Stratasys (SSYS) Q4 Earnings and Revenues Miss Estimates

Stratasys Ltd. SSYS reported fourth-quarter 2019 earnings of 18 cents per share, which lagged the Zacks Consensus Estimate by 14.29%. Moreover, the bottom line was lower than the year-ago reported figure of 21 cents.

Further, Stratasys’ revenues of $160.2 million missed the consensus mark of $170 million and declined 9.5% year over year.

Economic weakness in Europe and Asia remained a major headwind. Decline in materials associated with the company’s legacy platforms also affected the top line.

However, continued strength in the Americas, particularly in the F123 Series was a relief.

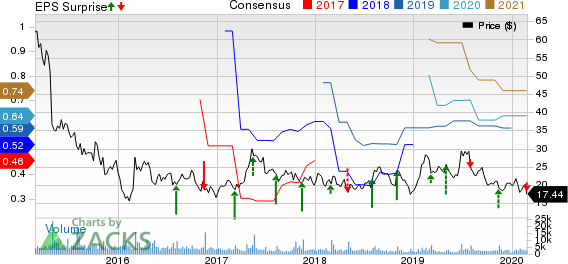

Stratasys, Ltd. Price, Consensus and EPS Surprise

Stratasys, Ltd. price-consensus-eps-surprise-chart | Stratasys, Ltd. Quote

Quarter Details

Segment wise, Product revenues fell 12.4% from the year-ago quarter to $109 million. The figure was down 12.1% in constant currency. The decline was due to weakness in Europe and Asia that affected systems sales in those regions.

Within Products revenues, System revenues decreased 20.6%. Consumables revenues fell 2.9% year over year.

System revenues were affected by persistent macroeconomic sluggishness in Europe and Asia. Moreover, decline in certain legacy product lines were also a headwind. However, Stratasys expects new products to offset the headwinds in future.

Materials for high-end platforms including design realism in PolyJet, and advanced materials in FDM increased year over year, reflecting strong customer adoption of high-value application solutions.

Revenues from Services decreased 2.6% to $51.2 million. However, within service revenues, customer support revenues increased 1% year over year.

Increasing adoption of manufacturing-focused platforms in automotive, aerospace and healthcare was encouraging.

Margin

Stratasys’ non-GAAP gross profit decreased 9.2% from the year-ago quarter to $84 million. Non-GAAP gross margin expanded 20 basis points (bps) to 52.4%.

Non-GAAP operating expenses declined 7.4% year over year to $73.8 million driven by efforts to increase cost efficiency.

Non-GAAP operating income totaled $10.2 million, down 20.3%.

Balance Sheet and Cash Flow

The company exited the quarter with cash and cash equivalents of $321.8 million compared with $347.1 million at the end of the previous quarter.

As of Dec 31, 2019, there was no long-term debt.

Net cash used in operating activities in the quarter was $3.4 million.

Guidance

For full-year 2020, the company provided revenue guidance. Revenues are expected in the range of $620-$680 million.

Non-GAAP earnings per share for the full year are expected between 45 cents and 60 cents.

Non-GAAP operating margin is projected between 5% and 6.5%.

Capital expenditures are estimated to lie within $40-$60 million.

About 52% of total full-year revenues is expected come at the second part of the year. Fourth quarter is typically the strongest, while the first quarter is the weakest.

First-quarter 2020 is anticipated to be negatively impacted by significant macroeconomic headwinds due to the coronavirus menace.

Zacks Rank & Stocks to Consider

Stratasys currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Cirrus Logic, Inc. CRUS, SYNNEX SNX and Mellanox Technologies MLNX, all sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Cirrus, SYNNEX and Mellanox is currently pegged at 15.27%, 10.37% and 18.25%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stratasys, Ltd. (SSYS) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

SYNNEX Corporation (SNX) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance