StockRank Movers - April 14th: Investing in Spain

Investors are turning their eyes towards Europe. As early as April 2014, an article in the Financial Times, titled 'Flying Pigs', noted that 'countries on the edge of Europe have long been out of favour with investors, but interest is reviving in these markets as share prices rise and economic conditions continue to improve.'

Indeed, the FTSEurofirst 300 Index has appreciated by nearly 25% over the last year, while the FTSE 100 has risen by just 7%. Investors may be wondering whether there are still good value stocks to be found on the Continent. We covered Greece in a recent article which can be found here. This week we turn our attention to Spain.

Is Spain still cheap?

Investors could use the CAPE ratio to assess where a company is in the economic cycle. The CAPE, or cyclically adjusted P/E ratio, is defined as price divided by the average of ten years of earnings. It therefore seeks to smooth out the economic cycle and allow for better comparisons over time.

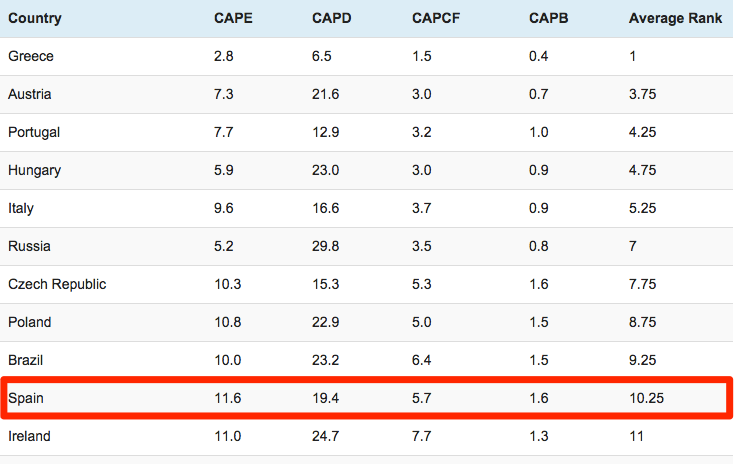

Research by Meb Faber shows that the average CAPE for Spanish stocks is 11.6 - cheaper than the UK (12.1), Germany (15.8) and the United States (23.6).

But there are many ways to skin a cat. Investors can also assess the value of a stock by using the following metrics:

These three data-points are calculated using a similar method to the CAPE, but rather than compare the cyclically-adjusted price against the PE ratio, they compare the price against stocks' respective dividend, cash flow and book values.

Meb Faber has calculated a composite rank based on these cyclically-adjusted metrics. He has analysed over 40 countries and suggests that Spain is the 10th cheapest (see table below).

It is not difficult to understand why Spain is so cheap. Its economy is stuck in first gear and unemployment remains at over 20%. But has the market overreacted to this news? Let's take a closer look by analysing several high StockRank Spanish stocks.

Lingotes Especiales SA (LGT)

The legendary investor, Peter Lynch, likes companies that 'do something dull'. He believes that 'if a company with terrific earnings and a strong balance sheet also does dull things, it gives you a lot of time to purchase the stock at a discount' - before other investors realise the opportunity. So what would Peter Lynch make of Lingotes Especiales?

However, the market has a long memory. Spain's recent history of economic problems may lead many investors to be wary about investing in Spanish stocks. Indeed, Lingotes still trades with a P/E ratio of 14.7, and an overall ValueRank of 75, suggesting that the company is in the cheapest quarter of the European market.

Lingotes is in the cyclical auto-parts industry. Cyclical companies tend to do very well during an economic recovery, as people have more money to splash out on cars and other luxury goods. Cyclical companies may benefit if the Spanish economy recovers.

The company's overall StockRank is 98.

Azkoyen SA (AZK)

The Azkoyen Group makes payment and security systems. The company has an overall ValueRank of 79 - comfortably in the cheapest quartile of the European market. Spain's economic challenges may help to explain why some investors are reluctant to buy this stock. However, Azkoyen makes 70% of its sales in markets outside of Spain, and could therefore be sheltered from weak domestic demand.

Indeed, Azkoyen has an overall Piotroski F-Score of 7 out of 9. The Piotroski score looks for companies that are profit-making, have improving margins, don't employ any accounting tricks and have strengthening balance sheets.

Azkoyen is more profitable than it was last year. The company's Return on Assets has increased from 0.1 to 2.4. Azkoyen is also improving its capacity to service debt. The firm's debt to asset ratio was 18 last year, compared to 13 this year.

The company has an overall StockRank of 99.

Iberpapel Gestion SA (IBG)

Iberpapel Gestion, like Lingotes Especiales, does something boring. It makes paper. Furthermore, the paper industry faces headwinds. Demand for paper has decreased globally over recent years. Iberpapel has felt the pinch as revenues declined from €211m (2011) to €200m (2014). However, Iberpapel managed to grow earnings by 20% in 2014 - thanks in part to an improvement in production efficiency. The company's pricing power is also increasing, as Gross Margins expanded towards 60%. Brokers are also optimistic about future growth. They predict that earnings will grow by 7% in 2015 and another 12% in 2016.

Iberpapel is also exposed to one of the most powerful forces that drive stock market returns - momentum. It has an overall MomentumRank of 96, after beating the market by 3% over the last month. The company now trades above its 52 week high.

Iberpapel's overall StockRank is 99.

Conclusion

The Spanish IBEX Index has appreciated by 14% over the last year - double the return investors would have got by investing in the FTSE 100. But investors can still find good quality Spanish companies that trade at cheap prices. Feel free to check out this screen to explore other high ranking Spanish stocks:

http://www.stockopedia.com/screens/investing-in-spain-51993/

If you want to learn more about the CAPE ratio, see this article by Faber for more details, as well as this paper for longer-term results. Also, bear in mind that Stockopedia subscribers can filter the market for companies with a low CAPE ratio using our powerful screening tools. Alternatively, users can hone in on good quality companies trading at bargain prices by exploring the StockRanks Portal. If you wanted to learn more about valuation tools, then Stockopedia's free ebooks are a good place to start. Indeed, we discuss the CAPE ratio in detail in How to Make Money in Value Stocks.

Read More about IBI Inc on Stockopedia

Discuss IBI Inc on Stockopedia

Yahoo Finance

Yahoo Finance