What to watch: AO World sales jump, Heineken faces £2m fine and Ryanair cuts flights

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and around the world:

AO World Sales Jump

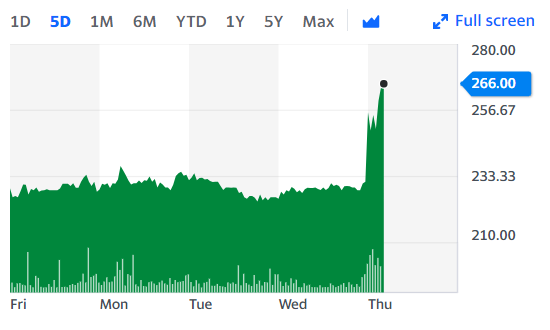

British online electricals retailer AO World (AO.L) said it expects to report a 57% increase in first-half revenue following strong consumer demand during the COVID-19 pandemic, according to a company statement on Thursday.

The news sent shares higher almost by almost 15% in early trading.

As many Britons continue to work from home during the COVID-19 pandemic, sales of electrical goods and home office supplies have risen.

The company, which also sells washing machines, fridges, cookers and televisions as well as mobile phones and printers, expects to report revenue of £715m ($911.37m) for the six months to 30 September.

Heineken fined £2m for breaching pubs code

Heineken (HEINA.AS) has been fined £2m in the UK for forcing pubs it owned to sell “unreasonable levels of Heineken beers and ciders.”

The Dutch brewing giant was handed the fine on Thursday by the UK’s Pubs Code Adjudicator, an ombudsman set up to oversee the Pubs Code. The adjudicator also released a damning report alongside the judgement, calling Heineken a “repeat offender.”

Heineken rejected the findings and said it was considering appealing against the fine.

The Pubs Code, which came into force in 2016, legislates for how pub owners with more than 500 establishments should treat landlords. Heineken’s fine is the first financial penalty imposed by the Pubs Code Adjudicator.

“The report of my investigation is a game changer,” adjudicator Fiona Dickie said in a statement. “It demonstrates that the regulator can and will act robustly to protect the rights that parliament has given to tied tenants.”

Ryanair cuts one in three winter flights

One of Europe’s largest budget airlines Ryanair (RYA.L) is slashing its winter flights by a third and will also temporarily shut down three bases.

In a statement, Ryanair said that it further reduced its winter schedule from 60% to 40%, blaming flight restrictions imposed by governments in Europe, as its boss warned of job cuts.

It will close bases in Cork, Shannon, and Toulouse for the winter period of November to March. Ryanair also announced significant base aircraft cuts in Belgium, Germany, Spain, Portugal and Vienna.

However, it hopes to keep its planes 70% full to “minimise cash burn” and at least break even. The budget airline expects full year 2020 traffic to fall to approximately 38 million passengers.

It said this figure could be further revised downwards “if EU governments continue to mismanage air travel and impose more lockdowns this winter.”

Markets retreat as coronavirus fears rise and US stimulus hopes wane

Asian and European markets were lower on Thursday as investors focused on the rising COVID-19 threat and fading hopes of a US stimulus package before the 3 November election.

European markets opened in negative territory in early trading. The pan-European STOXX 600 (^STOXX) was down 1.4%. Germany’s DAX (^GDAXI) was lower by 1.6%, and France’s CAC 40 (^FCHI) declined by 1.4%. The FTSE 100 (^FTSE) was down by 1.5% in London.

Watch: Coronavirus restrictions tighten in London

On the COVID-19 front in the UK, the government in Northern Ireland has laid out its plans for a four week mini lockdown, while the Welsh government is preparing to close its border with England.

Sterling was the strongest performing G10 currency on Wednesday following reports that the UK has softened its stance on Brexit and won’t walk away from trade talks with the EU. Following a call that reportedly took place between UK Prime Minister Boris Johnson, European Commission President Von der Leyen and European Council President Charles Michel, the end of October or first few days of November is now regarded as the real deadline for getting a deal done.

US futures are also sliding lower.

S&P futures (ES=F) are down 0.5%, Dow Jones (YM=F) also went lower by 0.5, and Nasdaq (NQ=F) tilted down by 1%.

Additional reporting by Oscar Williams-Grut

Yahoo Finance

Yahoo Finance