StockRank Movers - March 17th: St. Patrick's Day is here

The Irish will celebrate St. Patrick's Day today as their economy gathers momentum. Citigroup expects the Irish economy to grow by around 4% over the next couple of years, while the rest of the Eurozone struggles to grow faster than 2%. Exports are rising while unemployment is falling. We can mark Ireland's recent success, and celebrate St. Patrick's Day at the same time, by looking at Irish stocks with a high StockRank.

Fyffes (FQ3)

Last year, Fyffes, the Irish banana grower, was in merger negotiations with the American company, Chiquita. If the merger deal went through, Fyffes would have become the world's largest banana supplier, with €835m in annual revenues. However, back in October, Chiquita shareholders voted against a merger and the deal collapsed. The announcement sent shares in Fyffes down 5%, but did the market overreact to the bad news?

The company has an overall StockRank of 84 and a QualityRank of 74 - comfortably within the highest third of the market. Revenues have grown each year since 2009. Profits also grew strongly in 2014, supported by volume growth and improved production efficiency in farms. Furthermore, the company's management have noted that the group was 'actively pursuing a promising number of attractive acquisition opportunities'. Brokes are getting increasingly optimistic about the future and have gradually been upping their numbers. Earnings forecasts have risen from 9c in March 2014, towards 11c by February 2015. Let's see what the future holds.

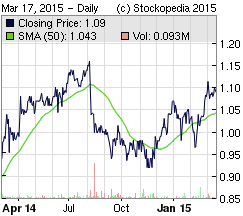

Total Produce (T70)

The Irish fruit and veg distributor, Total Produce, is Ireland's highest StockRank company, with an overall QVM rank of 96. The firm has recently faced challenges from unfavourable currency fluctuations, alongside difficult trading conditions in the Eurozone, where like-for-like revenues have more or less been flat. Total Produce faced trouble as warm weather on the continent led to oversupply and lower prices. Bad news like this may help to explain why Total Produce is relatively cheap, with a ValueRank of 78 - within the cheapest quarter of the market.

However, the company has recently been beating the market and now trades close to its 52 week high price. Why is the market getting so excited? When the firm released its results at the beginning of March, it revealed that revenues had grown from €2,638m to €2,667m - despite the headwinds. This was supported by a series of acquisitions across Europe and America. Brokers are becoming increasingly optimistic too. This month, the broker consensus for 2015 earnings have jumped from 9c to 9.4c. Where will the share price go from here?

Want to learn more?

Stockopedia subscribers can filter the Irish and other international markets using our powerful screening tools. Alternatively, users can hone in on good quality companies trading at bargain prices by exploring the StockRanks Portal. If you wanted to learn more about valuation tools, then Stockopedia's free ebooks are a good place to start. As always - these are not share tips and should not be read as investment advice. Please do your own research before investing.

Read More about Fyffes on Stockopedia

Discuss Fyffes on Stockopedia

Yahoo Finance

Yahoo Finance