FTSE 100 shrugs off historic UK GDP collapse to lead Europe higher

London-listed shares rallied on Wednesday, despite GDP numbers confirming the worst recession on record for the UK.

Data released early on Wednesday confirmed the UK economy shrank by 20.4% in the second quarter, officially triggering a recession and marking the worst COVID-19 slump of any developed nation economy.

Despite this, the FTSE 100 (^FTSE) was the best performing index across Europe, closing up 2.2%. The index was buoyed by strong earnings reports from companies like Just Eat Takeaway, M&G, and Admiral.

The more domestically-focused FTSE 250 (^FTMC) index gained 0.2%. The pound was down half a percent against the euro (GBPEUR=X) but flat against the dollar (GBPUSD=X).

READ MORE: Coronavirus: UK economy officially enters recession after record 20.4% contraction

Analysts said investors had largely priced in expectations of a sharp fall in GDP.

“It had been widely anticipated,” said Russ Mould, investment director at stockbroker AJ Bell.

The data also showed the UK economy returned to growth in June, marking one of the shortest recessions on record.

“From an output point of view, the low point is in all probability behind us, which means that the important focus now is what lies ahead,” said Michael Hewson, chief market analyst at CMC Markets.

Economists said the UK was unlikely to make up all the lost ground this year. Barclays downgraded its growth forecast on Wednesday, saying it now expects a 10% fall in GDP across 2020.

“A resurgence in COVID-19 caseloads and Brexit risks are additional factors suggesting the UK economy could underperform its peers,” economists at the bank wrote.

Deutsche Bank also flagged Brexit risks, as well as the “premature” end to government support through the furlough scheme.

“This we think will dampen growth in Q4 (and beyond),” economist Sanjay Raja wrote.

READ MORE: Just Eat's lockdown boost, M&G 'resilient', and Admiral helped by quiet roads

Stock markets elsewhere across Europe turned positive by mid-afternoon, following a cautious open.

Germany’s DAX (^GDAXI) closed up 0.9%, France’s CAC 40 (^FCHI) ended 1% higher, Spain’s IBEX 35 (^IBEX) was up 0.4%, and Italy’s FTSE MIB (FTSEMIB.MI) rose 1%.

Markets were buoyed by a rally on Wall Street. The S&P 500 (^GSPC) was up 1.3% by the time Europe closed, while the Dow Jones (^DJI) was up 0.9% and the Nasdaq (^IXIC) had gained 2%.

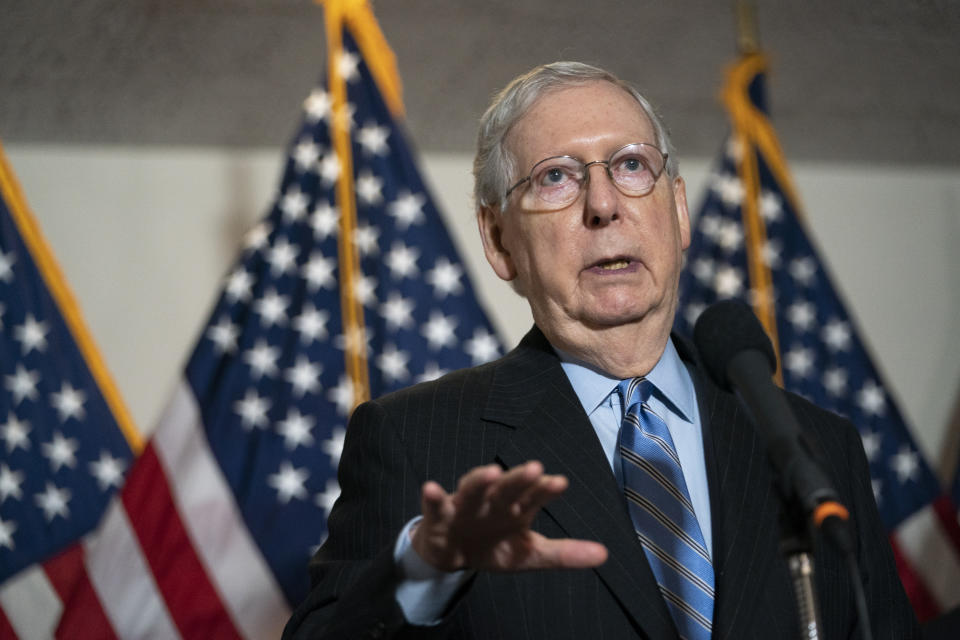

It marked a rebound for US markets following a late sell-off during Tuesday’s trading session. Analysts said the trigger was comments from Mitch McConnell, the US Republican leader in the Senate, suggesting no progress had been made on stimulus talks.

McConnell told Fox News there has been no dialogue between the White House and Democrats.

“Another day has gone by with an impasse and they need to get together,” he said.

Sebastien Galy, a senior strategist at Nordea bank, wrote in a morning note: “The problem is that Mitch McConnell is in trouble at home as benefits are running out in Kentucky and businesses are furious.

“Hence, the fuse is lit on both sides of the isle and it is likely a matter of two weeks before we get a deal. There is a natural cooling period after a breakdown with an eye on the audience.”

READ MORE: Asos boosted by sports clothing and beauty sales

Gold and Silver suffered their worst one-day losses in years on Tuesday but had found a floor by Wednesday afternoon. Gold futures (GC=F) were up 0.1% to $1,948.80 per ounce, while silver (SI=F) had parred earlier losses and was down just 0.7% to $25.85.

Stocks were mixed overnight in Asia. Japan’s Nikkei (^N225) rose 0.4% and the Hong Kong Hang Seng (^HSI) added 0.8%. The Shanghai Composite (000001.SS) dropped 0.7% and the Shenzen Component (399001.SZ) shed 1.2%. Australia’s ASX 200 (^AXJO) fell 0.1%.

Yahoo Finance

Yahoo Finance