Stockranks Upgrades & Downgrades 9 December: AAPL; MSFT.

In the 1990s, the word 'billionaire' was almost synonymous with the words 'Bill' and 'Gates'. Microsoft was the big technology company of the day. Everyone was using Windows and all my friends were playing Age of Empires. Apple Inc was nowhere to be seen. I didn't even know who Steve Jobs was. We could probably write a whole book on how Apple was able to turn itself around, but in this week's StockRanks column, we'll simply compare two technology giants from a quality, value and momentum perspective.

Apple

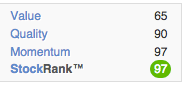

Apple shows all the financial hallmarks of being one of the highest quality business in the USA. With sector and market leading profitability (ROE of 31%) and operating margins (29%) it generates huge cashflow for shareholders. Shareholders can thank the firm's expansion into new markets like China, and its stellar product line for the growth in revenues from $37m back in 2008 to $182m in 2014. Apple has a high Quality Rank of 90, only dipping from the top score due to some recent negative trends in profits and margins from perhaps unsustainable highs.

Doubts over Apple's expansion into China and the sustainability of margins weigh heavily on the valuation. As a result Apple remains cheap for such a quality stock with a PE ratio of 15.9 and an overall Value Rank of 74.

But the company looks well set to beat expectations. Analysts are becoming more optimistic about the company's earnings. Since December 2013, EPS estimates have risen from $6.82 to $7.76. This improving sentiment has driven the share price upwards, with the company beating the S&P 500 by 25% over the last year. Taken together these factors propel Apple to a Momentum Rank of 98.

Microsoft

Both companies are more or less evenly matched in terms of Value. Apple has a ValueRank of 65, whereas Microsoft has a ValueRank of 66. However, Apple has a higher QualityRank than Microsoft (90 vs 76). Over the last three years, Apple has been able to grow sales more consistently than Microsoft. Apple also has a slight lead when it comes to profitability returns, with a ROCE of 31%, compared to Microsoft's ROCE is 22%. However, Microsoft's operating margins (30%) are slightly wider than Apple's 29%.

Apple also has a higher MomentumRank than Microsoft. While brokers have been becoming more optimistic about Apple, the EPS estimates for Microsoft have fallen from $2.91 to $2.67. Microsoft has also failed to beat the market in the same way that Apple has. Microsoft's Relative Strength is 10% compared to 25% at Apple.

On the whole, Apple's StockRank is 97, while Microsoft has a StockRank of 89.

Read More about Apple Inc on Stockopedia

Discuss Apple Inc on Stockopedia

Yahoo Finance

Yahoo Finance