StockRank Movers - June 9th: Is Wincanton still a SuperStock?

Wincanton is one of the more controversial stocks in Stockopedia's discussion stream. This logistics company sparked an intense debate between Ed Croft and Paul Scott earlier in the year, mainly because the company has "one of the worst balance sheets" that Paul has ever seen; however, it retains a very high StockRank (97) and has returned about 150% since it first entered the 90+ StockRank bucket. The price trend appeared to support Paul's argument between early February and late April, when Wincanton's share price dropped by around 9%.

Nevertheless, the share price has rebounded in recent weeks, appreciating by 18% since 1st May. Prices have a tendency to follow a random walk over the short-run, but over the long-term, SuperStocks - which are good, cheap and improving - have a tendency to beat the market. Is Wincanton still a SuperStock?

Do balance sheets matter?

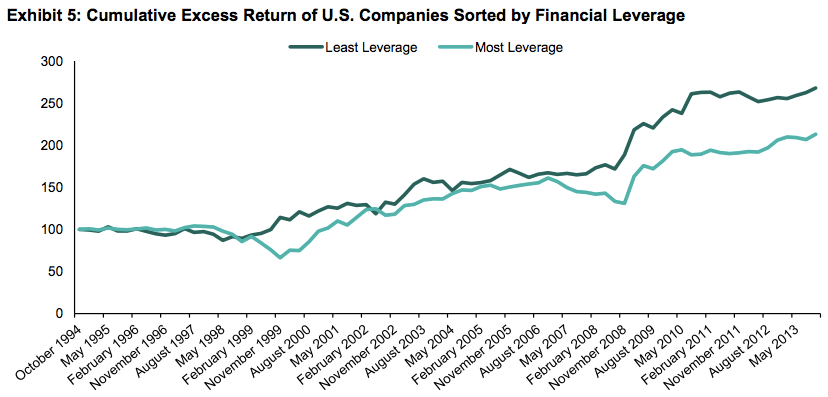

Financial health is an important aspect of quality. Poor quality companies tend to have deteriorating fundamentals and face higher bankruptcy risks. Is Wincanton a risky stock? According to the Altman Z-Score, Wincanton does have a high risk of bankruptcy. Is this a problem? Research by S&P suggests that 'lowly-geared companies beat highly geared ones by about 1% per annum'. Indeed, the chart below suggests that lower indebtedness offers greater downside protection during recessions, when weaker companies could go to the wall. For example, notice how companies with the most leverage fell harder during the bear market of 2007-08.

Falling Quality

Wincanton may have a poor Z-Score, but around twelve months ago, investors who were bullish about the company may have pointed to Wincanton’s F-Score. The Piotroski F-Score was designed to identify companies with improving fundamentals - for example, an improving balance sheet. In July 2014, Wincanton had a strong F-Score (8 out of 9), so the bulls may have argued that Wincanton had a weak balance sheet, but was nevertheless improving its capacity to service debt. However, the F-Score has now fallen from 8 to 6, and the firm's ability to pay short term debts has decreased. Wincanton's current ratio improved between September 2013 and July 2014. But since then the current ratio has fallen from 0.75 to 0.66.

This is part of a wider trend whereby Wincanton's overall QualityRank has dropped. Firms with a higher QualityRank are usually stable, growing, cash generative businesses with high returns on capital. However, Wincanton's QualityRank has fallen from around 95 (July 2014) to 80 (October 2014) and then 55 (January 2015). The QualityRank is now 62, as you can see from the chart below.

So over the last twelve months, Wincanton appears to have made a transition from being a Super Stock, with high value, quality and momentum ranks, to a value-momentum play. The firm has a deteriorating QualityRank, but retains high Momentum and ValueRanks (see below). Indeed, the stock has beaten the market by 17% over the last month alone. Brokers are also becoming increasingly optimistic about Wincanton. EPS estimates have risen from 17.6p to 19.7p since Jun 2014.

Should investors be worried that Wincanton may no longer have all the characteristics of a Super Stock? James O'Shaughnessy, in his classic book What Works on Wall Street, found that “Trending Value [ie. high Value-Momentum] is the best performing strategy since 1963". However, we do not have a crystal ball. Past trends may not persist forever. There are also other factors to consider...

High beta

Since the 1970s, academics have observed that companies that are less volatile (ie. have more stable share prices) have a tendency to beat the market over the long-run.

'Beta' is a way of measuring whether a company is more, or less, volatile than the market. If a stock’s price tends to rise more than the market on up-days and fall more than the market on down days, it will have a Beta greater than 1 (ie. higher volatility). But if it isn’t as sensitive to market movements, rising less and falling less than the market, then it will have a Beta of less than 1 (ie. lower volatility).

Wincanton's beta is 1.37, so it has been more volatile than the market. The company is engaged in the highly cyclical business of managing supply chains. Cyclical companies can flourish and often beat the market by a large margin coming out of a recession and into a vigorous economic recovery. However, cyclicals tend to fall harder during an economic crash. Indeed, Wincanton's shares plunged 90% during the recession. With its current levels of leverage, Wincanton could perhaps be particularly vulnerable if interest rates rise suddenly and/or the economy slows down.

Conclusion

Maybe the biggest red flag for Wincanton is the firm’s bankruptcy risk. Around 12 months ago, many investors may have been prepared to overlook this risk because the company had a high overall QualityRank and a strong Piotroski F-Score. However, the QualityRank and F-Score have both fallen and Wincanton now has the characteristics of a value-momentum play - and one with relatively high volatility to boot.

To find companies with improving, or deteriorating StockRanks, subscribers can check out our StockRank portal. The ‘Movers’ page shows stocks that have been moving up and down through the rankings over recent weeks. Also check out our screening tools to filter for companies with strong balance sheets, here.

Read More about Wincanton on Stockopedia

Discuss Wincanton on Stockopedia

Yahoo Finance

Yahoo Finance