StoneX Group Inc. (SNEX) Q2 Earnings: Misses EPS Projections, Surpasses Revenue Expectations

Quarterly Revenue: Reported at $818.2 million, marking a 16% increase year-over-year, significantly above the estimated $444.27 million.

Quarterly Net Income: Achieved $53.1 million, up 27% from the previous year, below the estimated $59.80 million.

Diluted EPS: Recorded at $1.63, a 25% increase year-over-year, below the estimated $1.91.

Interest Income: Grew by 44% year-over-year to $326.0 million, reflecting stronger financial market activities.

Operating Expenses: Total compensation and other expenses rose by 4% to $356.9 million, indicating controlled growth in operational costs.

Segment Performance: Institutional segment revenue grew by 28% to $463.4 million, highlighting strong performance in this area.

Return on Equity (ROE): Reported at 14.0%, showing robust profitability and effective use of equity.

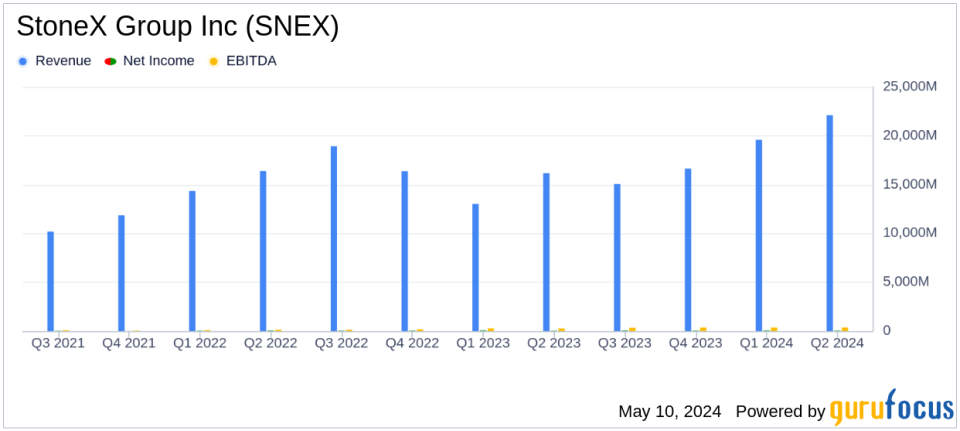

On May 8, 2024, StoneX Group Inc. (NASDAQ:SNEX), a prominent global financial services network, disclosed its financial outcomes for the second quarter of fiscal year 2024, which concluded on March 31, 2024. The company announced these results through its 8-K filing. StoneX operates across various segments including commercial, institutional, retail, and global payments, providing a wide array of services such as brokerage, advisory, and risk management solutions.

Fiscal Performance Highlights

For the quarter, StoneX reported operating revenues of $818.2 million, marking a 16% increase from the previous year, and significantly surpassing the estimated revenue of $444.27 million. However, the diluted earnings per share (EPS) stood at $1.63, which did not meet the analyst expectations of $1.91 per share. The company's net income rose to $53.1 million, reflecting a 27% increase year-over-year but fell short of the anticipated $59.80 million.

Strategic Insights and Operational Efficiency

CEO Sean M. OConnor highlighted the diversification of the company's product offerings and client base as a key driver of the robust quarterly performance. Despite facing unrealized losses of $9.1 million on derivative positions, which are expected to reverse in subsequent quarters, the company maintains a positive outlook for delivering superior returns moving forward.

Detailed Financial Analysis

StoneX's net operating revenues saw a modest rise of 6% to $422.3 million. The firm managed to keep its compensation and other expenses in check, with only a 4% increase compared to the previous year. Notably, the company's interest income surged by 44% due to favorable market conditions, contributing significantly to the revenue growth.

The segment performance was mixed, with the Institutional and Retail segments showing remarkable growth of 28% and 30% in operating revenues, respectively. However, the Commercial segment experienced a 9% decline. The Payments segment remained relatively stable with a slight 1% decrease.

Balance Sheet and Future Outlook

StoneX's balance sheet remains robust, with a continued focus on maintaining a strong equity base while managing liabilities effectively. The company's return on equity (ROE) was reported at 14.0%, indicating efficient use of shareholder equity. Looking ahead, StoneX is poised to leverage its global network and diversified service offerings to navigate the dynamic market conditions and drive further growth.

The company has scheduled a conference call on May 9, 2024, to discuss these results in detail and outline the strategic priorities for the upcoming quarters. This call is expected to provide investors with deeper insights into the company's operations and market strategies.

Conclusion

While StoneX's earnings per share fell short of analyst expectations, its significant revenue growth and strategic expansions highlight the company's resilience and adaptability in a challenging economic environment. Investors and stakeholders will likely keep a close watch on how the company's strategies unfold in the coming months, particularly in terms of profitability and market expansion.

Explore the complete 8-K earnings release (here) from StoneX Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance