Stock market sell-off a taste of things to come, Morgan Stanley warns

The global stocks sell-off that rattled markets earlier this month was just an “appetiser” before an even gloomier main course as a nine-year bull run reaches its final stages, Morgan Stanley has warned investors.

The investment banking giant’s models indicate that developed markets are caught in the “late stages of a late-cycle environment” and that a combination of softer growth and climbing inflation could hit investor returns this year.

The Dow Jones and S&P 500 – the two major benchmark indices in the US – plunged into correction territory this month amid fears that rising inflation will force the Federal Reserve to hike interest rates quicker than markets had anticipated.

The correction – when stocks fall 10pc from an index’s 52-week high – was widely seen as overly frothy equities letting off steam but Morgan Stanley believes that the plunge could be a tremor before a larger downwards move on markets.

The US bank predicted that markets could begin to struggle after the first quarter of 2018, arguing that a concoction of “rising equities, rising inflation, tightening policy, higher commodity prices and higher volatility” resembles a familiar pattern before stocks stumble.

“Underneath all that sound and fury of the recent volatility spike, we think we're still dealing with a playbook with a reasonable amount of precedent,” its strategist Andrew Sheets told clients.

Meanwhile analysts at Credit Suisse and the London Business School also struck a grim tone, arguing that they see little chance the recent boom in asset values can be repeated.

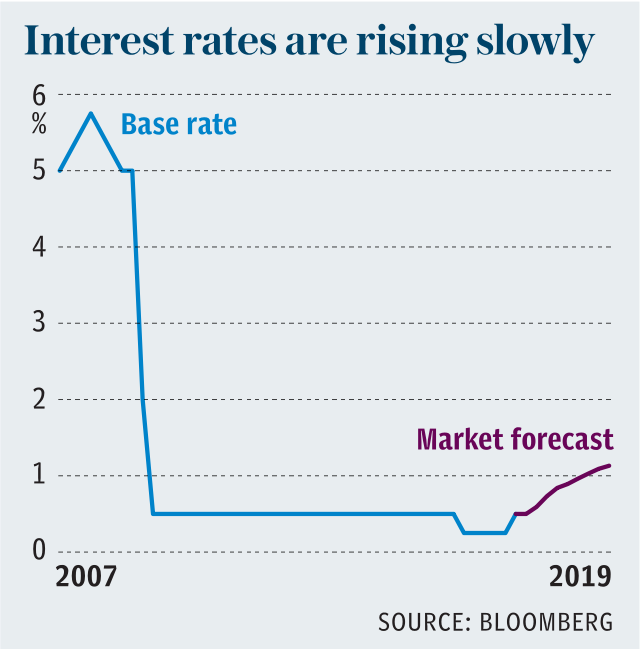

Part of the cause was low interest rates which have pushed up valuations, and the shift from higher rates in the Eighties and Nineties to very low rates in recent years will not be repeated.

Indeed it could be reversed as interest rates are now rising gradually.

In addition, the much longer boom in stocks in the second half of the 20th century is unlikely to be repeated either, as much of it was based on improved diversification and lower risks which is hard to imagine being continued beyond its current point.

“Expected returns in the future are likely to be considerably lower than the ones we have enjoyed since the financial crisis,” said Professor Paul Marsh.

“We’ve had incredibly good returns since the global financial crisis on both equities and bonds, and we have been arguing for some time that we’re in a low expected return world, and yet returns keep on coming through as very high.”

“Last year most countries enjoyed double digit returns, many were in excess of 20pc, and the world index had a return of 24pc,” he said, adding that the study, which looks at returns on different assets since 1900, asks “whether those high returns can last, and we think they can’t”.

Yahoo Finance

Yahoo Finance