It's A Story Of Risk Vs Reward With Kingswood Holdings Limited (LON:KWG)

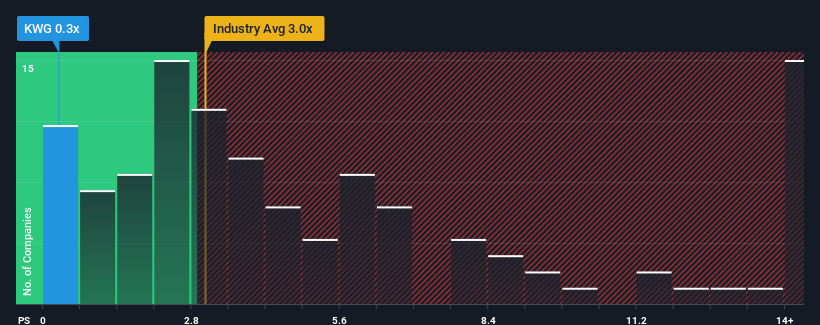

With a price-to-sales (or "P/S") ratio of 0.3x Kingswood Holdings Limited (LON:KWG) may be sending very bullish signals at the moment, given that almost half of all the Capital Markets companies in the United Kingdom have P/S ratios greater than 3x and even P/S higher than 9x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kingswood Holdings

How Has Kingswood Holdings Performed Recently?

Recent times have been more advantageous for Kingswood Holdings as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Kingswood Holdings will help you uncover what's on the horizon.

Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Kingswood Holdings would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 8.9% per annum over the next three years. That's shaping up to be materially higher than the 4.2% each year growth forecast for the broader industry.

In light of this, it's peculiar that Kingswood Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Kingswood Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Kingswood Holdings is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance