StockRank Movers - May 26th: Focus on Indivior

Joel Greenblatt believes that ‘you can make a pile of money investing in spinoffs.’ In his bestselling book, You can be a Stock Market Genius, Greenblatt explains that during the twenty-five years ending 1988, spinoff companies outperformed their industry peers by about 10% per year in the first three years of independence.

A spinoff is of course formed when a corporation takes part of its business and separates it from the parent company, thereby creating a new company. Indivior is a good example of a recent spinoff. It is the former pharmaceutical division of Reckitt Benckiser, and was spun-off as an independent company towards the end of 2014. Indivior is particularly interesting because it is also has a QV Rank of 98/100, suggesting that the company could be a good quality company trading at a cheap price. Let’s take a closer look....

Risk of generic competition

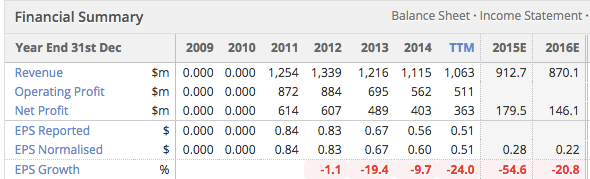

Indivior has a very low PE ratio (7) and an overall ValueRank of 92, making it one of the cheapest stocks in the market. The cheapness of Indivior may reflect risks from generic competition. The company's lead product, Suboxone Film - which is used to treat opioid dependence - represents around 77% of sales. However, the patent for Suboxone expired in 2010. Earnings per share have since fallen from 84 cents (2011) to 60 cents (2014) as Indivior faced increased generic-drug competition. Brokers expect earnings to fall by another 54% in 2015, and then 21% in 2016.

Strong Product pipeline

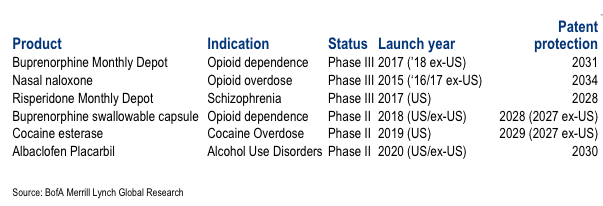

The risk of generic competition may already be reflected in the price. However, Indivior’s pipeline could be undervalued by investors. The company plans to launch a series of new products to treat opioid addiction and other illnesses over the next five years.

Opioids are prescribed to treat acute pain (for example, pain following surgery). However, there is currently a worldwide epidemic of opioid overdoses. This is especially apparent in the United States, where prescription opioid overdoses were responsible for more deaths between 1999 and 2008 than heroin and cocaine overdose combined.

Indivior has several products in its pipeline that could treat opioid addiction and overdoses:

Furthermore, in May Indivior announced top-line results from its phase 3 clinical trial of RBP-7000 - a form of risperidone for the treatment of schizophrenia. Based on the results of this trial, Indivior expects to submit a New Drug Application (NDA) to the U.S. Food and Drug Administration for potential approval in 2017. Deutsche Bank responded positively to this news and upgraded its price target from 212.00p to 220.00p. You can see from the chart below that the EPS estimate jumped from 16p to 17.6p in May.

Insider buying

Indivior’s CEO, Shaun Thaxer, has stumped up for £1m worth of stock since the demerger, up to the £2 level. Thaxter is not the only director buying shares. Indivior’s CFO, Cary Claiborne, purchased over £100,000 in shares back in February. This may partly be to fulfil pending share holding requirements. However, holding requirements usually need to be built up over substantial time, so the decision to buy so much so quickly could be meaningful.

Potential takeover target

Towards the end of April, Ed Shing suggested that Indivior may be a potential takeover target (see here). Despite its strong product pipeline, Indivior currently trades at 232p. This gives the company a market cap of £1.65 billion, making it relatively small compared to industry giants like GlaxoSmithKline, AstraZeneca and Shire. The company is also relatively cheap on a number of valuation metrics such as the PE raio, as you can see here:

Last year, TSB was spun off from Lloyds. TSB floated with a PE ratio of around 8 and by the end of March, the company had been brought out by the Spanish bank, Sabadell.

Conclusions

So Indivior faces risk from generic competition. However, this bad news may already be reflected in the share price. Moreover, the company does have a strong pipeline of products which may be undervalued by investors. In addition, insiders are buying and the company could be a potential takeover target. Spinoffs in the UK stockmarket are few and far between, but HSBC has recently raised the prospects of spinning off UK retail branches (see here). So watch this space….!

To identify other high StockRank stocks, users may want to check out our StockRank portal. To take a free trial of our services, just click here.

Read More about value investing on Stockopedia

See the latest Stockmarket News, Commentary & Analysis on Stockopedia

Yahoo Finance

Yahoo Finance