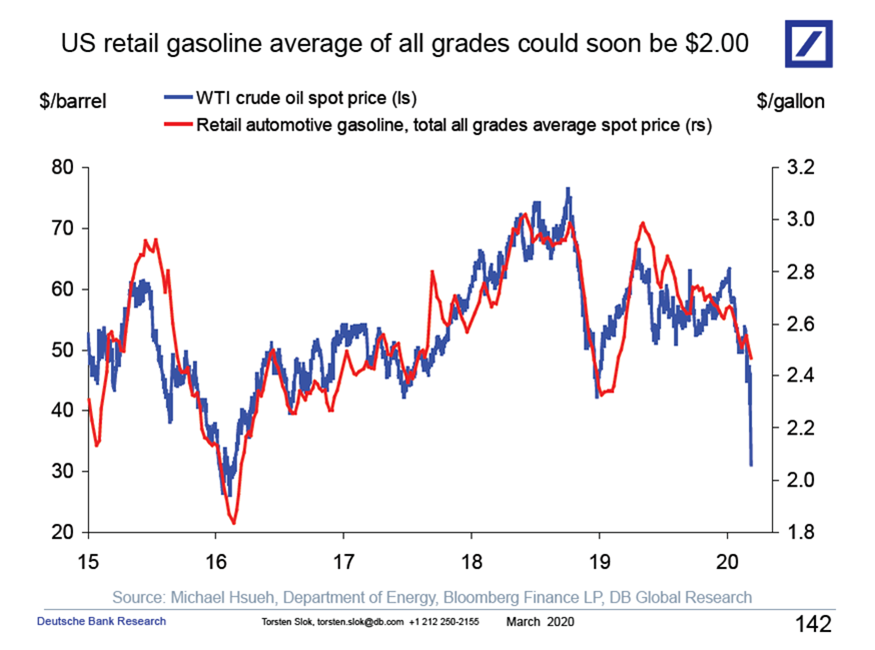

10:15 a.m. ET: Cheap gas on the way as oil crashes

The unmitigated clobbering of crude prices on Monday, in the midst of a power struggle between Russia and Saudi Arabia, was a force multiplier for the selloff. Still, the silver lining is in gas prices — which Deutsche Bank’s Torsten Slok said should hit $2 in relatively short order:

—

10 a.m. ET: SEC goes all in on WFH after employee has respiratory trouble

With coronavirus panic hitting a peak, Securities and Exchange Commission employees have been encouraged to work remotely — indefinitely — after one employee at its DC headquarters received treatment for respiratory symptoms on Monday.

In New York City, Mayor Bill de Blasio has encouraged all city residents to work from home if they can as the state’s new COVID-19 case count soars to the highest in the U.S.

—

9:49 a.m. ET: Oil prices, energy stocks catch a bid higher after leading Monday’s declines

Tuesday’s gains were led by Monday’s laggards.

The Energy sector led gains in the S&P 500, rising more than 3% after sliding 20% Monday. Individual names also recovered some of Monday’s losses, with Marathon Oil Corporation (MRO) jumping 16.8%, Occidental Petroleum Corporation (OXY) climbing 6% and Apache (APA) increased 4%.

Crude oil prices also recovered some of Monday’s steep losses, with West Texas intermediate prices up more than 7.5%. This came even after Saudi Arabia pledged to boost supply up to 12.3 million barrels of oil per day in April, or about 25% higher than last month’s pace, in an escalation of a price war with Russia. the

—

9:33 a.m. ET: Stocks open higher a day after their worst decline since 2008

The S&P 500 extended overnight gains as markets opened for trading Tuesday. The index was on track to recover some losses after tumbling more than 7% Monday in its biggest decline since 2008.

Here were the main moves in markets, as of 9:33 a.m. ET:

S&P 500 (^GSPC): 2,835.83, up 89.27 points, or +3.25%

Dow (^DJI): 24,680.06, up 829.04 points or +3.48%

Nasdaq (^IXIC): 8,217.96, up 272.44 points or +3.55%

Crude oil (CL=F): $33.69, up $2.56 or +8.22%

10-year Treasury (^TNX): yielding 0.674%, up 17.6 basis points

—

7:35 a.m. ET Tuesday: Stock futures leap higher, Dow contracts rise 900+ points

U.S. stock futures vaulted higher Tuesday morning and followed global equities higher, after President Donald Trump floated the notion of a payroll tax cut to help alleviate the impact from the coronavirus.

Treasury yields also recovered losses from Monday, the first session ever in which in entire yield curve fell below 1%. The benchmark 10-year yield added about 20 basis points and approached 0.7%.

Here were the main moves in markets, as of 7:35 a.m. ET:

S&P 500 futures (ES=F): 2,860.25, up 112.5 points or +4.09%

Dow futures (YM=F): 24,833, up 956 points or +4.00%

Nasdaq futures (NQ=F): 8,294.75, up 343.25 points or +4.32%

Crude oil (CL=F): $33.86 per barrel, up 8.77%

Gold (GC=F): $1,664.70 per ounce, down $11 or -0.66%

10-year Treasury note (^TNX): yielding 0.696%, up 19.8 basis points

—

7:27 p.m. ET Monday: Stock futures rise

S&P 500 futures (ES=F): +23.50 points (+0.86%) to 2,771.25

Dow futures (YM=F): +199 points (+0.83%) to 24,076.00

Crude oil (CL=F): +2.73% to $31.98 a barrel

—

6:39 p.m. ET Monday: Stock futures fall as overnight session kicks off

Stock futures began the overnight session lower, extending losses from Monday.

Here were the main moves in markets, as of 6:39 p.m. ET:

S&P 500 futures (ES=F): 2,725.25, down 22.5 points or -0.82%

Dow futures (YM=F): 23,635.00, down 242 points or -1.01%

Nasdaq futures (NQ=F): 7,901.25, down 50.25 points or -0.63%

Crude oil (CL=F): $31.17 per barrel, down 0.03%

Gold (GC=F): $1,675.40 per ounce, up $0.30 or +0.02%

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance